C. THE EFFECT OF CHANGES IN ASSUMPTIONS

The effect of changes in assumptions on the net outstanding claims liability, which incorporates the reinsurance recoveries on

outstanding claims and other recoveries receivable, is disclosed in the claims note.

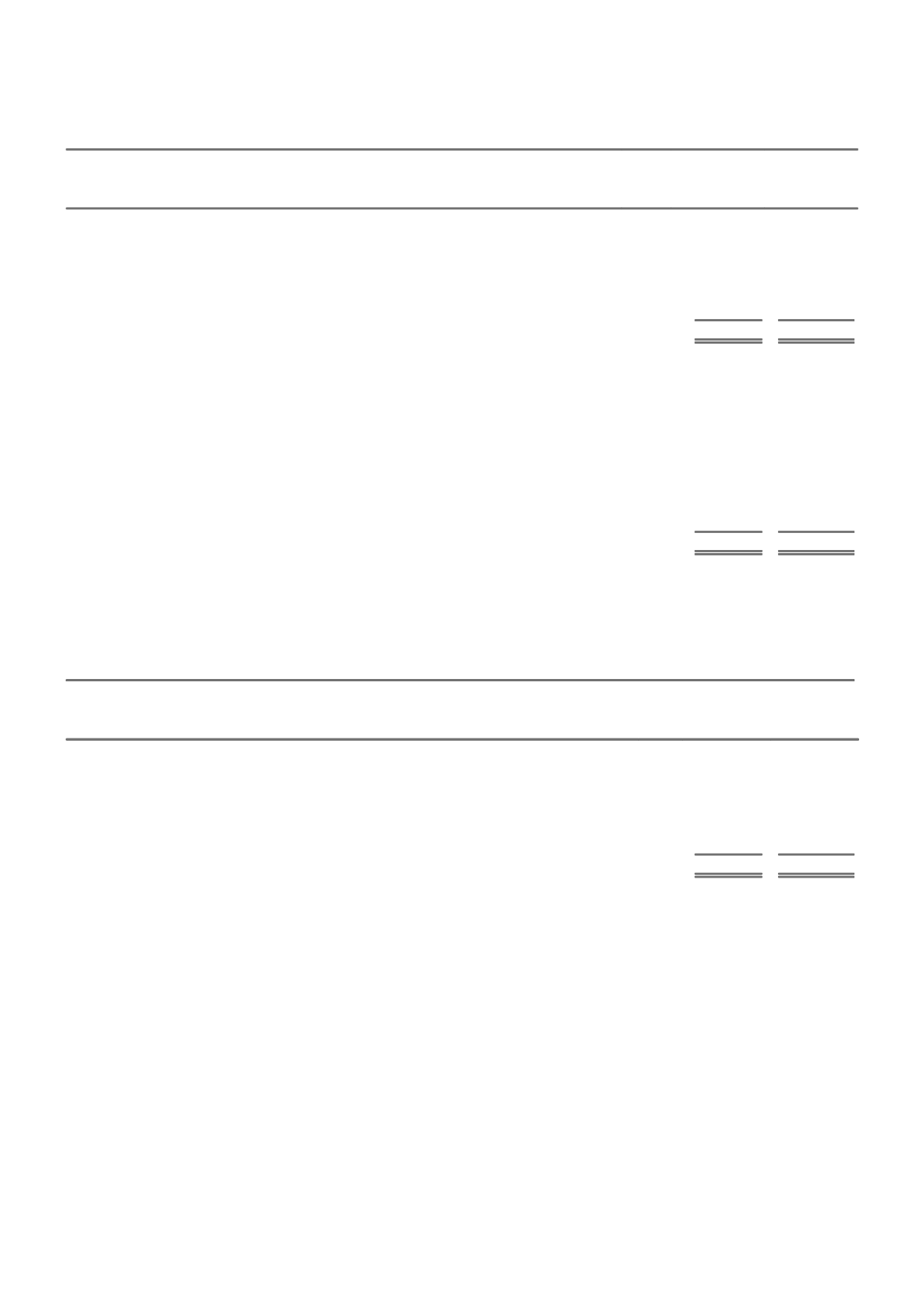

NOTE 12. DEFERRED INSURANCE ASSETS

CONSOLIDATED

2015

2014

$m

$m

A. DEFERRED ACQUISITION COSTS

Reconciliation of movements

Deferred acquisition costs at the beginning of the financial year

1,028

795

Acquisition costs deferred

1,744

1,607

Amortisation charged to profit

(1,750)

(1,386)

Net foreign exchange movements

(7)

12

Deferred acquisition costs at the end of the financial year

1,015

1,028

The carrying value of deferred acquisition costs includes $90 million (2014-$82 million) which is expected to be amortised more than

12 months from reporting date.

B. DEFERRED OUTWARDS REINSURANCE EXPENSE

Reconciliation of movements

Deferred outwards reinsurance expense at the beginning of the financial year

706

542

Reinsurance expenses deferred

2,326

1,186

Amortisation charged to profit

(1,196)

(1,077)

Addition through business acquisition

3

20

Net foreign exchange movements

(16)

35

Deferred outwards reinsurance expense at the end of the financial year

1,823

706

The carrying value of deferred outwards reinsurance expense includes $20 million (2014-$9 million) which is expected to be amortised

more than 12 months from reporting date.

The increase in deferred outwards reinsurance expense predominantly relates to recognition of the Berkshire Hathaway quota share

agreement for unearned premium ceded at reporting date.

