The determination of the overall risk margin takes into account the volatility of each class of business and the diversification between

the lines of business. The current risk margin, which has been determined after assessing the inherent uncertainty in the central

estimate and risks in the prevailing environment, results in an overall probability of adequacy for the outstanding claims liability of 90%

(2014-90%).

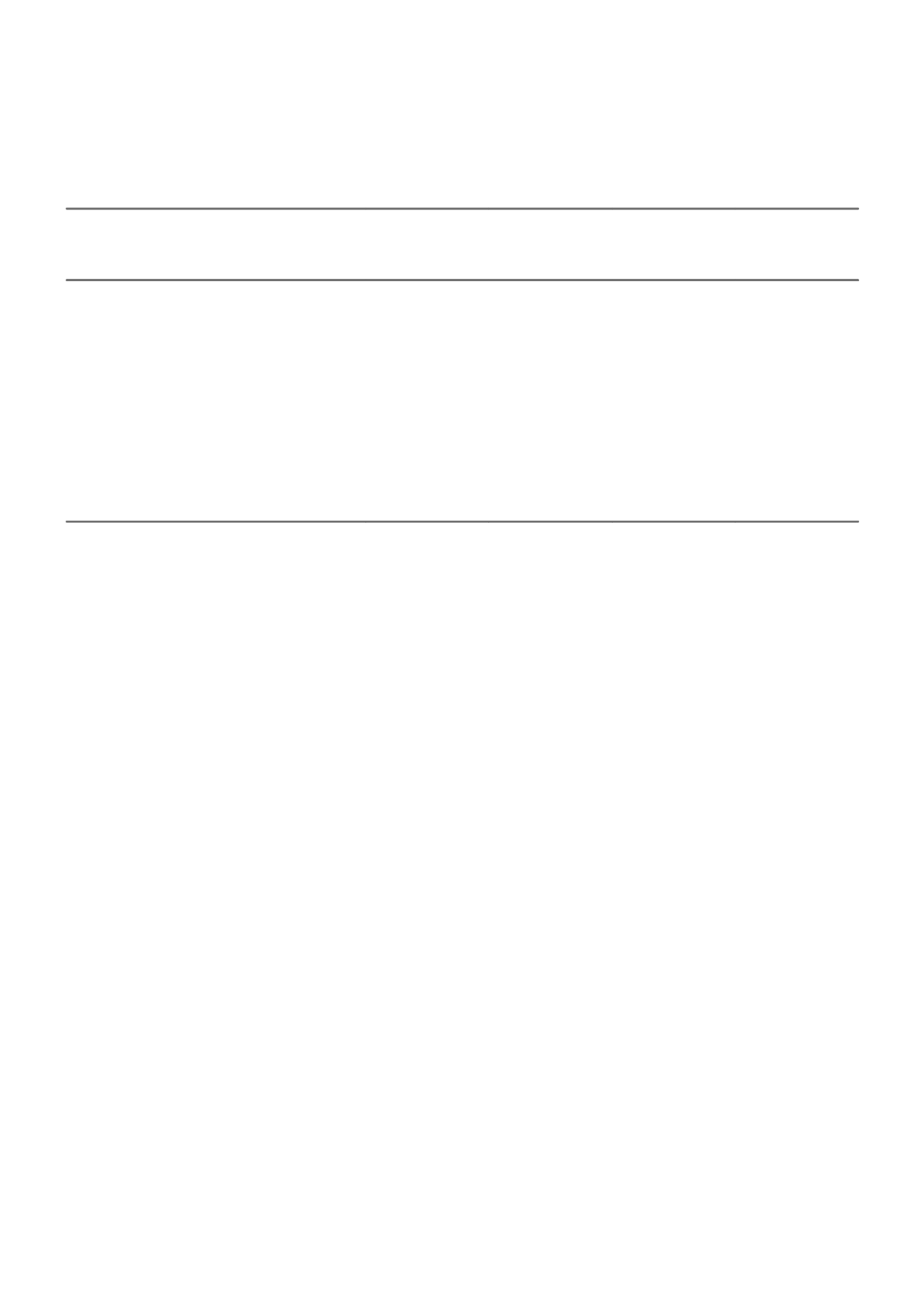

VI. Actuarial assumptions

The following ranges of key actuarial assumptions were used in the measurement of outstanding claims and recoveries, where

appropriate, at the reporting date, within the operating segments.

ASSUMPTION

CONSOLIDATED

AUSTRALIA

PERSONAL

INSURANCE

AUSTRALIA

COMMERCIAL

INSURANCE NEW ZEALAND

ASIA

2015

Discounted average term to settlement

3.1 years

4.4 years

1.0 years

0.4 years

Inflation rate

2.3%-4.0%

0.0%-4.5%

2.0%-2.5%

0.0%-4.0%

Superimposed inflation rate

0.0%-5.0%

0.0%-5.0%

0.0%

0.0%

Discount rate

1.9%-4.8%

1.9%-4.7%

2.2%-3.3%

0.0%

Claims handling costs ratio

3.9%

5.2%

5.3%

1.4%

2014

Discounted average term to settlement

3.2 years

4.7 years

0.8 years

0.4 years

Inflation rate

2.4%-4.0%

2.5%-4.8%

2.5%

0.0%-4.0%

Superimposed inflation rate

0.0%-5.0%

0.0%-5.0%

0.0%

0.0%

Discount rate

2.4%-5.0%

2.4%-5.0%

3.0%-4.1%

0.0%

Claims handling costs ratio

4.2%

5.8%

5.2%

2.1%

a. PROCESS USED TO DETERMINE ASSUMPTIONS

i. Discounted average term to settlement

The discounted average term to settlement relates to the expected payment pattern for claims (inflated and discounted). It is

calculated by class of business and is generally based on historic settlement patterns. The discounted average term to settlement,

while not itself an assumption, provides a summary indication of the future cash flow pattern.

ii. Inflation rate

Insurance costs are subject to inflationary pressures. Economic inflation assumptions are set by reference to current economic

indicators.

iii. Superimposed inflation rate

Superimposed inflation tends to occur due to trends in wider society such as the cost of court settlements increasing at a faster rate

than the economic inflation rate utilised. An allowance for superimposed inflation is made for each underlying model, where

appropriate, after considering the historical levels of superimposed inflation present in the portfolio, projected future superimposed

inflation and industry superimposed inflation trends.

iv. Discount rate

The discount rate is derived from market yields on government securities.

v. Claims handling costs ratio

The future claims handling costs ratio is generally calculated with reference to the historical experience of claims handling costs as a

percentage of past payments, together with budgeted costs going forward.

VII. The effect of changes in assumptions

a. GENERAL IMPACT OF CHANGES

i. Discounted average term to settlement

A decrease in the discounted average term to settlement would reflect claims being paid sooner than anticipated and so would

increase the claims expense. Note that this sensitivity test only extends or shortens the term of the payments assumed in the

valuation, without changing the total nominal amount of the payments.

ii. Inflation and superimposed inflation rates

Expected future payments take account of inflationary increases. An increase or decrease in the assumed levels of either economic or

superimposed inflation will have a corresponding decrease or increase on profit and loss.

72 IAG ANNUAL REPORT 2015