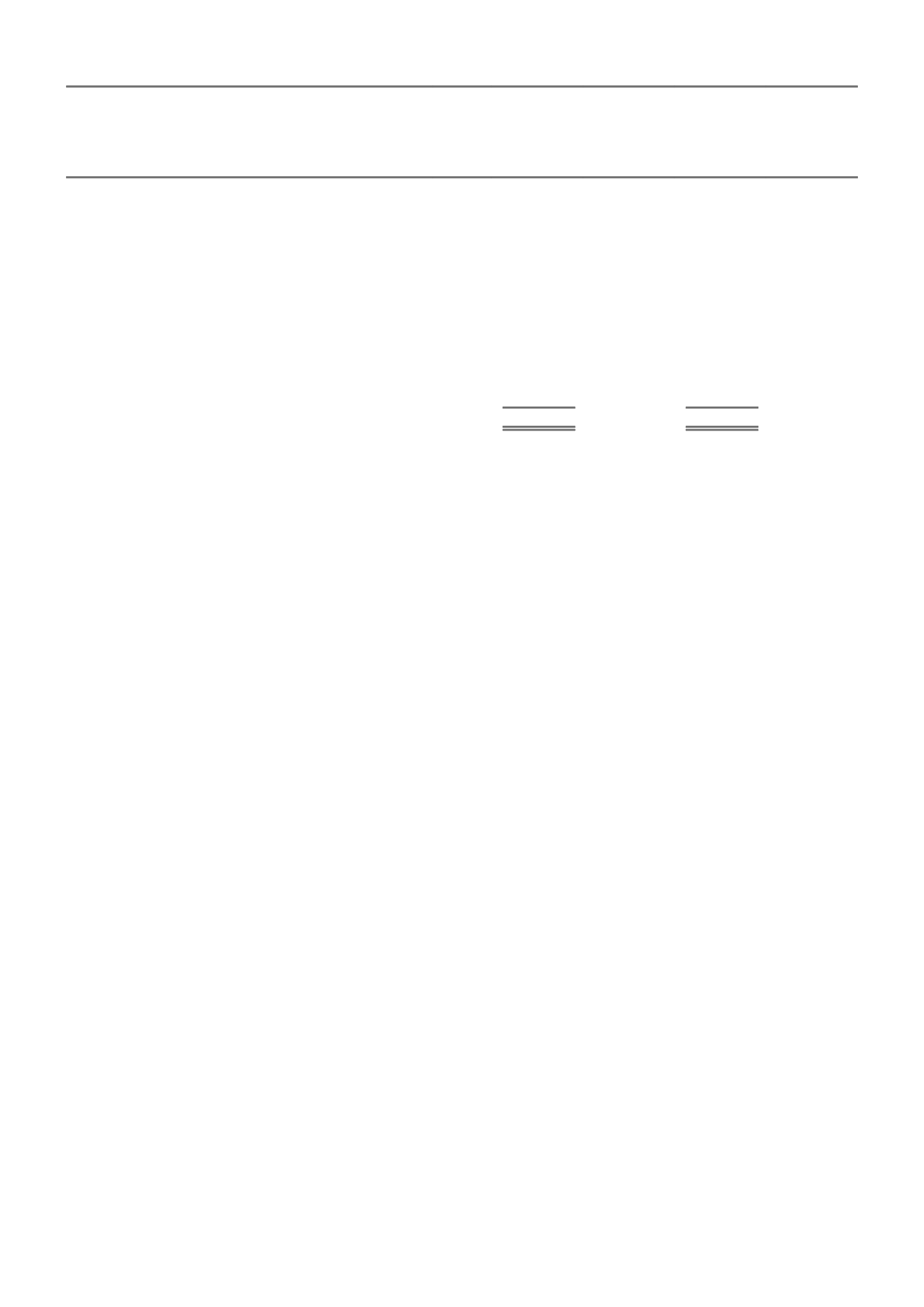

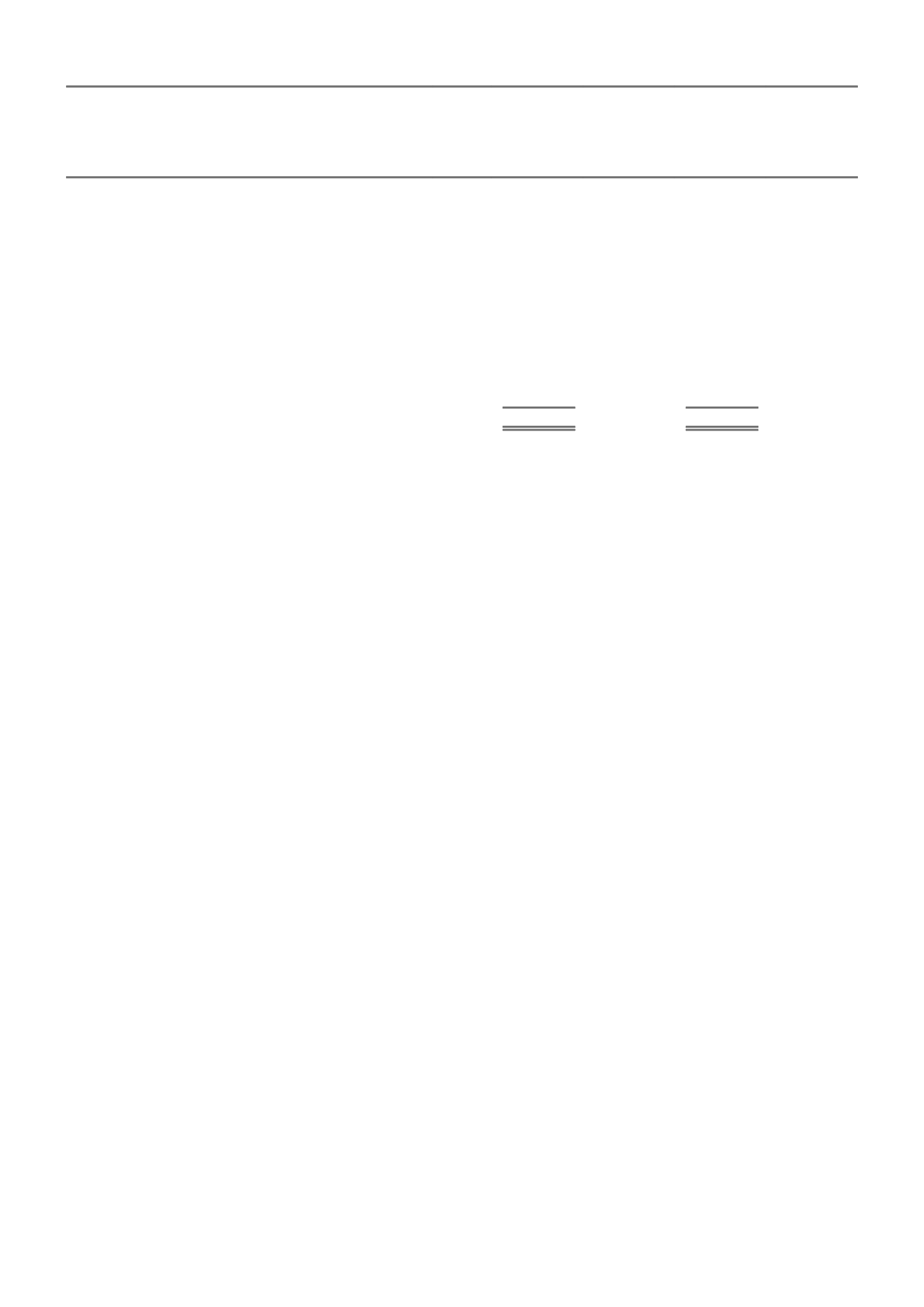

NOTE 20. INTEREST BEARING LIABILITIES

CONSOLIDATED

2015

2014

Section

CARRYING

VALUE

$m

FAIR VALUE

$m

CARRYING

VALUE

$m

FAIR VALUE

$m

A. COMPOSITION

I. Capital nature

a. TIER 1 REGULATORY CAPITAL

*

Convertible preference shares

B. I

377

383

377

402

Reset exchangeable securities

B. II

550

567

550

589

b. TIER 2 REGULATORY CAPITAL

GBP subordinated term notes

B. III

205

210

182

190

NZD subordinated bonds

B. IV

286

297

302

314

AUD subordinated convertible term notes

B. V

350

358

350

357

II. Operational nature

Other interest bearing liabilities

2

2

2

2

Less: capitalised transaction costs

(8)

(11)

1,762

1,752

* Instruments issued prior to 1 January 2013 are eligible for inclusion in the relevant category of regulatory capital up to limits prescribed by APRA under transitional

arrangements. Any capital that is ineligible to be included in Tier 1 capital as a consequence may be included in Tier 2 capital to the extent there is residual capacity

within Tier 2 transitional limits.

B. SIGNIFICANT TERMS AND CONDITIONS

I. Convertible preference shares

The convertible preference shares (CPS) have a face value of $377 million and were issued by the Company.

Key terms and conditions:

