CREDIT RISK

a. NATURE OF THE RISK AND HOW MANAGED

Credit risk is the risk of loss from a counterparty failing to meet their financial obligations. The Group's credit risk arises predominantly

from investment activities, reinsurance activities and dealings with intermediaries. The Group’s credit risk appetite is approved by the

Board and the Group has a Credit Risk Policy which is consistent with the Board's risk appetite and also approved by the Board. The

policy outlines the framework and procedures in place to ensure an adequate and appropriate level of monitoring and management of

credit quality throughout the Group.

IAG Group Treasury is responsible for ensuring that the policies governing the management of credit quality risk are properly

implemented. Any new or amended credit risk exposures must be approved in accordance with the Group’s approval authority

framework.

Concentrations of credit risk exist where a number of counterparties have similar economic characteristics. At reporting date, there

are material concentrations of credit risk to the banking sector, in particular the four major Australian banks, also to securitised assets

in Australia and to reinsurers in relation to the reinsurance recoverables. Credit exposures are, however, sufficiently diversified so as

to avoid a concentration charge in the regulatory capital calculation (refer to the capital management note).

b. CREDIT RISK EXPOSURE

i. Premium and reinsurance recoveries on paid claims receivable

The maximum exposure to credit risk as at reporting date is the carrying amount of the receivables on the balance sheet.

An ageing analysis for certain receivables balances is provided below. The other receivables balances have either no overdue

amounts or an insignificant portion of overdue amounts. The amounts are aged according to their original due date. Receivables for

which repayment terms have been renegotiated represent an insignificant portion of the balances.

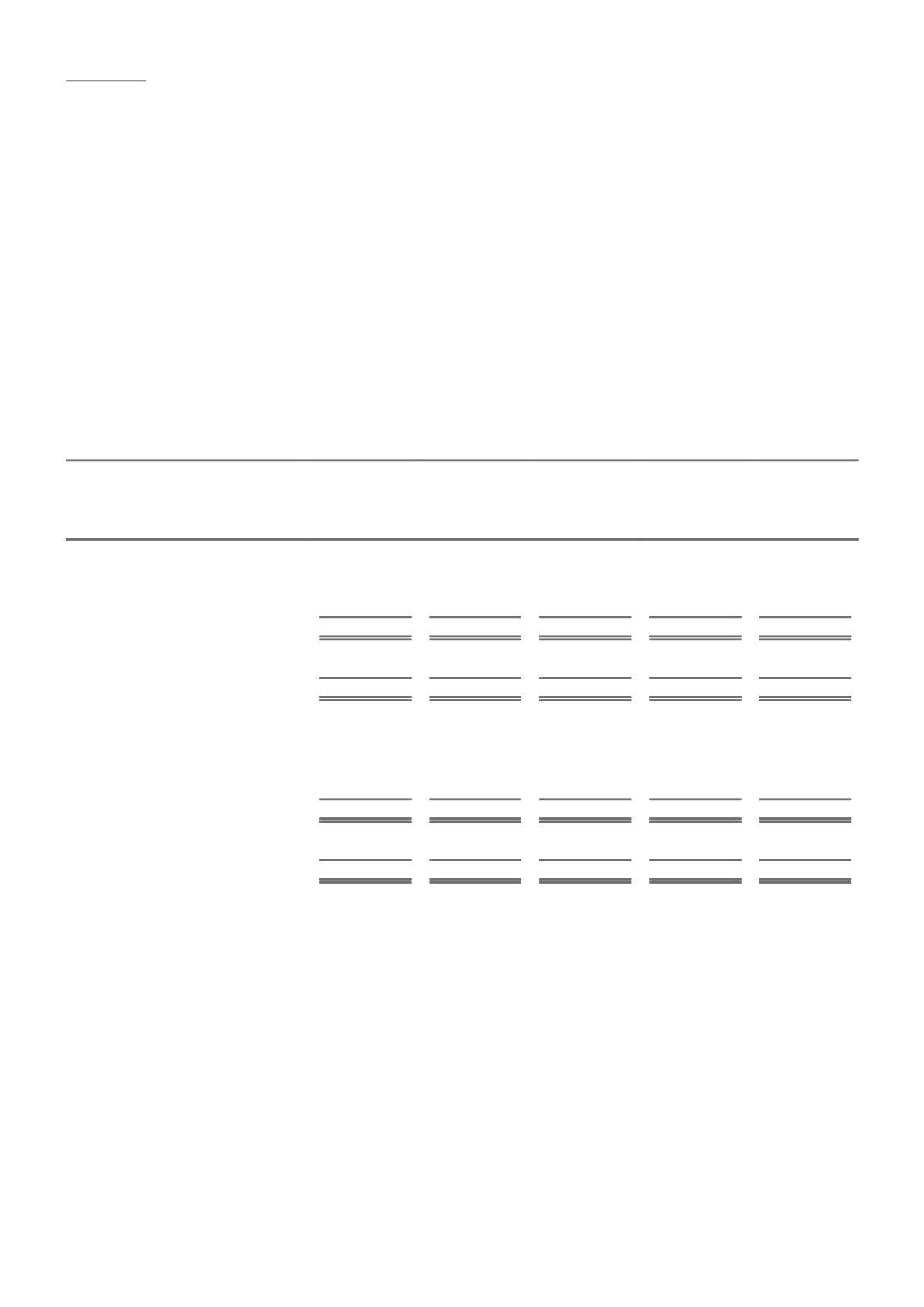

CONSOLIDATED

NOT OVERDUE

OVERDUE

TOTAL

<30 days

30-120 days

>120 days

$m

$m

$m

$m

$m

2015

Premium receivable

2,773

233

244

40

3,290

Provision for impairment - specific

-

(2)

(5)

(21)

(28)