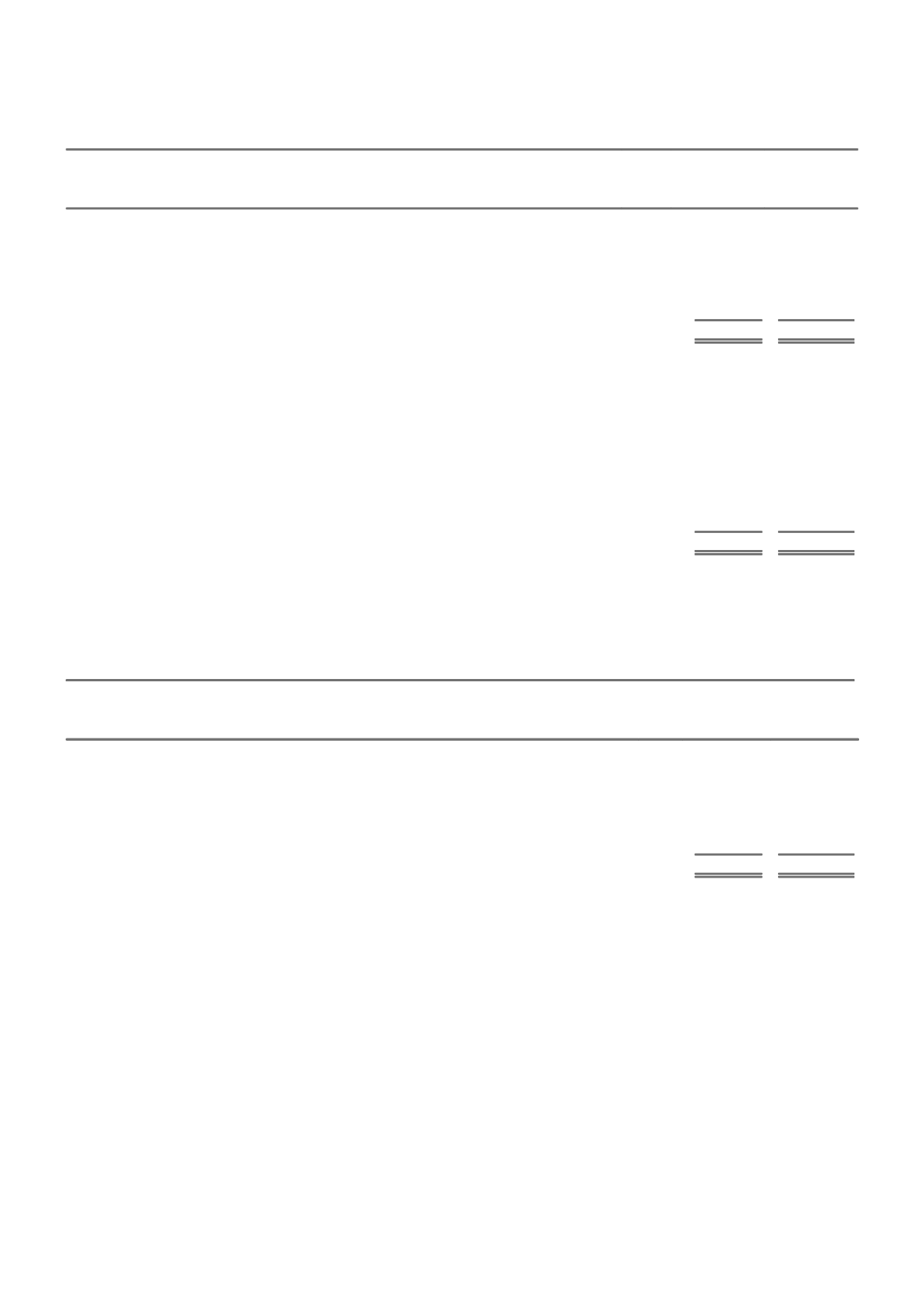

NOTE 13. UNEARNED PREMIUM LIABILITY

CONSOLIDATED

2015

2014

$m

$m

A. RECONCILIATION OF MOVEMENTS

Unearned premium liability at the beginning of the financial year

6,256

5,145

Deferral of premiums written during the financial year

5,935

5,062

Earning of premiums written in previous financial years

(6,020)

(5,004)

Additions through business acquisition

7

987

Net foreign exchange movements

(22)

66

Unearned premium liability at the end of the financial year

6,156

6,256

The carrying value of unearned premium liability includes $246 million (2014-$236 million) which is expected to be earned more than

12 months from reporting date.

B. LIABILITY ADEQUACY TEST

The liability adequacy test (LAT) has been conducted using the central estimate of the premium liabilities calculated for reporting to

APRA (refer to the capital management note), adjusted as appropriate, together with an appropriate margin for uncertainty for each

portfolio of contracts. The test is based on prospective information and so is heavily dependent on assumptions and judgements.

The liability adequacy test is required to be conducted at a level of a portfolio of contracts that are subject to broadly similar risks and

that are managed together as a single portfolio. The Group defines ‘broadly similar risks’ at a level where policies are affected by one

or more common risk factors, including natural peril events, general weather conditions, economic conditions, inflationary movements,

legal and regulatory changes as well as legislative reforms, reinsurance cost changes and variation in other input costs. The ‘broadly

similar risks’ test results in a more granular interpretation for business written in Asia. The Group defines 'managed together' at a

segment level as the respective Divisional CEOs manage the entire portfolio within their respective division. The ‘managed together’

test results in a more granular interpretation for business written within Australia. As a result, the liability adequacy test is currently

performed at the segment level for Australia Personal Insurance, Australia Commercial Insurance and New Zealand, and at subsidiary

level within Asia until such time when the Asian portfolio becomes more diverse.

The liability adequacy test at reporting date resulted in a surplus for the Group (2014-surplus for the Group).

74 IAG ANNUAL REPORT 2015