II. Level 2 other observable inputs

Valued using inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (as

prices) or indirectly (derived from prices), including: quoted prices in active markets for similar assets or liabilities, quoted prices in

markets in which there are few transactions for identical or similar assets or liabilities and other inputs that are not quoted prices but

are observable for the asset or liability, for example interest rate yield curves observable at commonly quoted intervals.

III. Level 3 unobservable inputs

Inputs for the asset or liability that are not based on observable market data (unobservable inputs) are used. Level 3 investments are

primarily unlisted private equity funds where the fair value of investments is determined on the basis of published redemption values

of those funds received from the relevant managers who themselves use various methods to value the underlying investments.

Where the determination of fair value for an instrument involves inputs from more than one category, the level within which the

instrument is categorised in its entirety is determined on the basis of the lowest level input that is significant to the fair value

measurement.

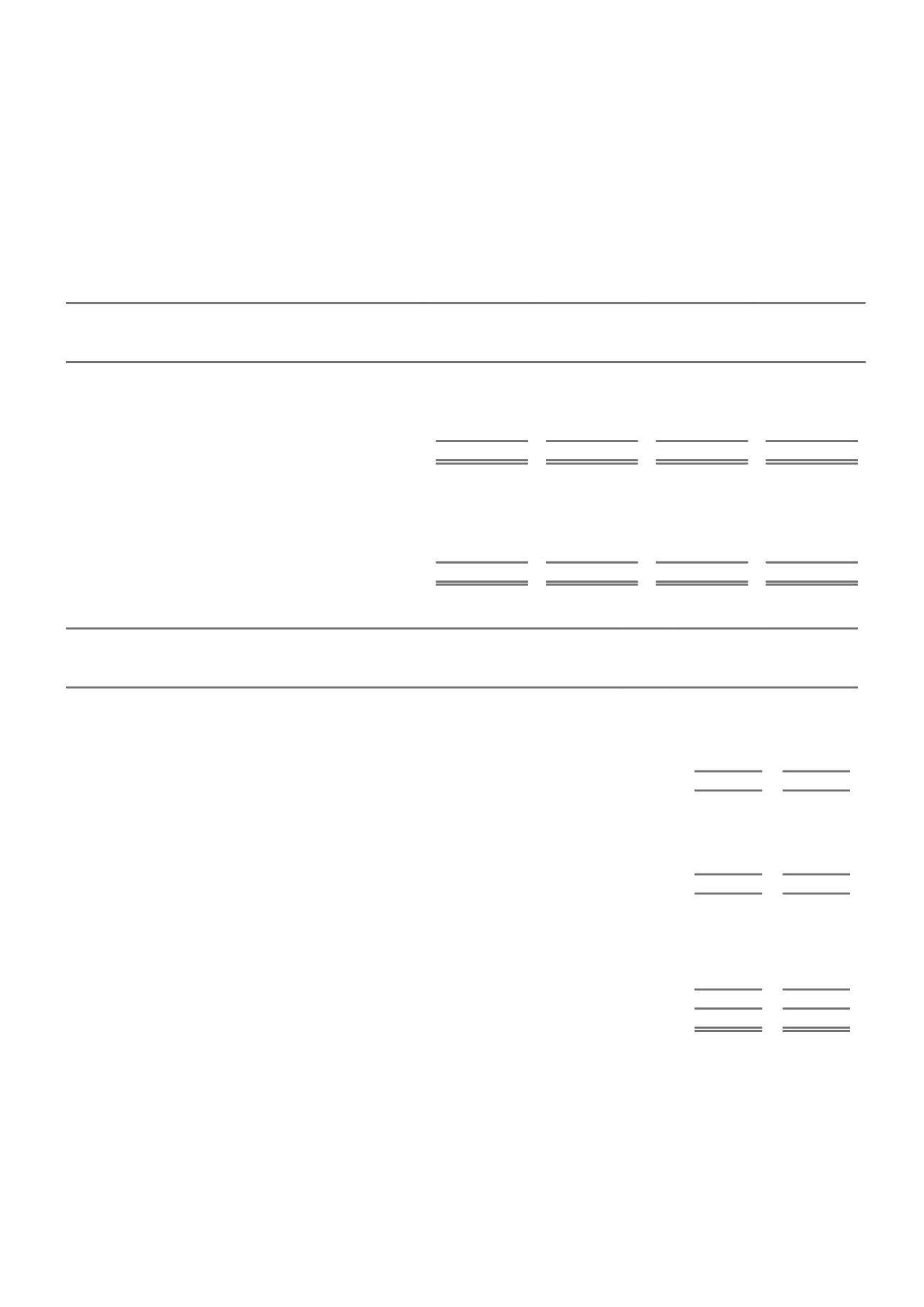

CONSOLIDATED

LEVEL 1

LEVEL 2

LEVEL 3

TOTAL

$m

$m

$m

$m

2015

Interest bearing investments

4,056

10,068

1

14,125

Equity investments

636

363

143

1,142

Other investments

-

268

-

268

4,692

10,699

144

15,535

2014

Interest bearing investments

4,850

8,934

-

13,784

Equity investments

877

433

112

1,422

Other investments

-

158

-

158

Derivatives

(1)

