c. DISCOUNT RATE

Discount rates reflect a beta and equity risk premium appropriate to the Group, with risk adjustments for individual segments and

countries where applicable. The post-tax discount rates used for significant cash generating units as at 30 June 2015 are: Australia

Personal Insurance operations 10.2% (2014-10.2%), Australia Commercial Insurance operations 10.2% (2014-10.2%) and New

Zealand operations 10.8% (2014-10.8%).

E. IMPAIRMENT TESTING

I. For the year ended 30 June 2015

There was no impairment charge recognised during the year.

II. For the year ended 30 June 2014

There was no impairment charge recognised during the year.

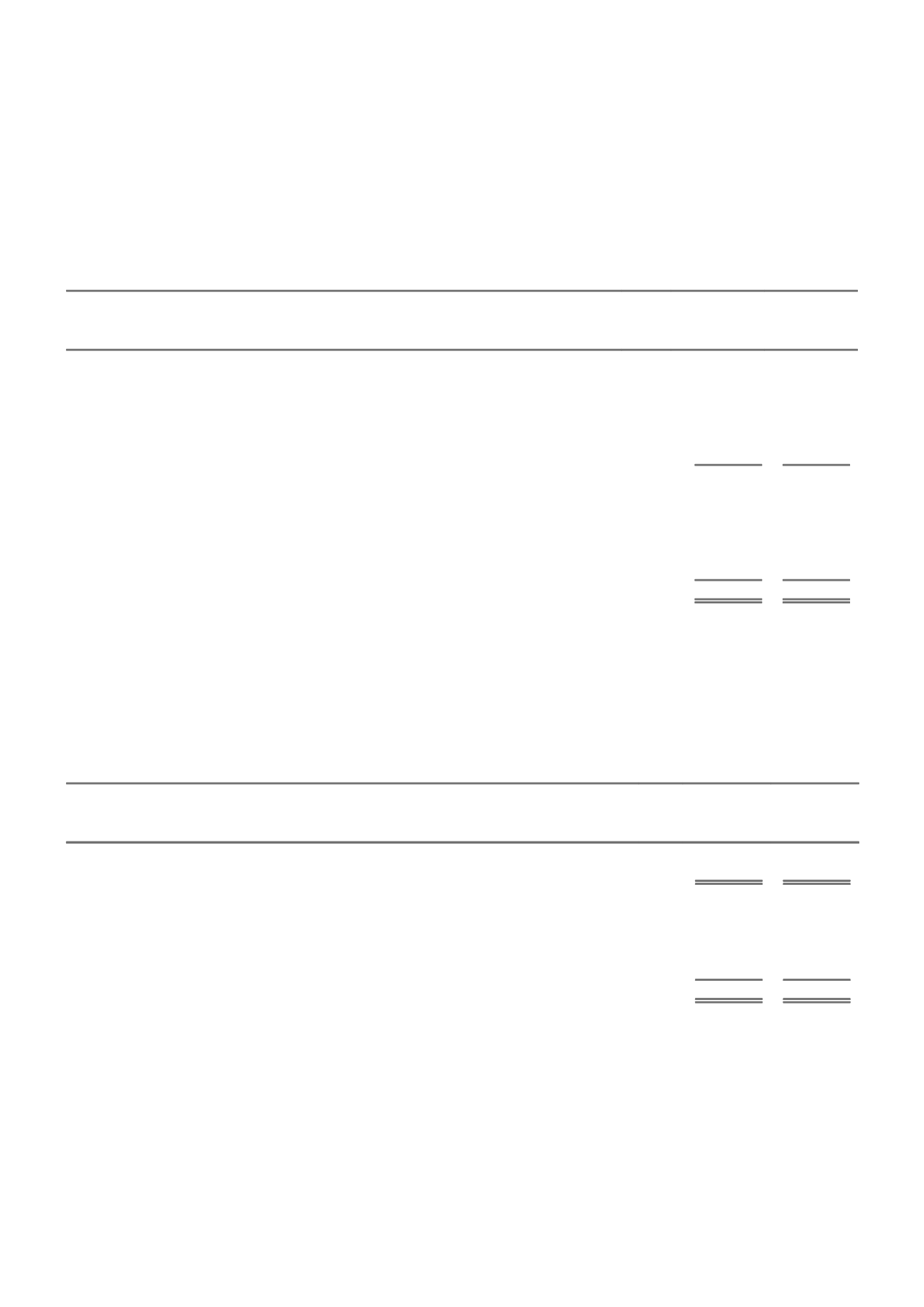

NOTE 18. TRADE AND OTHER PAYABLES

CONSOLIDATED

2015

2014

$m

$m

A. COMPOSITION

I. Trade creditors

Commissions payable

226

229

Stamp duty payable

120

123

GST payable on premium receivable

136

137

Other

332

323

814

812

II. Other payables

Other creditors and accruals

444

503

Investment creditors

38

176

Interest payable on interest bearing liabilities

16

15

Loan from joint venture

*

9

8

1,321

1,514

* The loan relates to the Group's current payable balance with NTI Limited, a joint venture, and is expected to be settled within 12 months.

