It is Group policy to only deal with reinsurers with credit ratings of at least Standard & Poor’s BBB+ (or other rating agency equivalent)

without collateralisation other than a mandatory placement to meet local regulatory requirements. Where the credit rating of a

reinsurer falls below the required quality during the period of risk, a contractual right to replace the counterparty exists. Some of the

reinsurance protection is purchased on a ‘collateralised’ basis, where reinsurers have deposited funds equivalent to their participation

in a trust fund. The counterparty credit profile of the catastrophe reinsurance program currently has more than 89% of the limit for the

2015 program (2014-89%) with parties rated by Standard & Poor’s as A+ or better. For long-tail reinsurance arrangements 98%

(2014-100%) of the program is placed with parties rated by Standard & Poor's as A+ or better.

Having reinsurance protection with strong reinsurers also benefits the Consolidated entity in its regulatory capital calculations. The

risk charges vary with the grade of the reinsurers such that higher credit quality reinsurance counterparties incur lower APRA

regulatory capital charges.

The following table provides information regarding the credit risk relating to the reinsurance recoveries receivable on the outstanding

claims balance, excluding other recoveries, based on Standard & Poor’s counterparty credit ratings. These rating allocations relate to

balances accumulated from reinsurance programs in place over a number of years and so will not necessarily align with the rating

allocations noted above for the current program.

