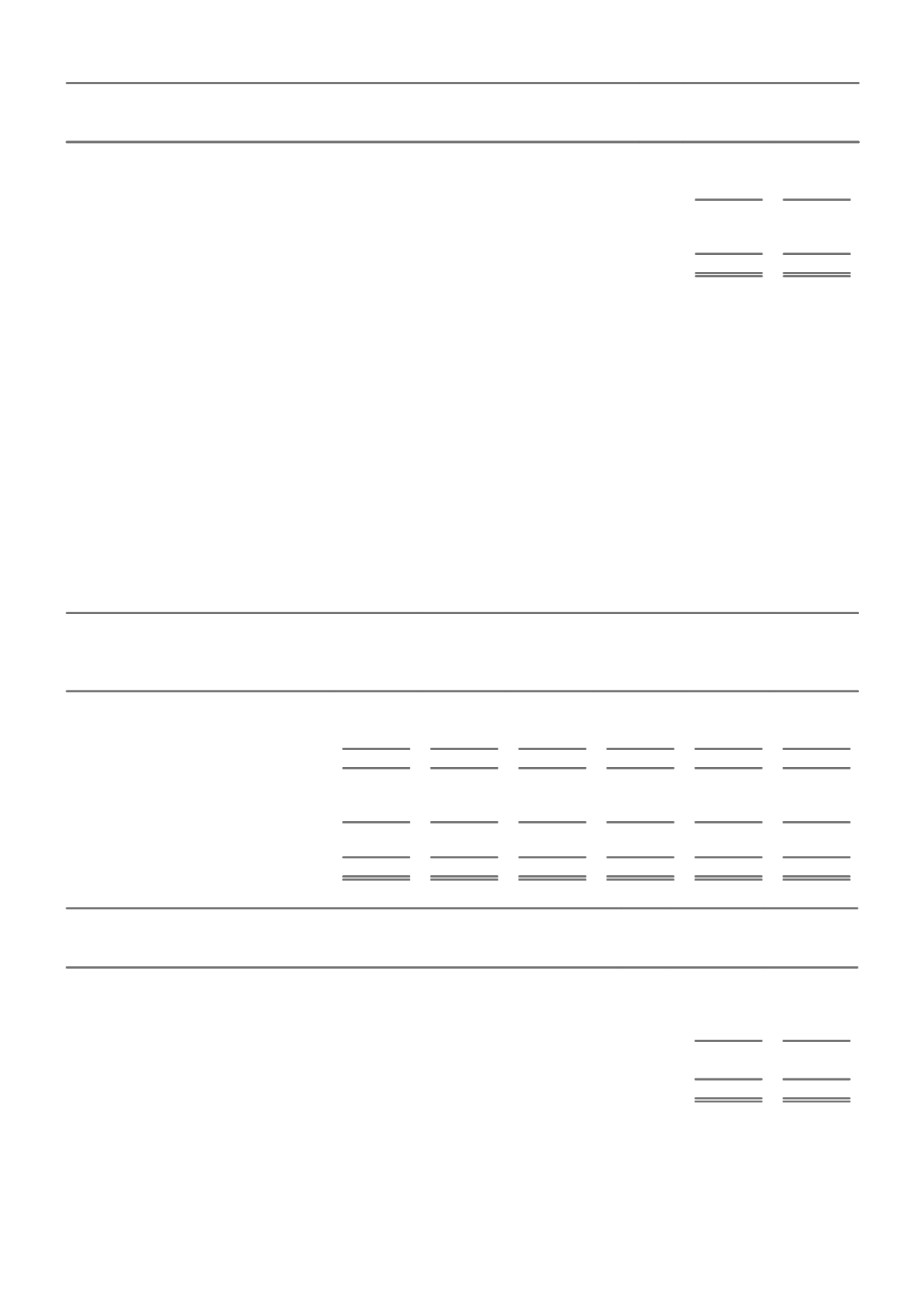

G. DIVIDEND FRANKING AMOUNT

CONSOLIDATED

2015

2014

$m

$m

Franking account balance at reporting date at 30%

525

609

Franking credits to arise from payment of income tax payable

15

81

Franking credits to arise from receipt of dividends receivable

1

-

Franking credits available for future reporting periods

541

690

Franking account impact of dividends determined before issuance of financial report but not

recognised at reporting date

(167)

(261)

Franking credits available for subsequent financial periods based on a tax rate of 30%

374

429

After payment of the final dividend the franking balance of the Company has $292 million franking credits available for subsequent

financial periods and is capable of fully franking a further $681 million of distributions.

The balance of the franking account arises from:

franked income received or recognised as a receivable at the reporting date;

income tax paid, after adjusting for any franking credits which will arise from the payment of income tax provided for in the

financial statements; and

franking debits from the payment of dividends recognised as a liability at the reporting date.

In accordance with the tax consolidation legislation, the consolidated amounts include franking credits that would be available to the

Parent if distributable profits of non-wholly owned subsidiaries were paid as dividends.

All of the distributions paid in relation to the convertible preference shares and the interest payments in relation to the reset

exchangeable securities for the financial year were fully franked at 30% (2014-fully franked at 30%).

