iii. Discount rate

The outstanding claims liability is calculated with reference to expected future payments. These payments are discounted to adjust for

the time value of money. An increase or decrease in the assumed discount rate will have a corresponding increase or decrease on

profit and loss.

iv. Claims handling costs ratio

An increase in the ratio reflects an increase in the estimate for the internal costs of administering claims. An increase or decrease in

the ratio assumption will have a corresponding decrease or increase on profit and loss.

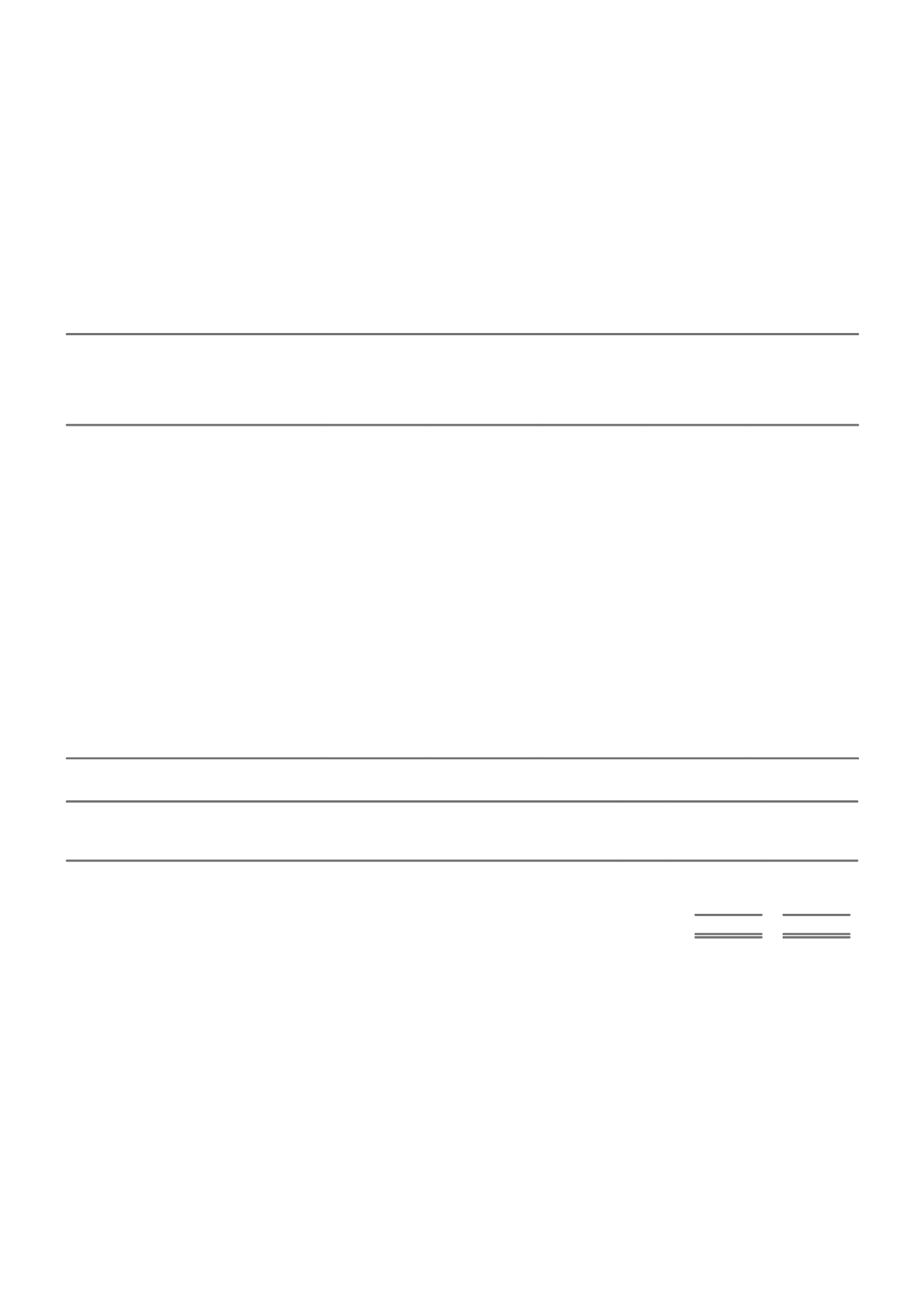

b. SENSITIVITY ANALYSIS OF CHANGES

The impact on the net outstanding claims liabilities before income tax to changes in key actuarial assumptions is summarised below.

Each change has been calculated in isolation of the other changes and without regard to other balance sheet changes that may

simultaneously occur. Changes are stated net of reinsurance recoveries.

The movements are stated in absolute terms where the base assumption is a percentage, for example, if the base inflation rate

assumption was 3.5%, a 1% increase would mean assuming a 4.5% inflation rate.

