b. INTEREST RATE RISK

i. Nature of the risks and how managed

Interest rate risk is the risk of loss arising from an unfavourable movement in market interest rates. Fixed interest rate assets and

liabilities are exposed to changes in market value derived from mark-to-market revaluations. Financial assets and liabilities with

floating interest rates create exposure to cash flow volatility.

Interest rate risk arises primarily from investments in interest bearing securities. Interest bearing liabilities are exposed to interest rate

risk but as they are measured at amortised cost and are not traded they therefore do not expose the Group to fair value interest rate

risk. In addition, interest bearing liabilities bearing fixed interest rates (subject to some reset conditions) reduce the Group's exposure

to cash flow interest rate risk. Movements in market interest rates therefore impact the price of the securities (and hence their fair

value measurement), however have a limited effect on the contractual cash flows of the securities.

Exposure to interest rate risk is monitored through several measures that include value-at-risk analysis, position limits, scenario testing

and stress testing, and managed by asset and liability matching using measures such as duration. Derivatives are used to manage

interest rate risk. The interest rate risk arising from money market securities is managed using interest rate swaps and futures. For

information regarding the notional contract amounts associated with these derivative financial instruments together with a maturity

profile and reporting date fair values, refer to the derivatives note.

The underwriting of general insurance contracts creates exposure to the risk that interest rate movements may materially impact the

value of the insurance liabilities. Movements in interest rates should have minimal impact on the insurance profit or loss due to the

Group’s policy of investing in assets backing insurance liabilities principally in fixed interest securities broadly matched to the expected

payment pattern of the insurance liabilities. Movements in investment income on assets backing insurance liabilities broadly offset

the impact of movements in discount rates on the insurance liabilities.

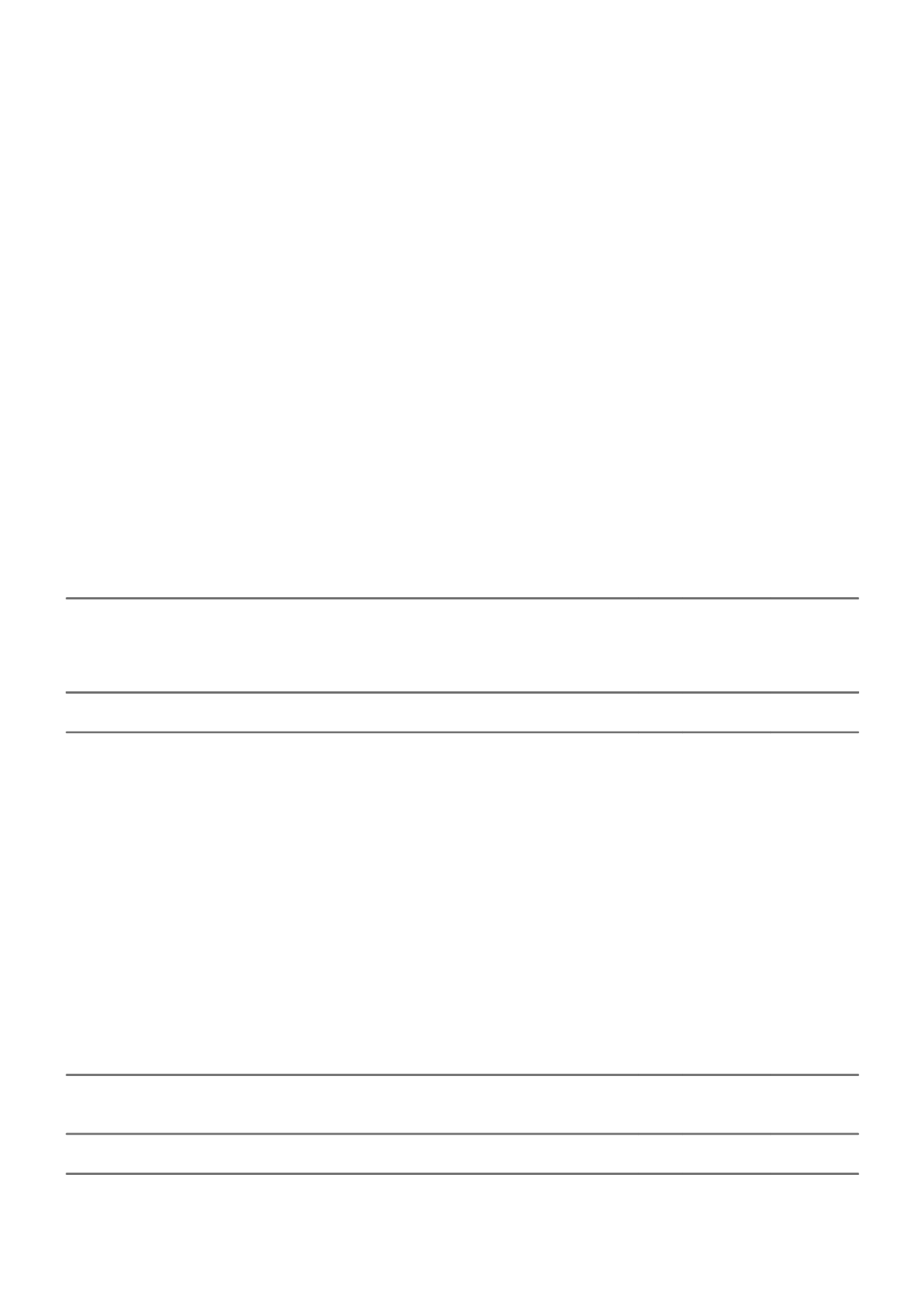

ii. Sensitivity

The sensitivity analysis provided in the following table demonstrates the effect of a change in a key assumption while other

assumptions remain unchanged. In reality, there is a correlation between the assumptions and other factors. The sensitivities do not

include interdependencies among variables, but rather show isolated interest rate movements.

