II. Anti-dilution right

On entry by the Company and NICO into the Subscription Agreement, the Company granted NICO a right to maintain, by way of a right

to participate in any issue of shares or to subscribe for shares, its percentage interest in the issued share capital of the Company ('Anti-

dilution Right') in respect of a diluting event which occurs or is announced after 16 June 2015.

C. TREASURY SHARES HELD IN TRUST

Share based remuneration is provided in different forms to eligible employees. To satisfy obligations under the various share based

remuneration plans, shares are generally bought on-market at or near grant date of the relevant arrangement and held in trust. Upon

consolidation of the trusts, the shares held that are controlled for accounting purposes are recognised as treasury shares held in trust,

as described in section AG of the summary of significant accounting policies note. The balance of treasury shares held in trust at a

reporting date represents the cumulative cost of acquiring IAG shares that have not yet been distributed to employees as share based

remuneration.

D. NATURE AND PURPOSE OF RESERVES

I. Foreign currency translation reserve

The foreign currency translation reserve records the foreign currency differences arising from the translation of the financial position

and performance of subsidiaries that have a functional currency other than Australian dollars.

II. Share based remuneration reserve

The share based remuneration reserve is used to recognise the fair value at grant date of equity settled share based remuneration

provided to employees over the vesting period, as described in section AA of the summary of significant accounting policies note.

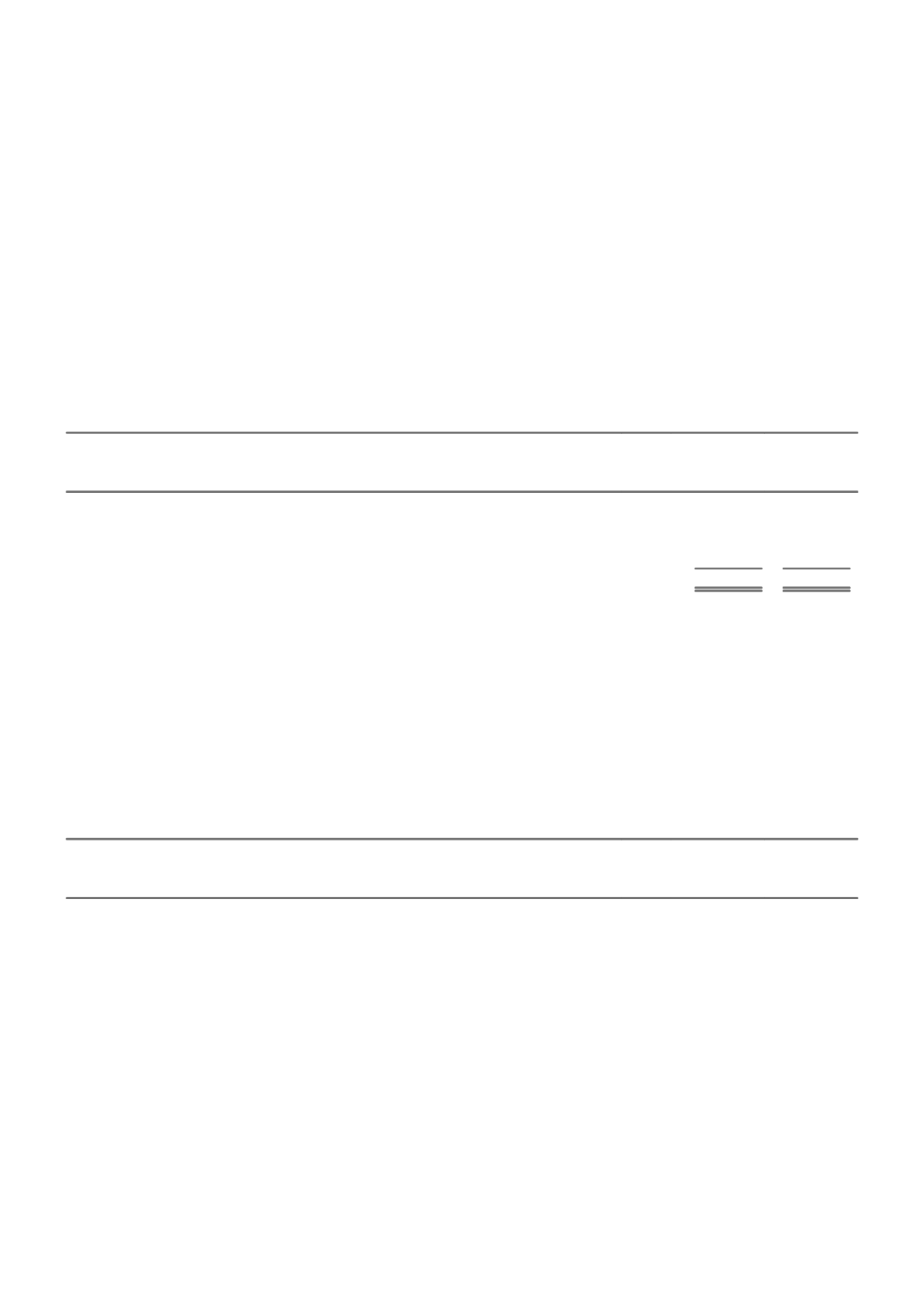

NOTE 22. NOTES TO THE CASH FLOW STATEMENT

CONSOLIDATED

2015

2014

$m

$m

A. COMPOSITION

Cash held for operational purposes

306

447

Cash and short term money held in investments

1,127

2,554

Other

-

9

Cash and cash equivalents

1,433

3,010

Cash and cash equivalents represent cash on hand and held with banks, deposits at call and short term money held in investments

readily convertible to cash within two working days, net of any bank overdraft. The carrying amount of the cash and cash equivalents

presented on the balance sheet is the same as that used for the purposes of the cash flow statement.