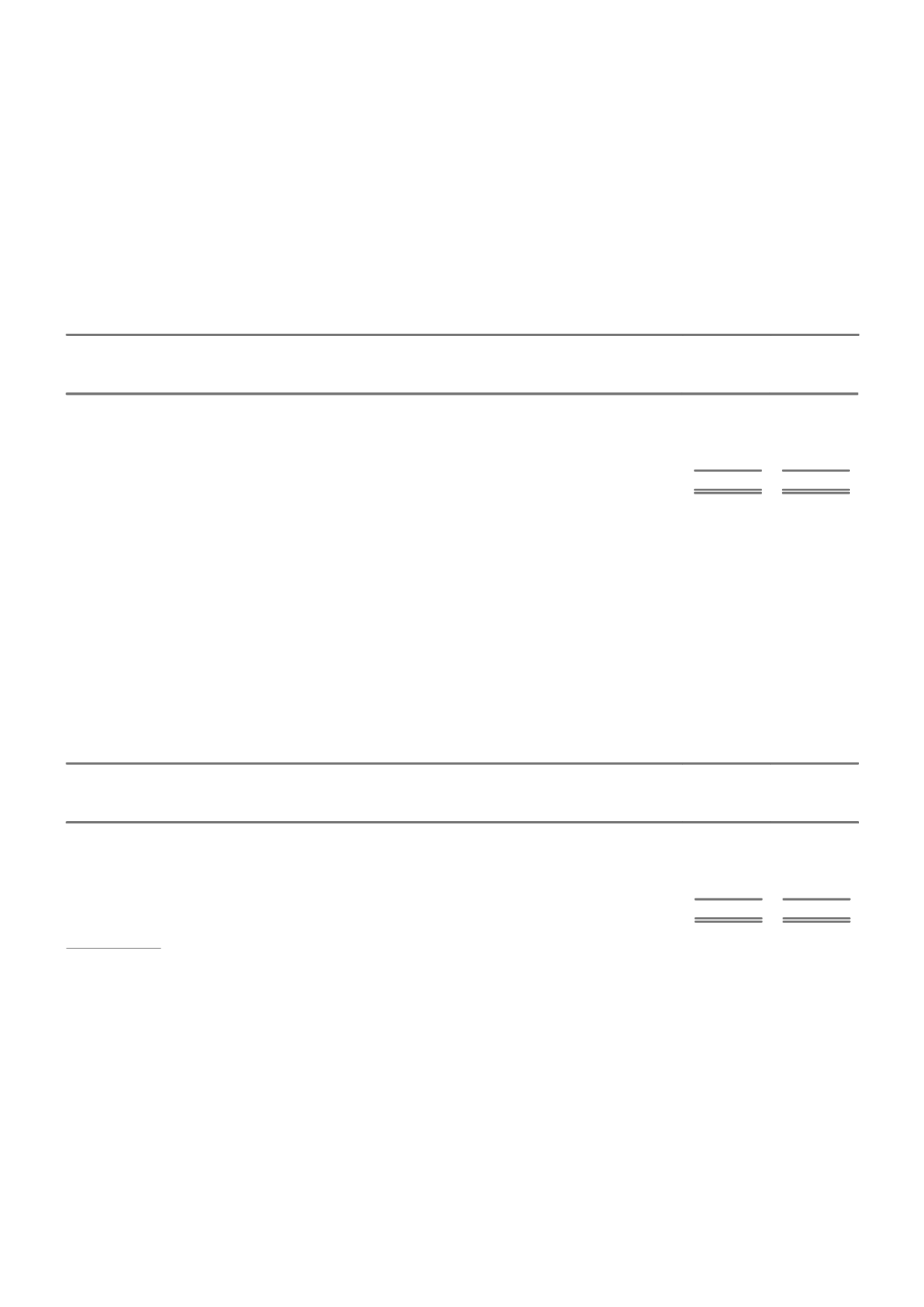

CREDIT RATING

CONSOLIDATED

2015

2014

$m

$m

AAA

1

1

AA

1,501

1,159

A

905

901

BBB and below

19

12

Total

2,426

2,073

Of these, approximately $720 million (2014-$862 million) is secured directly as follows, which reduces the credit risk:

deposits held in trust: $321 million (2014-$354 million);

letters of credit: $388 million (2014-$460 million); and

loss deposits: $11 million (2014-$48 million).

iii. Investments

The Group is exposed to credit risk from investments in third parties where the Group holds debt and similar securities issued by those

companies.

The credit risk relating to investments is monitored and assessed and maximum exposures are limited. The maximum exposure to

credit risk loss as at reporting date is the carrying amount of the investments on the balance sheet as they are measured at fair value.

The investments comprising assets backing insurance liabilities are restricted to investment grade securities.

The following table provides information regarding the credit risk relating to the interest bearing investments based on Standard &

Poor’s counterparty credit ratings.

