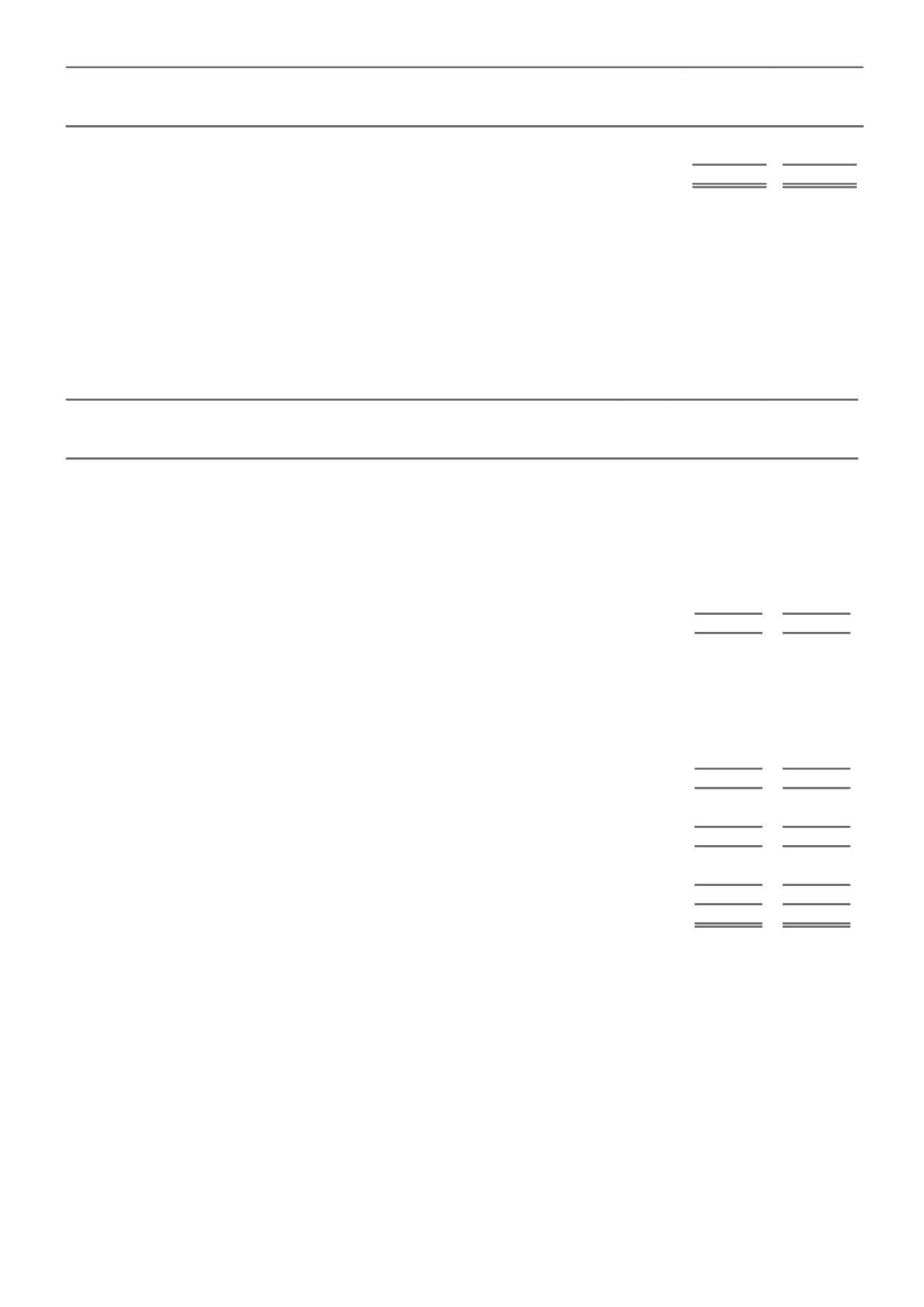

CONSOLIDATED

2015

2014

$m

$m

Net central estimate of present value of expected future cash flows from future claims

3,481

4,013

Risk margin of the present value of expected future cash flows

81

93

3,562

4,106

Risk margin percentage

2.3%

2.3%

Probability of adequacy

60.0%

60.0%

The risk margin used in testing individual portfolios is calculated by using a probability of adequacy methodology based on

assessments of the levels of risk in each portfolio for the liability adequacy test. The methodology of using probability of adequacy as a

basis for calculating the risk margin, including diversification benefit, is consistent with that used for the determination of the risk

margin for the outstanding claims liability. The process used to determine the risk margin, including the way in which diversification of

risks has been allowed for, is explained in the claims note. The probability of adequacy represented by the liability adequacy test

differs from the probability of adequacy represented by the outstanding claims liability. The reason for this difference is that the former

is in effect an impairment test used only to test the sufficiency of net premium liabilities whereas the latter is a measurement

accounting policy used in determining the carrying value of the outstanding claims liability.