B. SIGNIFICANT RISKS

The net carrying amount of cash and cash equivalents represents the maximum exposure to credit risk relevant to cash and cash

equivalents at reporting date and is equivalent to the fair value of the assets because of the negligible credit risk and frequent

repricing.

A portion of the cash balances is held in currencies other than the Australian dollar. For information regarding the management of

currency risk by the Group refer to the risk management note.

The majority of the amounts bear variable rates of interest. Those balances bearing a fixed rate of interest mature in less than one

year. A small portion of the amounts bears no interest.

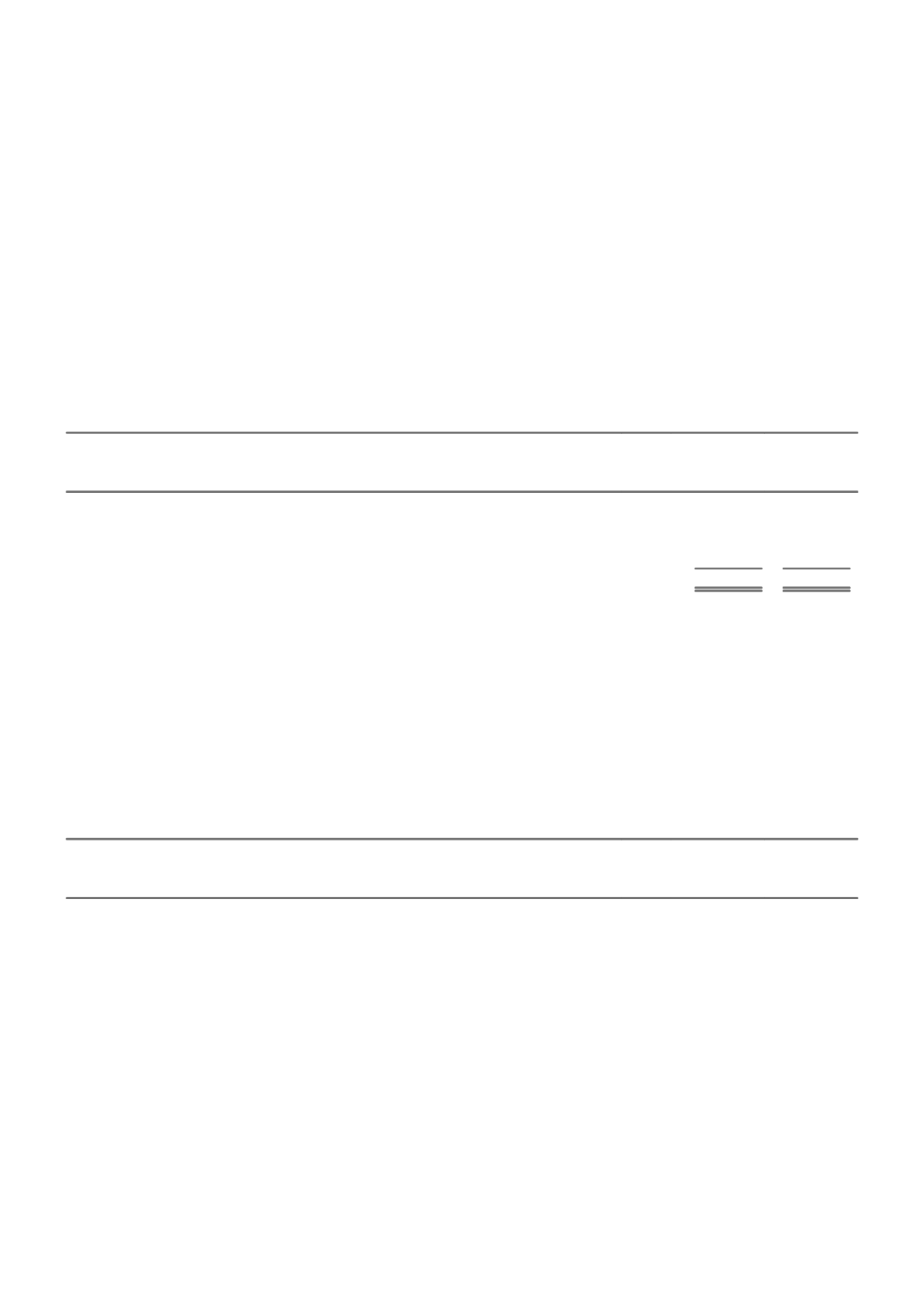

CONSOLIDATED

2015

2014

$m

$m

C. RECONCILIATION OF PROFIT/(LOSS) FOR THE YEAR TO NET CASH FLOWS FROM OPERATING ACTIVITIES

Profit/(loss) for the year

830

1,330

I. Non-cash items

Depreciation of property and equipment

67

62

Amortisation and impairment of intangible assets and goodwill

139

49

Impairment of investment in associate

60

-

Net realised (gains) and losses on disposal of investments

(227)

2

Net unrealised (gains) and losses on revaluation of investments

(14)

(296)

Retained earnings adjustment for share based remuneration

28

25

Other

19

(12)

II. Movement in operating assets and liabilities

DECREASE/(INCREASE) IN OPERATING ASSETS

Premium and other receivables

(443)

(248)

Prepayments, deferred levies and charges

(1,097)

(172)

Deferred tax assets

(175)

29

82 IAG ANNUAL REPORT 2015