14

-

13

5,726

9,539

112

15,377

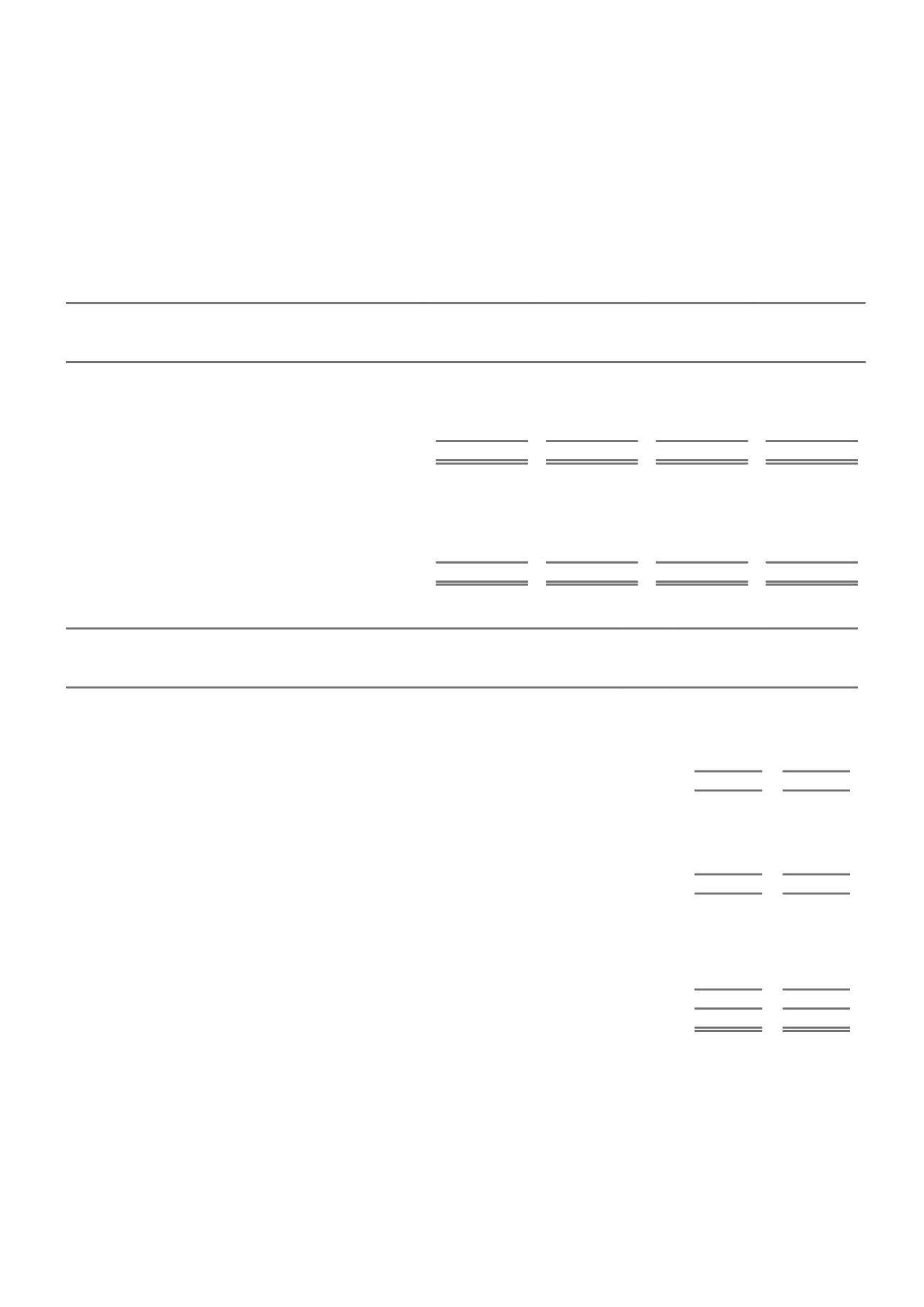

NOTE 15. RECEIVABLES

CONSOLIDATED

2015

2014

$m

$m

A. COMPOSITION

I. Premium receivable

Premium receivable

3,290

3,357

Provision for impairment

(39)

(41)

Net premium receivable

3,251

3,316

II. Trade and other receivables

(a)

Reinsurance recoveries on paid claims

300

230

Other trade debtors

52

39

Provision for impairment

(6)

(5)

46

34

Loan to associates

(b)

102

98

Investment income receivable

88

106

Investment transactions not yet settled at reporting date

5

38

Corporate treasury derivatives receivable

3

10

Other debtors

109

112

Trade and other receivables

653

628

3,904

3,944

(a)

Other than the loan to associates, receivables are non-interest bearing and are normally settled between 30 days and 12 months. The balance has not been discounted

as the effect of the time value of money is not material. The net carrying amount of receivables is a reasonable approximation of the fair value of the assets due to the

short term nature of the assets.

(b)

This loan is denominated in Malaysian ringgit and has a fixed term of 15 years. A cumulative preference dividend of 1% is payable annually. The loan relates to the

Group's increased investment in AmGeneral to acquire Kurnia during the financial year ended 30 June 2013.

76 IAG ANNUAL REPORT 2015