CONSOLIDATED

2015

2014

$m

$m

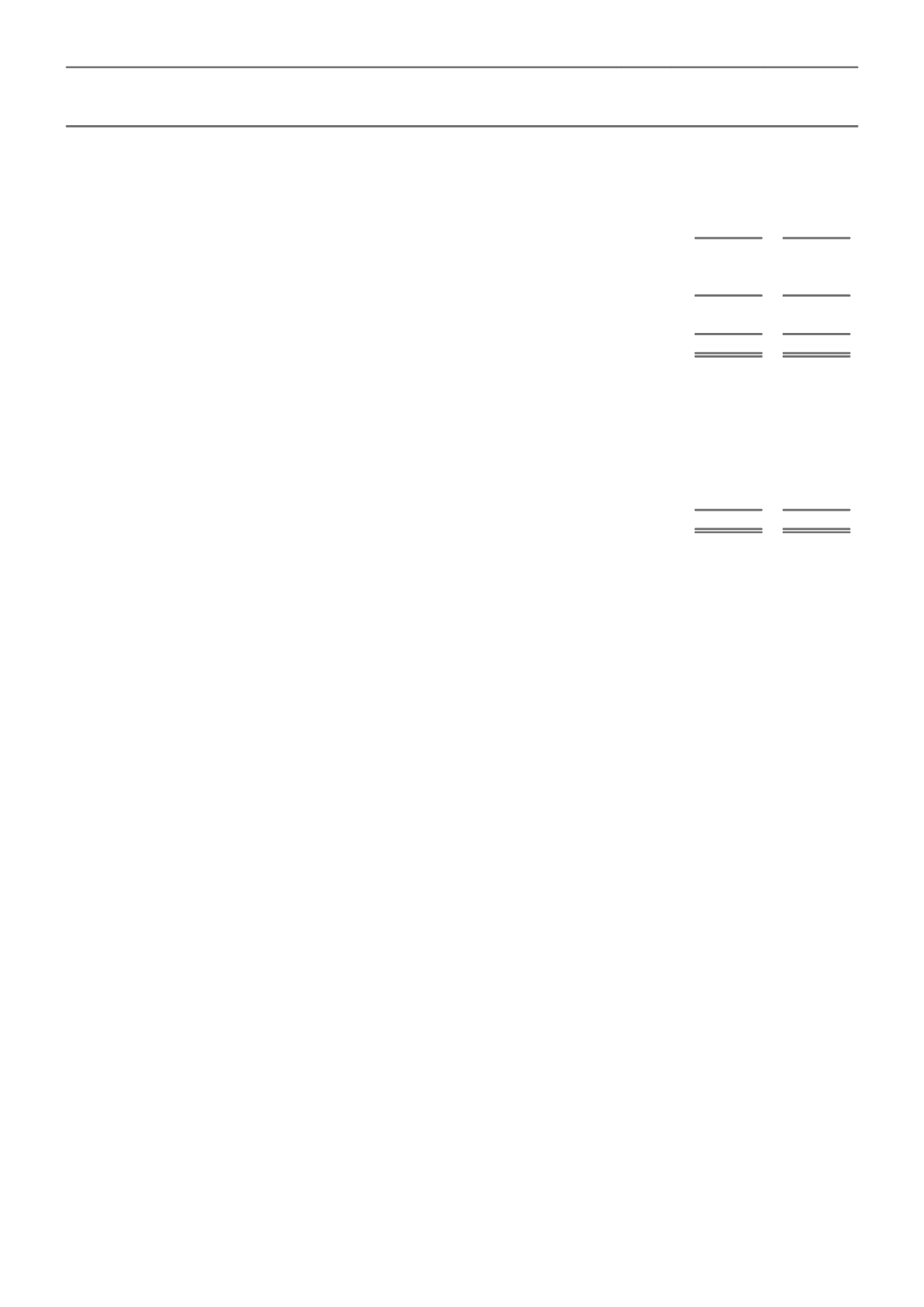

D. DEFERRED TAX LIABILITIES

I. Composition

a. AMOUNTS RECOGNISED IN PROFIT

Investments

35

108

Intangible assets

56

78

Other

165

130

256

316

b. AMOUNTS RECOGNISED DIRECTLY IN OTHER COMPREHENSIVE INCOME

Hedges

27

12

283

328

c. AMOUNTS SET-OFF AGAINST DEFERRED TAX ASSETS

(283)

(328)