The investments in interest bearing securities are recognised on the balance sheet at fair value. Movements in market interest rates

impact the price of the securities (and hence their fair value measurement) and so would impact profit or loss. The impact on the

measurement of the interest bearing securities held at reporting date of a change in interest rates by +1% or -1% on profit before tax,

net of related derivatives, is shown in the following table:

CONSOLIDATED

2015

2014

$m

$m

Impact to

profit

Impact to

profit

Investments - interest bearing securities and related interest rate derivatives

+1%

(366)

(328)

-1%

389

351

The majority of the interest bearing securities are expected to be held to maturity and so movements in the fair value are expected to

reverse upon maturity of the instruments.

c. PRICE RISK

i. Nature of the risk and how managed

Price risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate due to changes in market prices

(other than those arising from interest rate or foreign exchange risk), whether those changes are caused by factors specific to the

individual financial instrument or its issuer, or factors affecting all similar financial instruments traded on the market. The Group has

exposure to equity price risk through its investment in equities (both directly and through certain trusts) and the use of equity related

derivative contracts.

Exposure to equity price risk is monitored through several measures that include value-at-risk analysis, position limits, scenario testing

and stress testing.

For information regarding the notional amounts associated with equity related derivative contracts together with the associated

maturity profiles and reporting date fair values, refer to the derivatives note.

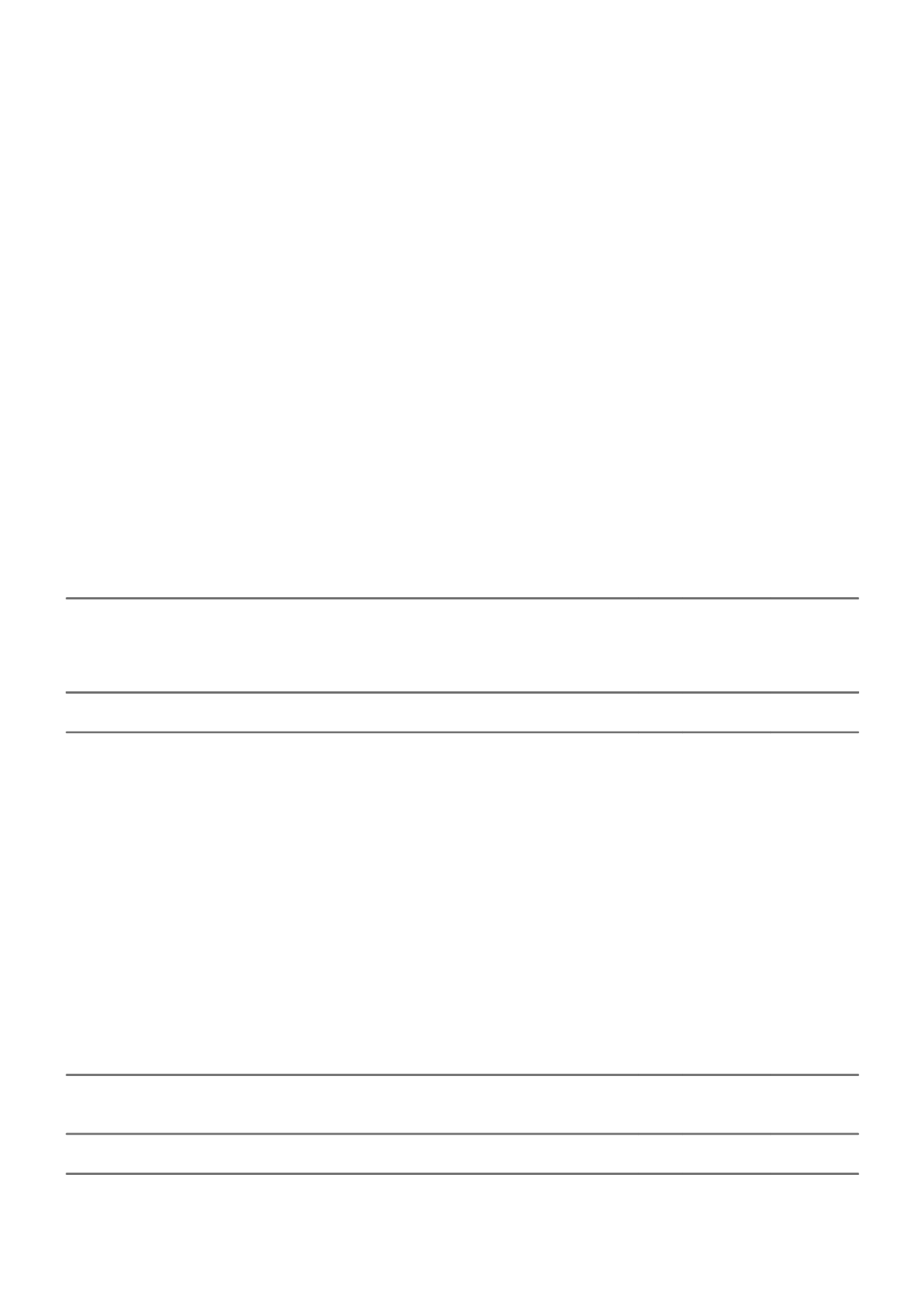

ii. Sensitivity

The impact on the measurement of the investments held at reporting date of a change in equity values by +10% or -10% on profit

before tax, net of related derivatives, is shown in the table below:

CONSOLIDATED

2015

2014

$m

$m

Investments – equity and trust securities and related equity derivatives

+10%

-10%

115

(115)

138

(138)

58 IAG ANNUAL REPORT 2015