Provision for impairment - collective

(5)

(1)

(1)

(4)

(11)

Net balance

2,768

230

238

15

3,251

Reinsurance recoveries on paid claims

176

87

10

27

300

Net balance

176

87

10

27

300

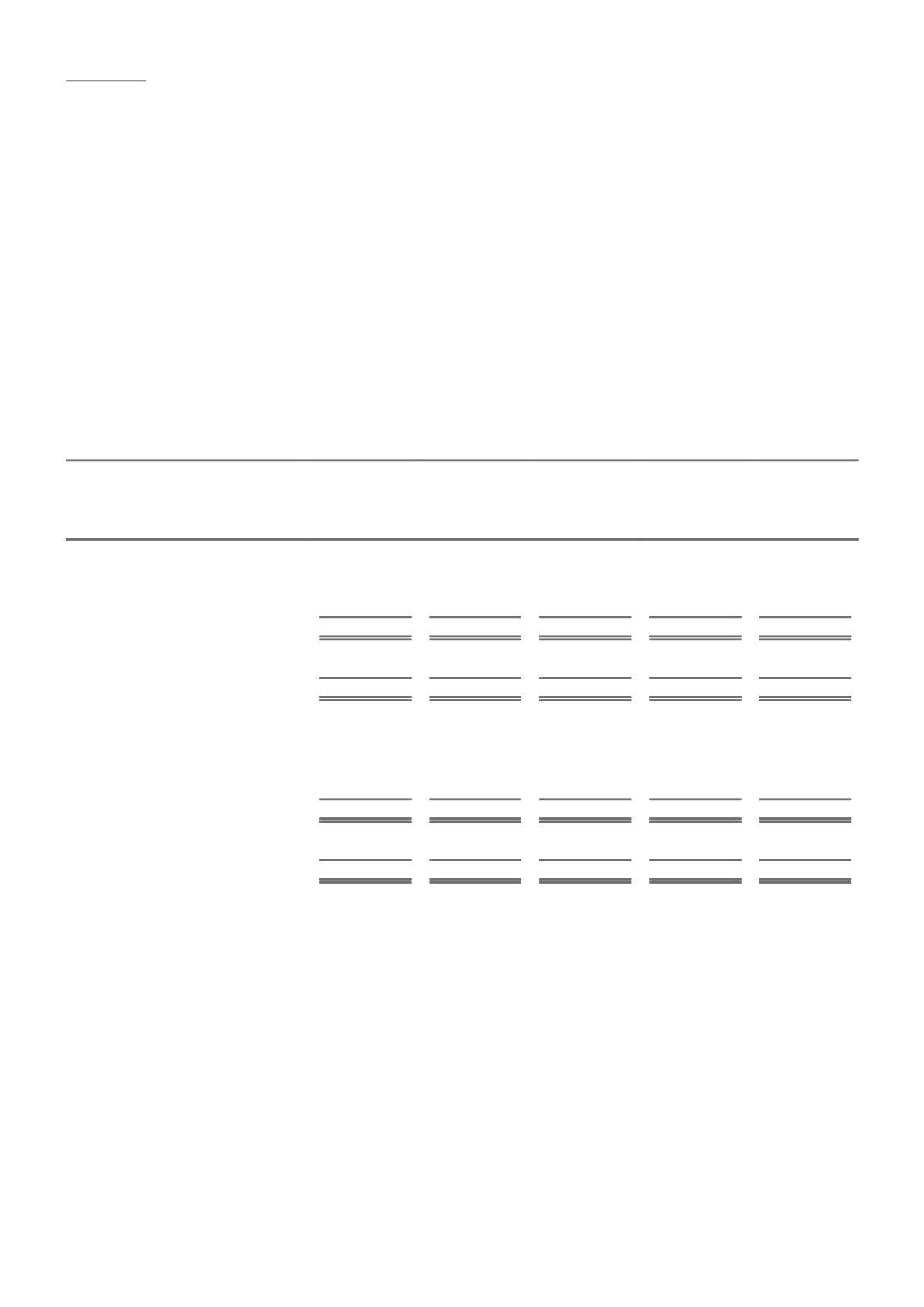

2014

Premium receivable

2,837

247

236

37

3,357

Provision for impairment - specific

-

(3)

(5)

(20)

(28)

Provision for impairment - collective

(7)

(1)

(1)

(4)

(13)

Net balance

2,830

243

230

13

3,316

Reinsurance recoveries on paid claims

153

29

14

34

230

Net balance

153

29

14

34

230

The majority of the premium receivable balance relates to policies which are paid on a monthly instalment basis. It is important to

note that the late payment of amounts due under such arrangements allows for the cancellation of the related insurance contract

eliminating both the credit risk and insurance risk for the unpaid amounts. Upon cancellation of a policy the outstanding premium

receivable and revenue is reversed.

ii. Reinsurance recoveries receivable on outstanding claims

Reinsurance arrangements mitigate insurance risk but expose the Group to credit risk. Reinsurance is placed with companies based

on an evaluation of the financial strength of the reinsurers, terms of coverage and price. The Group has clearly defined credit policies

for the approval and management of credit risk in relation to reinsurers. The Consolidated entity monitors the financial condition of its

reinsurers on an ongoing basis and periodically reviews the reinsurers’ ability to fulfil their obligations to the Consolidated entity under

respective existing and future reinsurance contracts. Some of the reinsurers are domiciled outside of the jurisdictions in which the

Group operates and so there is the potential for additional risk such as country risk and transfer risk.

The level and quality of reinsurance protection is an important element in understanding the financial strength of an insurer. The

financial condition of a reinsurer is a critical deciding factor when entering into a reinsurance agreement. The longer the tail of the

direct insurance, the more important is the credit rating of the reinsurer.

59