-

-

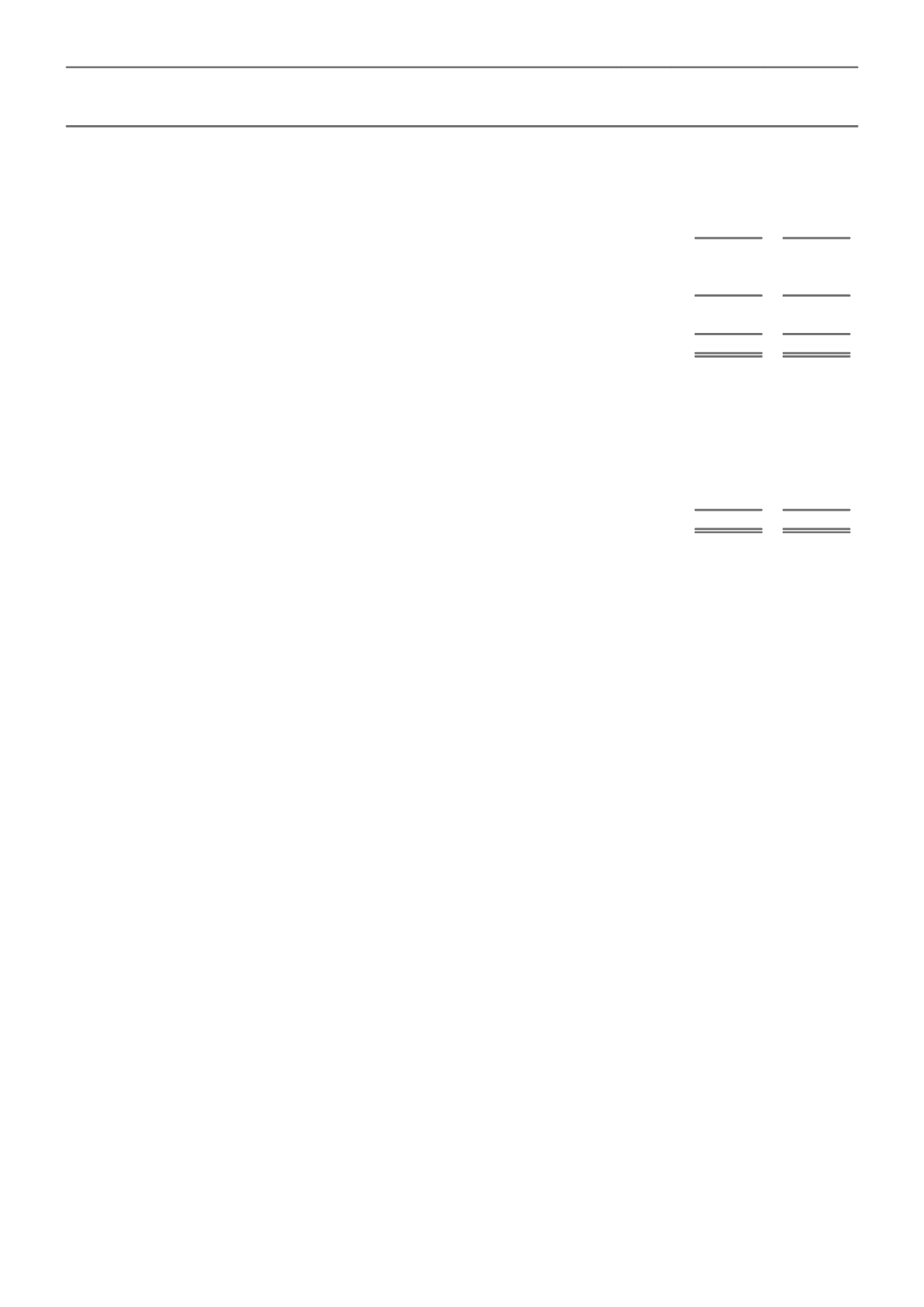

II. Reconciliation of movements

Balance at the beginning of the financial year

328

160

Charged/(credited) to profit or loss

(49)

71

Charged/(credited) to equity

15

(8)

Additions through business acquisition

-

108

Transfers

-

2

Adjustments relating to prior year

(12)

(4)

Foreign exchange differences

1

(1)

Balance at the end of the financial year prior to set-off

283

328

NOTE 7. SEGMENT REPORTING

The Consolidated entity has general insurance operations in Australia, New Zealand and Asia. In Australia, the financial results are

generated from three different divisions being Personal Insurance, Commercial Insurance and Corporate and other.

From 1 July 2014, a new Australian operating model came into effect resulting in changes to the reporting segments of the Australian

operations. Prior period segment information has been re-presented accordingly. The Australian operating segments are now

identified by management based on the activities that directly affect the customer experience, from pricing, marketing, to sales

services and claims; these segments are Personal Insurance and Commercial Insurance.

In the prior financial year, on 30 June 2014, the Group acquired the former Wesfarmers insurance business in Australia and New

Zealand, with the entities being consolidated by the Group from that date. The Australian and New Zealand acquired businesses form

part of the Australian Commercial Insurance and Australian Personal Insurance segments, and the New Zealand segment.

The Consolidated entity has identified its operating segments based on the internal reports that are reviewed and used by the Chief

Executive Officer (being the chief operating decision maker) in assessing performance and in determining the allocation of resources.

The reportable segments are based on the operating segments as these are the source of the Consolidated entity’s major risks and

have the most effect on the rates of return.

The reportable segments comprise the following business divisions:

A. AUSTRALIA PERSONAL INSURANCE

This segment provides general insurance products to individuals throughout Australia primarily under the NRMA Insurance, SGIO,

SGIC and CGU brands, in Victoria under the RACV brand (via a distribution and underwriting relationship with RACV) and the Coles

Insurance brand nationally (via a distribution agreement with Coles).

B. AUSTRALIA COMMERCIAL INSURANCE

This segment provides commercial insurance to business customers throughout Australia, predominantly under the CGU, WFI,

and Swann Insurance brands through intermediaries including brokers, authorised representatives and distribution partners.

C. NEW ZEALAND

This segment provides general insurance business underwritten through subsidiaries in New Zealand. Insurance products are

sold directly to customers predominantly under the State and AMI brands, and through intermediaries (insurance brokers and

authorised representatives) predominantly under the NZI and Lumley Insurance brands. Personal and commercial products are

also distributed by corporate partners, such as large financial institutions, using third party brands.

D. ASIA

This segment provides direct and intermediated insurance business underwritten through subsidiaries in Thailand, Vietnam and

Indonesia and the share of the operating result from the investment in associates in Malaysia, India and China. The businesses

offer personal and commercial insurance products through local brands.

65