ASSUMPTION

CONSOLIDATED

MOVEMENT IN

ASSUMPTION

AUSTRALIA

PERSONAL

INSURANCE

AUSTRALIA

COMMERCIAL

INSURANCE NEW ZEALAND

ASIA

$m

$m

$m

$m

2015

Discounted average term to settlement

+10%

(38)

(75)

(1)

-

-10%

38

73

1

-

Inflation rate

+1%

125

152

6

1

-1%

(117)

(134)

(6)

(1)

Discount rate

+1%

(117)

(133)

(5)

-

-1%

127

153

5

-

Claims handling costs ratio

+1%

57

42

6

3

-1%

(57)

(42)

(6)

(3)

2014

Discounted average term to settlement

+10%

(52)

(89)

(1)

-

-10%

52

85

1

-

Inflation rate

+1%

135

141

4

-

-1%

(127)

(124)

(4)

-

Discount rate

+1%

(126)

(122)

(4)

-

-1%

137

141

4

-

Claims handling costs ratio

+1%

53

36

7

2

-1%

(53)

(36)

(7)

(2)

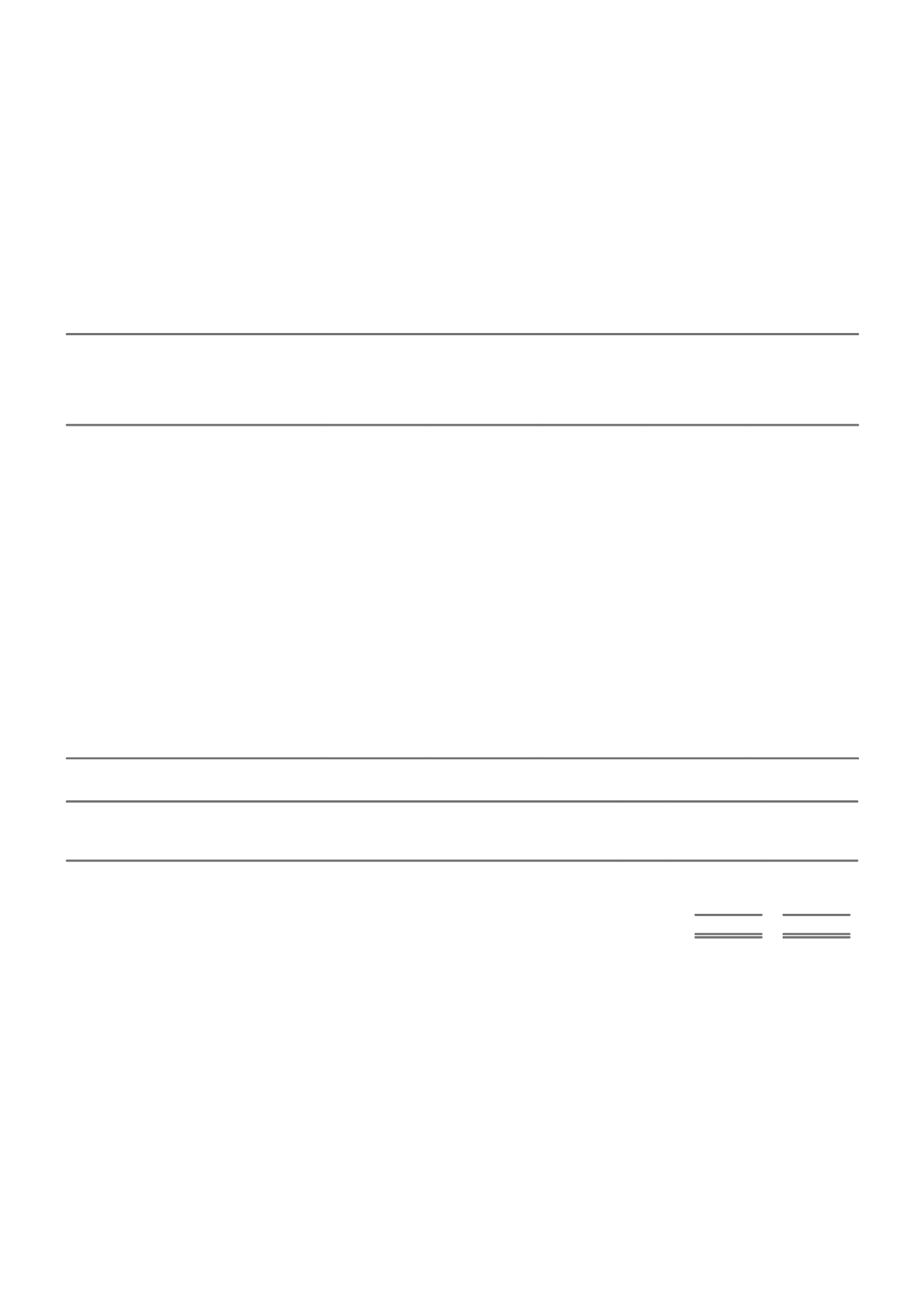

NOTE 11. REINSURANCE AND OTHER RECOVERIES ON OUTSTANDING CLAIMS

CONSOLIDATED

2015

2014

$m

$m

A. REINSURANCE AND OTHER RECOVERIES RECEIVABLE ON OUTSTANDING CLAIMS

Expected reinsurance and other recoveries receivable on outstanding claims - undiscounted

4,262

3,894

Discount to present value

(549)

(646)

Expected reinsurance and other recoveries receivable on outstanding claims - discounted

3,713

3,248

The carrying value of reinsurance recoveries and other recoveries includes $1,839 million (2014-$1,882 million) which is expected to

be settled more than 12 months from the reporting date.

Refer to the claims note for a reconciliation of the movement in reinsurance and other receivables on incurred claims.

B. ACTUARIAL ASSUMPTIONS

The measurement of reinsurance and other recoveries on outstanding claims is an inherently uncertain process involving estimates.

The amounts are generally calculated using actuarial assumptions and methods similar to those used for the outstanding claims

liability (refer to section VI of the claims note).

Where possible, the valuation of reinsurance recoveries is linked directly to the valuation of the gross outstanding claims liability.

Accordingly, the valuation of outstanding reinsurance recoveries is subject to similar risks and uncertainties as the valuation of the

outstanding claims liability. Significant individual losses (for example those relating to catastrophe events) are analysed on a case-by-

case basis for reinsurance purposes.

73