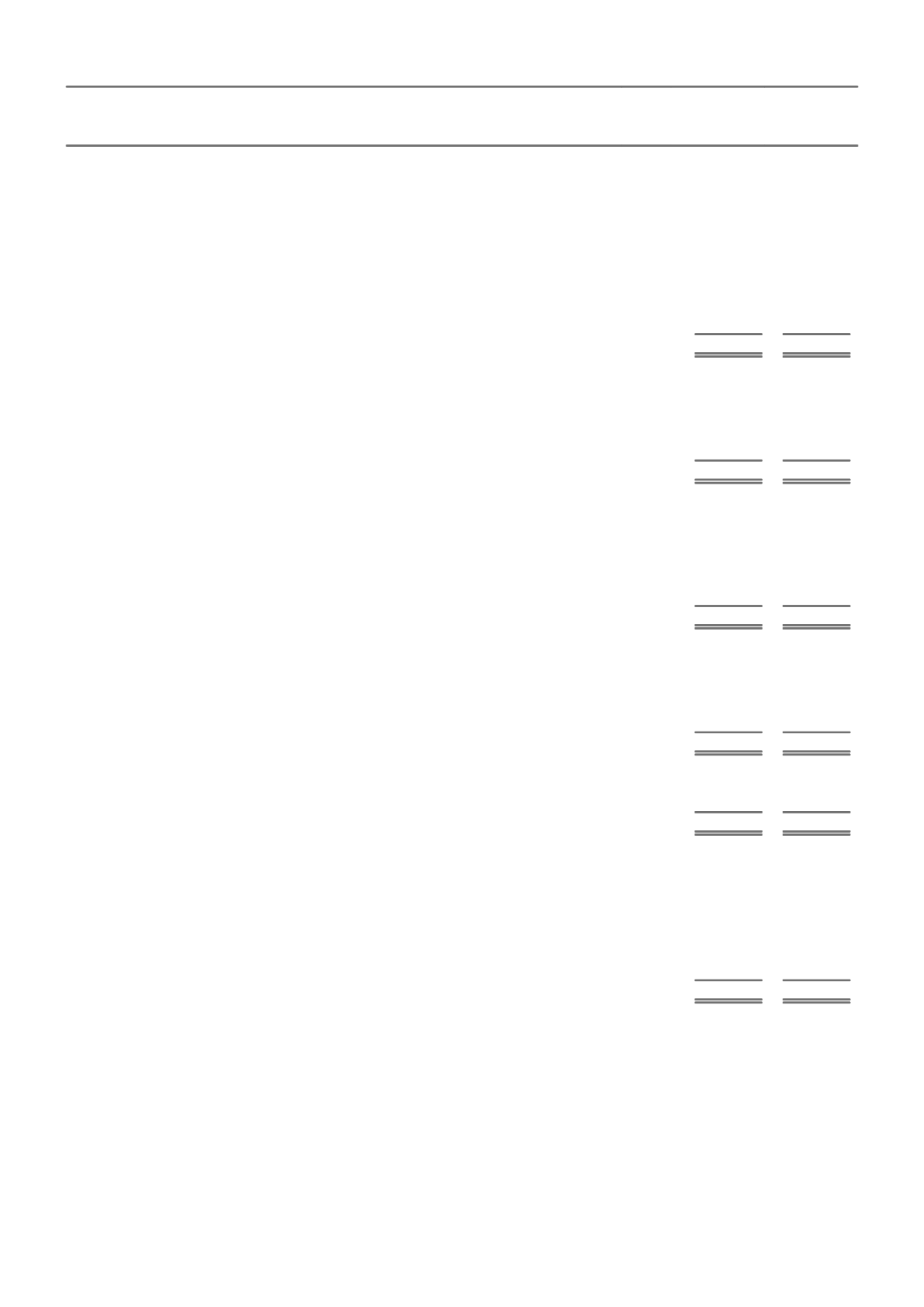

NOTE 5. ANALYSIS OF EXPENSES

CONSOLIDATED

2015

2014

$m

$m

A. EXPENSES AS PRESENTED IN THE STATEMENT OF COMPREHENSIVE INCOME

Outwards reinsurance premium expense

1,196

1,077

Claims expense

9,363

7,058

Acquisition costs

1,750

1,386

Other underwriting expenses

924

752

Fire services levies

225

216

Investment expenses on assets backing insurance liabilities

23

20

Finance costs

107

98

Net loss attributable to non-controlling interests in unitholders' funds

6

14

Fee based, corporate and other expenses

465

256

Total expenses

14,059

10,877

B. ANALYSIS OF EXPENSES BY FUNCTION

General insurance business expenses

13,481

10,509

Fee based business expenses

113

113

Investment and other expenses

12

21

Corporate and administration expenses

453

234

Total expenses

14,059

10,877

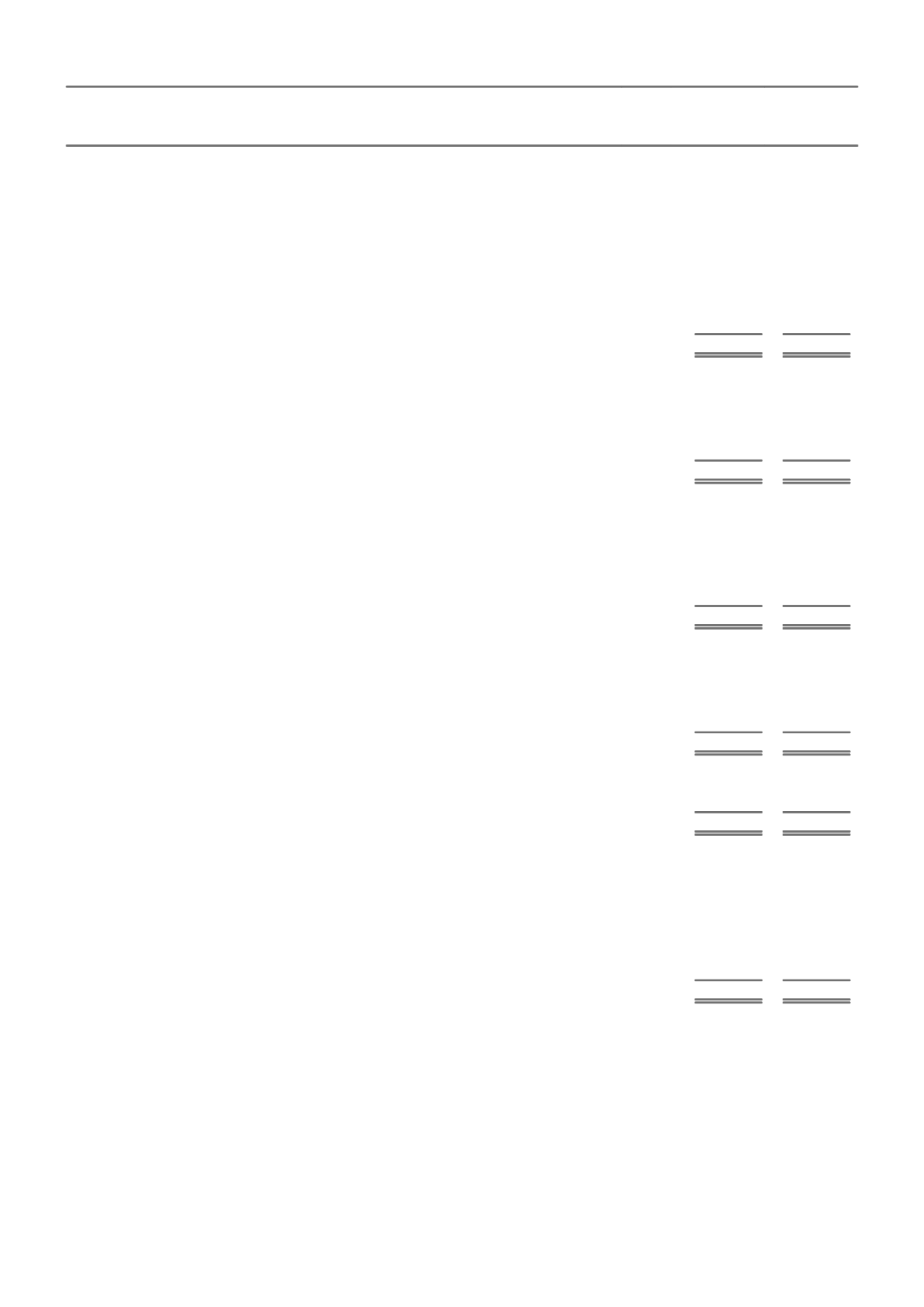

C. OTHER ITEMS

Disclosure of the following items is considered relevant in explaining the results for the financial year:

I. Depreciation and amortisation

Acquired intangible assets

80

11

Capitalised software development expenditure

59

38

Property and equipment

67

62

206

111

II. Employee benefits

Defined contribution superannuation plans

116

99

Defined benefit superannuation plans

10

12

Share based remuneration

28

25

Salaries and other employee benefits expense

1,605

1,313

1,759

1,449

III. Other

Restructuring provision and integration costs

155

50

Impairment in investment in associate

60

-

215

50

IV. Finance costs

Subordinated term notes interest paid/payable

30

26

Convertible preference share distributions paid/payable

18

18

Reset exchangeable securities interest paid/payable

25

26

Subordinated bonds interest paid/payable

23

22

Other debts of an operational nature, interest paid/payable

7

1

Amortisation of capitalised transaction costs

4

5

107

98

63