Non-cumulative floating rate distribution payable semi-annually, the payments are expected to be fully franked;

Distribution rate equals the sum of six month bank bill rate plus CPS margin of 4.00% per annum multiplied by (1–tax rate);

Payments of distributions can only be made subject to meeting certain conditions. If no distribution is made, no dividends can be

paid and no returns of capital can be made on ordinary shares until the next CPS dividend payment date;

The CPS are scheduled for conversion on 1 May 2019 provided the mandatory conversion conditions are satisfied;

IAG may exchange or redeem CPS on an exchange date, or upon occurrence of certain events, subject to APRA approval. The first

optional exchange date is 1 May 2017;

The CPS must be converted into ordinary shares upon request by APRA on occurrence of a non-viability trigger event; and

A non-viability trigger event occurs where APRA determines that CPS must be converted because without conversion or a public

sector injection of capital or equivalent support IAG would become, in APRA’s opinion, non-viable.

II. Reset exchangeable securities

The Reset Exchangeable Securities (RES) have a face value of $550 million and were issued at par by IAG Finance (New Zealand)

Limited, a wholly owned subsidiary of the Company.

Key terms and conditions:

Non-cumulative floating rate distribution payable quarterly and expected to be fully franked;

Distribution rate equals the sum of the three month bank bill rate plus RES margin of 4.00% per annum multiplied by (1-tax rate);

Payments of distributions can only be made subject to meeting certain conditions. If no distribution is made, no dividends can be

paid and no returns of capital can be made on ordinary shares unless IAG takes certain actions;

The RES may be exchanged by IAG or the holder on a reset date, or upon certain events. The next reset date for the RES is 16

December 2019. On exchange, IAG may convert RES into IAG ordinary shares, arrange a third party to acquire RES for their face

value or redeem RES for their face value (subject to APRA approval); and

The RES convert into IAG ordinary shares which would rank equally in all respects with all other IAG ordinary shares.

III. GBP subordinated term notes

The GBP subordinated term notes were issued with a face value of £250 million (equivalent to $625 million at date of issue) by the

Company. A total of £150 million of the notes has since been bought back.

Key terms and conditions:

Fixed interest rate of 5.625% per annum payable annually; and

The notes mature on 21 December 2026 (non-callable for the first 10 years). If the notes are not redeemed by 21 December

2016, all notes become floating rate notes with an interest rate of the three month GBP LIBOR plus 1.62%.

80 IAG ANNUAL REPORT 2015