Other trade creditors includes $27 million (2014-$59 million) reinsurance collateral arrangements with various reinsurers to secure

the Group reinsurance recoveries. The balance is anticipated to reduce through the settlement of amounts from reinsurers as they fall

due. This payable is interest bearing.

Trade and other payables are unsecured, non-interest bearing and are normally settled within 30 days to 12 months. Amounts have

not been discounted because the effect of the time value of money is not material. The carrying amount of payables is a reasonable

approximation of the fair value of the liabilities because of the short term nature of the liabilities.

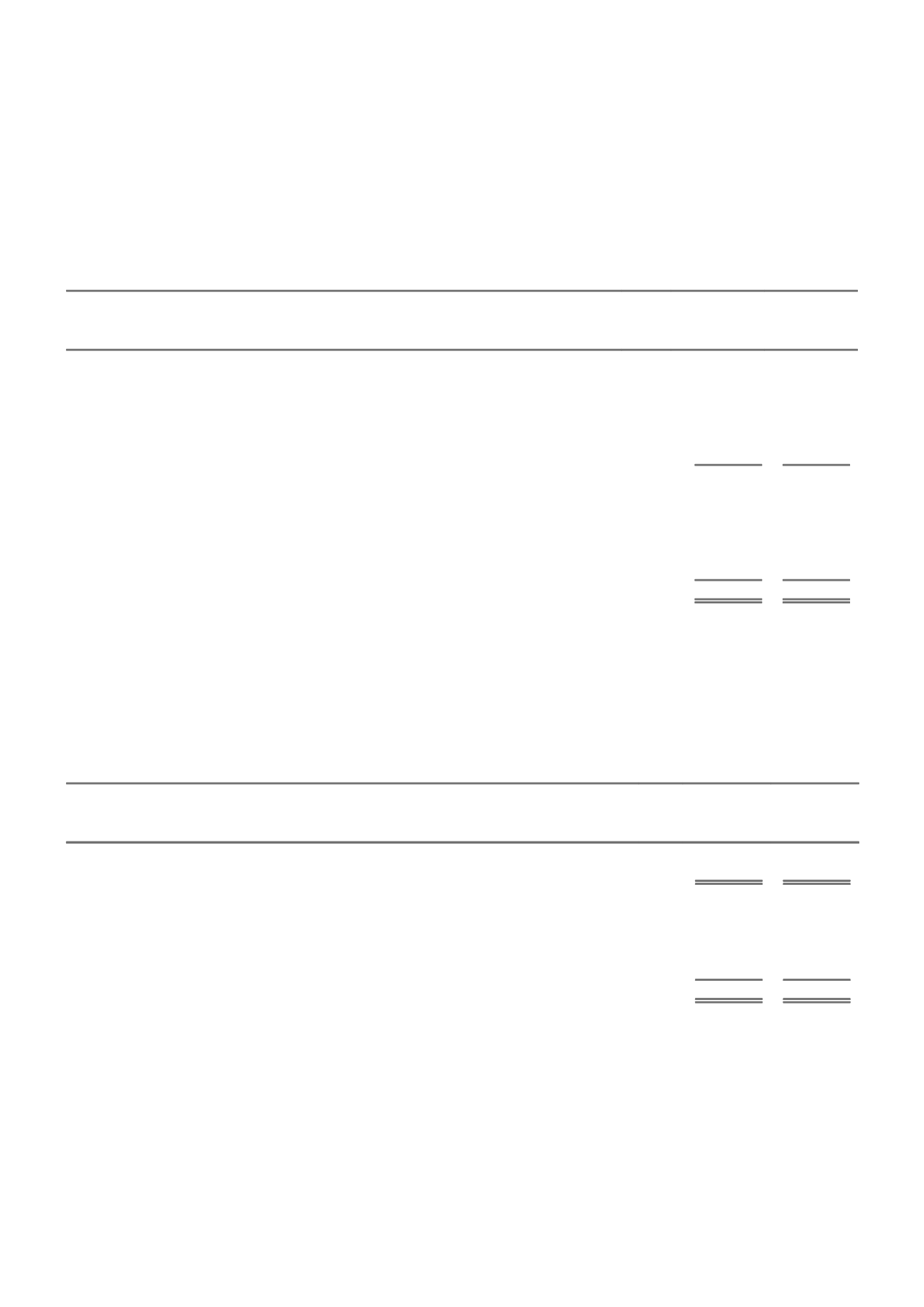

NOTE 19. RESTRUCTURING PROVISION

CONSOLIDATED

2015

2014

$m

$m

A. COMPOSITION

Restructuring provision

59

50

B. RECONCILIATION OF MOVEMENTS

Balance at the beginning of the financial year

50

6

Additions

27

50

Amounts settled

(18)

(6)

Balance at the end of the financial year

59

50

The provision primarily comprises restructuring costs in respect of the new operating model in Australia (implemented from 1 July

2014). All of the provision outstanding at the reporting date is expected to be settled within 12 months (2014–all). The balance has

not been discounted.

79