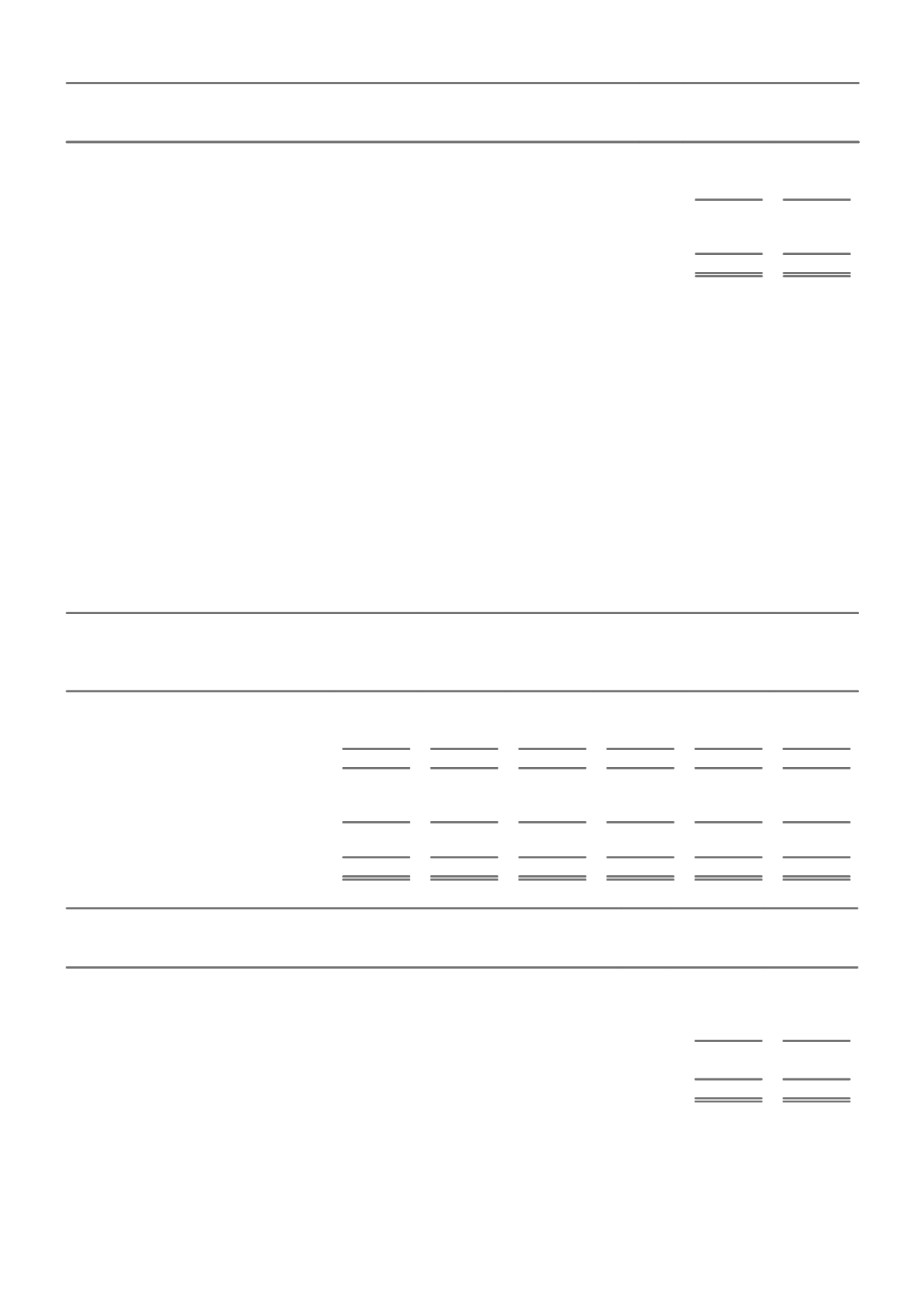

NOTE 10. CLAIMS

A. NET CLAIMS EXPENSE IN THE STATEMENT OF COMPREHENSIVE INCOME

Current year claims relate to claim events that occurred in the current financial year. Prior year claims relate to a reassessment of the

claim events that occurred in all previous financial periods.

CONSOLIDATED

2015

2014

Current year Prior years

Total

Current year

Prior years

Total

$m

$m

$m

$m

$m

$m

Gross claims - undiscounted

8,956

199

9,155

6,728

309

7,037

Discount

(205)

413

208

(199)

220

21

Gross claims - discounted

8,751

612

9,363

6,529

529

7,058

Reinsurance and other recoveries -

undiscounted

(1,651)

(734)

(2,385)

(1,074)

(806)

(1,880)

Discount

61

(98)

(37)

49

(26)

23

Reinsurance and other recoveries -

discounted

(1,590)

(832)

(2,422)

(1,025)

(832)

(1,857)

Net claims expense

7,161

(220)

6,941

5,504

(303)

5,201

B. OUTSTANDING CLAIMS LIABILITY RECOGNISED ON THE BALANCE SHEET

CONSOLIDATED

2015

2014

$m

$m

I. Composition of gross outstanding claims liability

Gross central estimate - undiscounted

11,283

10,696

Claims handling costs

453

449

Risk margin

2,574

2,799

14,310

13,944

Discount to present value

(1,623)

(1,938)

Gross outstanding claims liability - discounted

12,687

12,006

The outstanding claims liability includes $6,977 million (2014-$7,240 million) which is expected to be settled more than 12 months

from the reporting date.

69