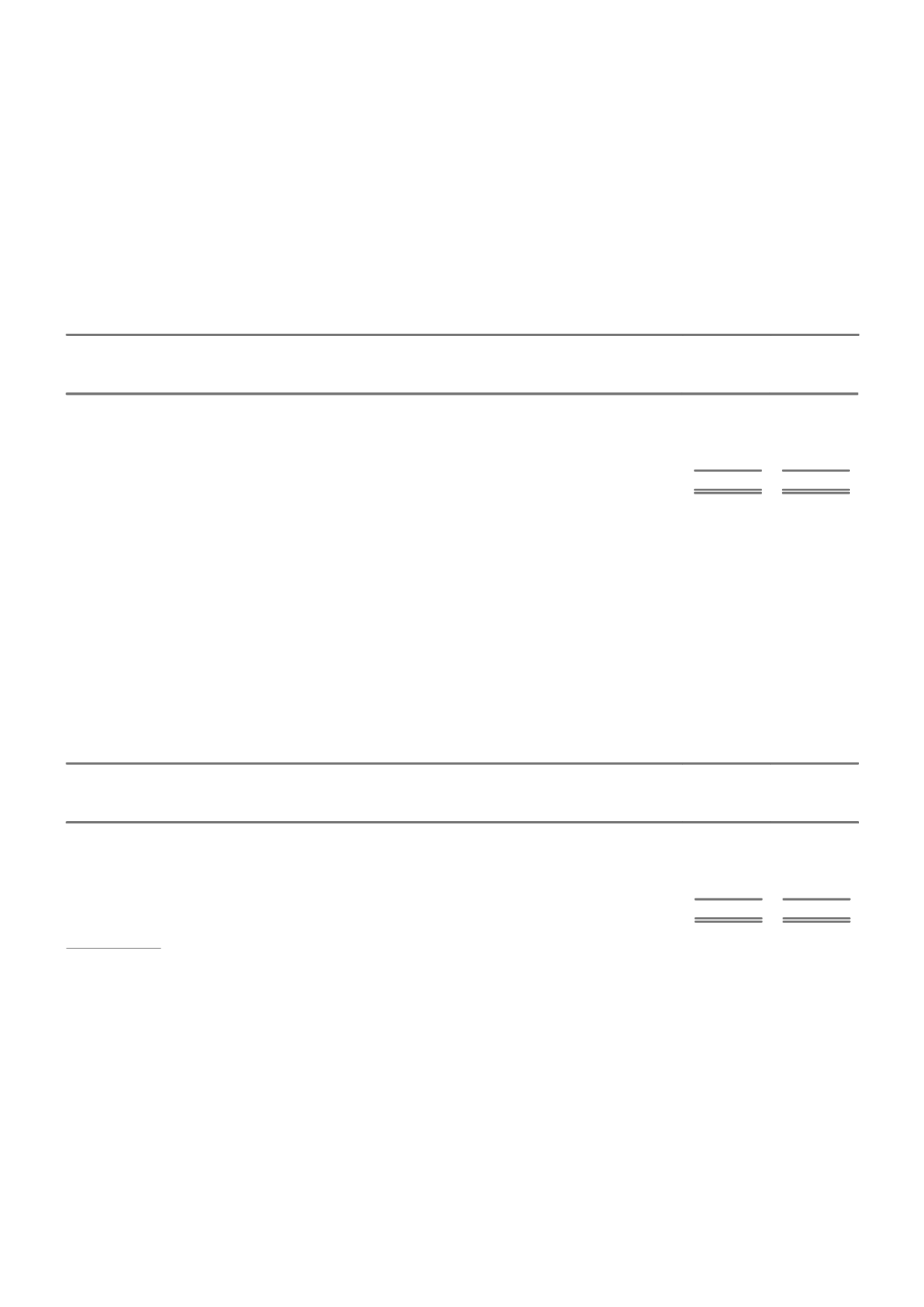

CREDIT RATING

CONSOLIDATED

2015

2014

$m

$m

AAA

5,821

5,153

AA

5,602

6,727

A

1,274

1,001

BBB and below

1,428

903

Total

14,125

13,784

LIQUIDITY RISK

a. NATURE OF THE RISK AND HOW MANAGED

Liquidity risk is concerned with the risk that sufficient cash resources will not be available to meet payment obligations as they become

due (without incurring significant additional costs). The liquidity position is derived from operating cash flows and access to liquidity

through related bodies corporate. The Group complies with its liquidity risk management practices, which include a Group policy, and

has the framework and procedures in place to ensure an adequate and appropriate level of monitoring and management of liquidity.

IAG also has an option to raise further share capital as part of the strategic relationship with Berkshire Hathaway Specialty Insurance

Company, which provides IAG access to additional liquidity. See the notes to the statement of changes in equity for further details.

Underwriting insurance contracts exposes the Group to liquidity risk through the obligation to make payments of unknown amounts on

unknown dates. The assets backing insurance liabilities consist of government securities and other quality securities which can

generally be readily sold or exchanged for cash. The assets are managed so as to broadly match the interest rate sensitivity created by

the maturity profile of the expected pattern of the claims payments. The debt securities are restricted to investment grade securities

with concentrations of investments managed by various criteria including: issuer, industry, geography and credit rating.

An additional source of liquidity risk for the Group relates to interest bearing liabilities. The management of this risk includes the

issuance of a range of interest bearing liabilities denominated in different currencies with different maturities.

60 IAG ANNUAL REPORT 2015