CAPITAL MANAGEMENT RISK

Refer to the capital management note for further details.

V. Operational risk

Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events.

Operational risk can impact other risk categories. When controls fail, an operational risk incident can cause injury, damage to

reputation, have legal or regulatory implications or can lead to financial loss. The Group does not aim to eliminate all operational risks,

but manages these by initiating an appropriate control framework and by monitoring and managing potential risks.

IAG's Operational Risk Management Framework, inclusive of the Group Operational Risk Policy, operates within IAG’s Enterprise Risk

Framework. IAG’s Operational Risk Management Framework articulates IAG’s key Operational Risk Management elements under its

Risk Framework and the operational risk management requirements of the Group. It aims to ensure that consistent governance

mechanisms are in-place and that activities undertaken which involve Operational Risk are assessed and managed with appropriate

regard to the Group’s Risk Appetite Statement and the achievement of IAG’s objectives. The Board and Executive team believe an

effective, documented and structured approach to operational risk is a key part of the broader risk management framework.

The Board has ultimate responsibility for risk management, including operational risk. The Board is responsible for oversight of the

Operational Risk Framework and approval of the Operational Risk Management Policy, and any changes to it.

As outlined in IAG's RMS and in the Group Operational Risk Framework, Group Policy and the supporting Operational Risk Procedures,

operational risk is to be identified and assessed on an ongoing basis. The Internal Capital Adequacy Assessment Process (ICAAP)

includes consideration of operational risk. Management and staff are responsible for identifying, assessing and managing operational

risks in accordance with their roles and responsibilities. The Group's Internal Audit function reviews the effectiveness of processes and

procedures surrounding operational risk.

The general insurance operations of the Group are subject to regulatory supervision in the jurisdictions in which they operate.

Regulatory frameworks continue to evolve in a number of jurisdictions. The Group works closely with regulators and monitors

regulatory developments across its international operations to assess potential impacts on its ongoing ability to meet the various

regulatory requirements.

Throughout the current reporting year the Group has conformed with the requirements of its debt agreements, including all financial

and non-financial covenants (2014-full conformance).

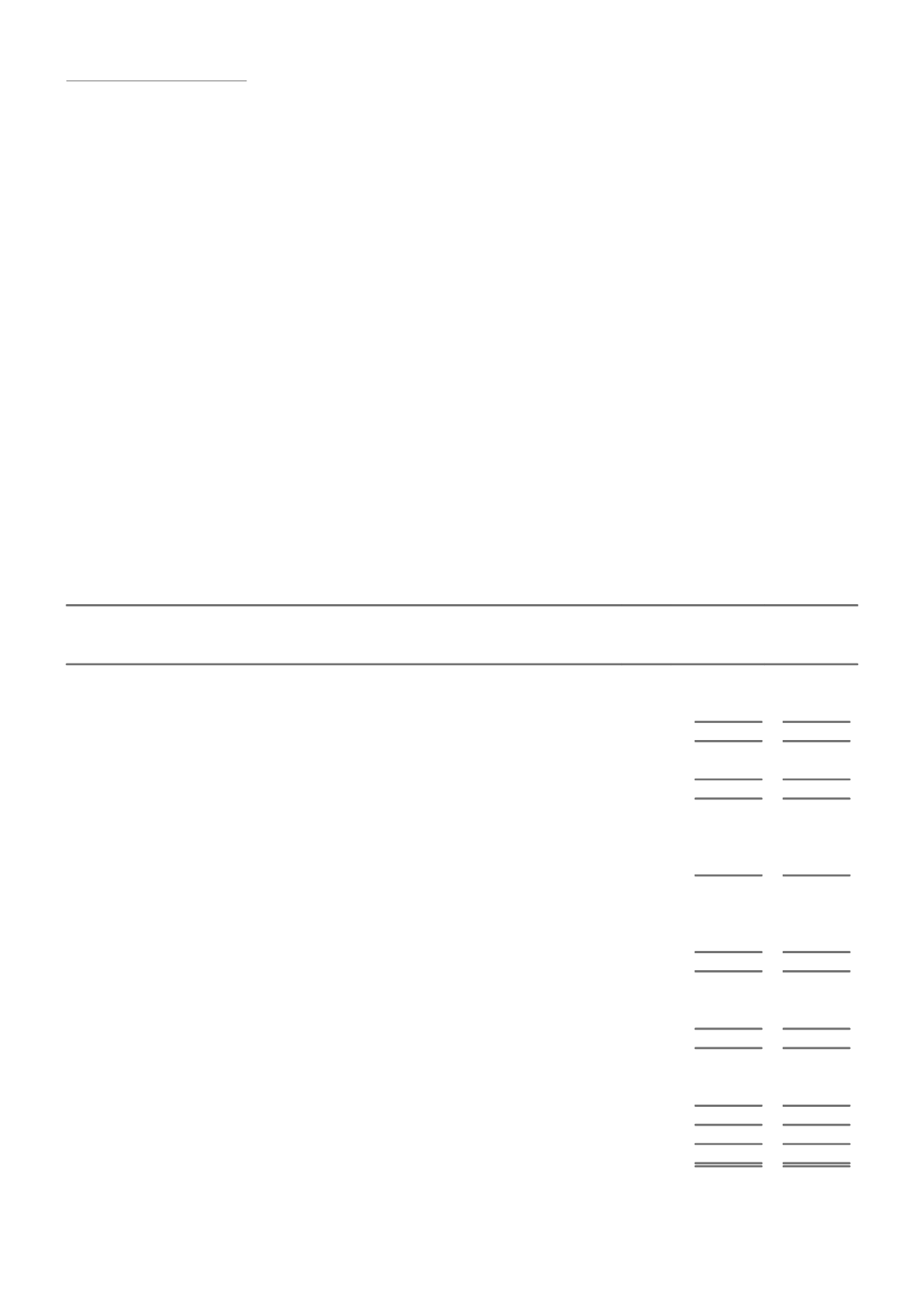

NOTE 4. ANALYSIS OF INCOME

CONSOLIDATED

2015

2014

$m

$m

A. GENERAL INSURANCE REVENUE

Gross written premium

11,440

9,779

Movement in unearned premium liability

85

(58)

Premium revenue

11,525

9,721

Reinsurance and other recoveries revenue

2,422

1,857

Reinsurance commission revenue

52

51

Total general insurance revenue

13,999

11,629

B. INVESTMENT INCOME

Dividend revenue

39

38

Interest revenue

517

511

Trust revenue

19

16

Total investment revenue

575

565

Net change in fair value of investments

Realised net gains and (losses)

227

(2)

Unrealised net gains and (losses)

14

296

Total investment income

816

859

Represented by

Investment income on assets backing insurance liabilities

585

459

Investment income on shareholders’ funds

231

400

816

859

C. FEE AND OTHER INCOME

Fee based revenue

132

125

Other income

55

74

Total fee and other income

187

199

D. SHARE OF NET PROFIT/(LOSS) OF ASSOCIATES

6

(8)

Total income

15,008

12,679

62 IAG ANNUAL REPORT 2015