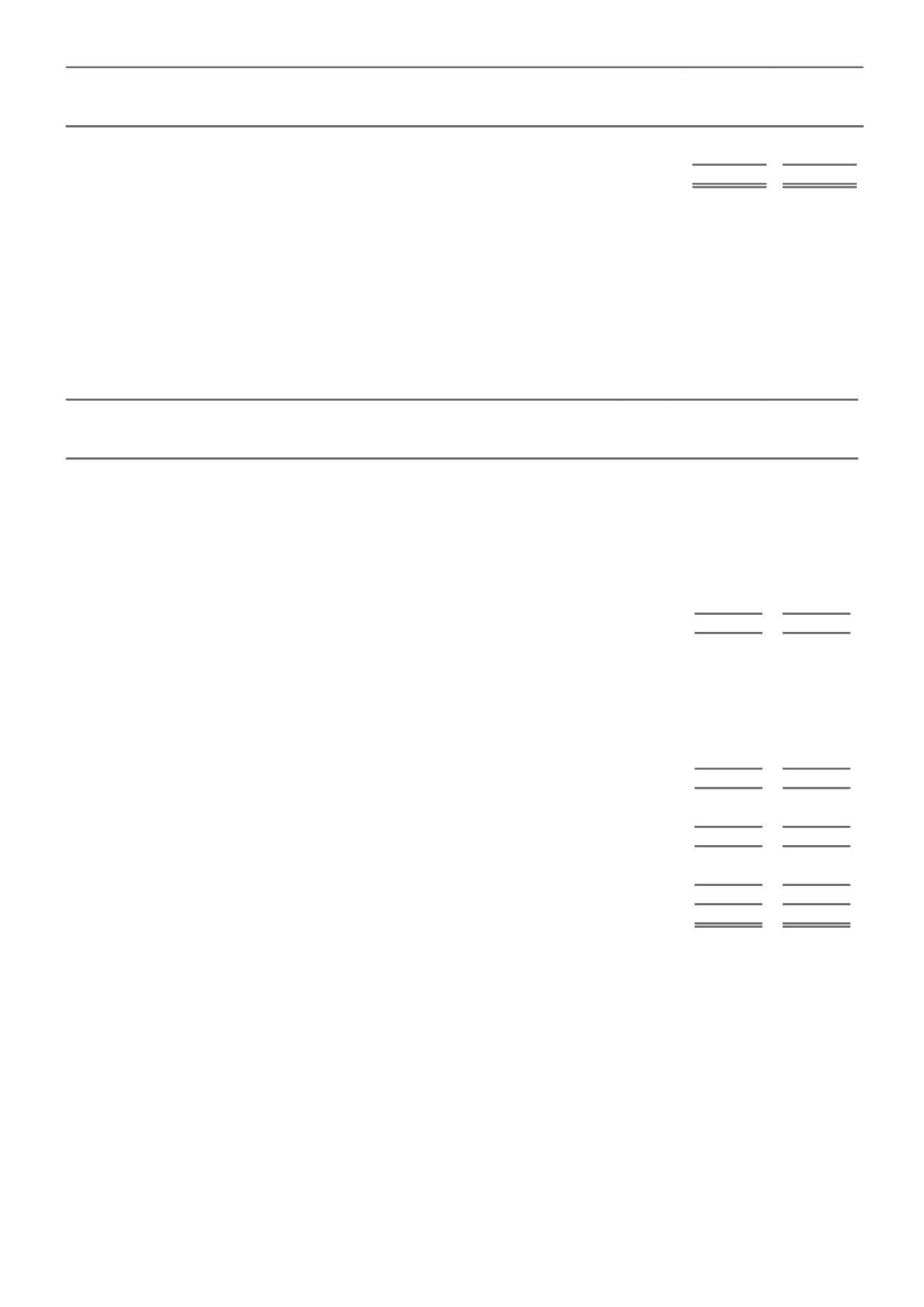

NOTE 14. INVESTMENTS

CONSOLIDATED

2015

2014

$m

$m

A. COMPOSITION

I. Interest bearing investments

Cash and short term money held in investment

1,127

2,554

Government and semi-government bonds

2,915

2,248

Corporate bonds and notes

8,158

7,538

Subordinated securities

1,769

1,307

Fixed interest trusts

71

63

Other

85

74

14,125

13,784

II. Equity investments

a. DIRECT EQUITIES

Listed

598

808

Unlisted

304

119

b. EQUITY TRUSTS (INCLUDING PROPERTY TRUSTS)

Listed

58

69

Unlisted

182

426

1,142

1,422

III. Other investments

Other trusts

268

158

268

158

IV. Derivatives

Investment related derivatives

-

13

-

13

15,535

15,377

The Group's equity investments include the exposure to convertible securities.

As at 30 June 2014 $728 million of other interest bearing securities have been reclassified to corporate bonds and notes within the

above disclosure to conform to the current year's presentation.

B. DETERMINATION OF FAIR VALUE

The table below separates the total investments balance based on a hierarchy that reflects the significance of the inputs used in the

determination of fair value. The fair value hierarchy is determined using the following levels:

I. Level 1 quoted prices

Quoted prices (unadjusted) in active markets for identical assets and liabilities are used.

75