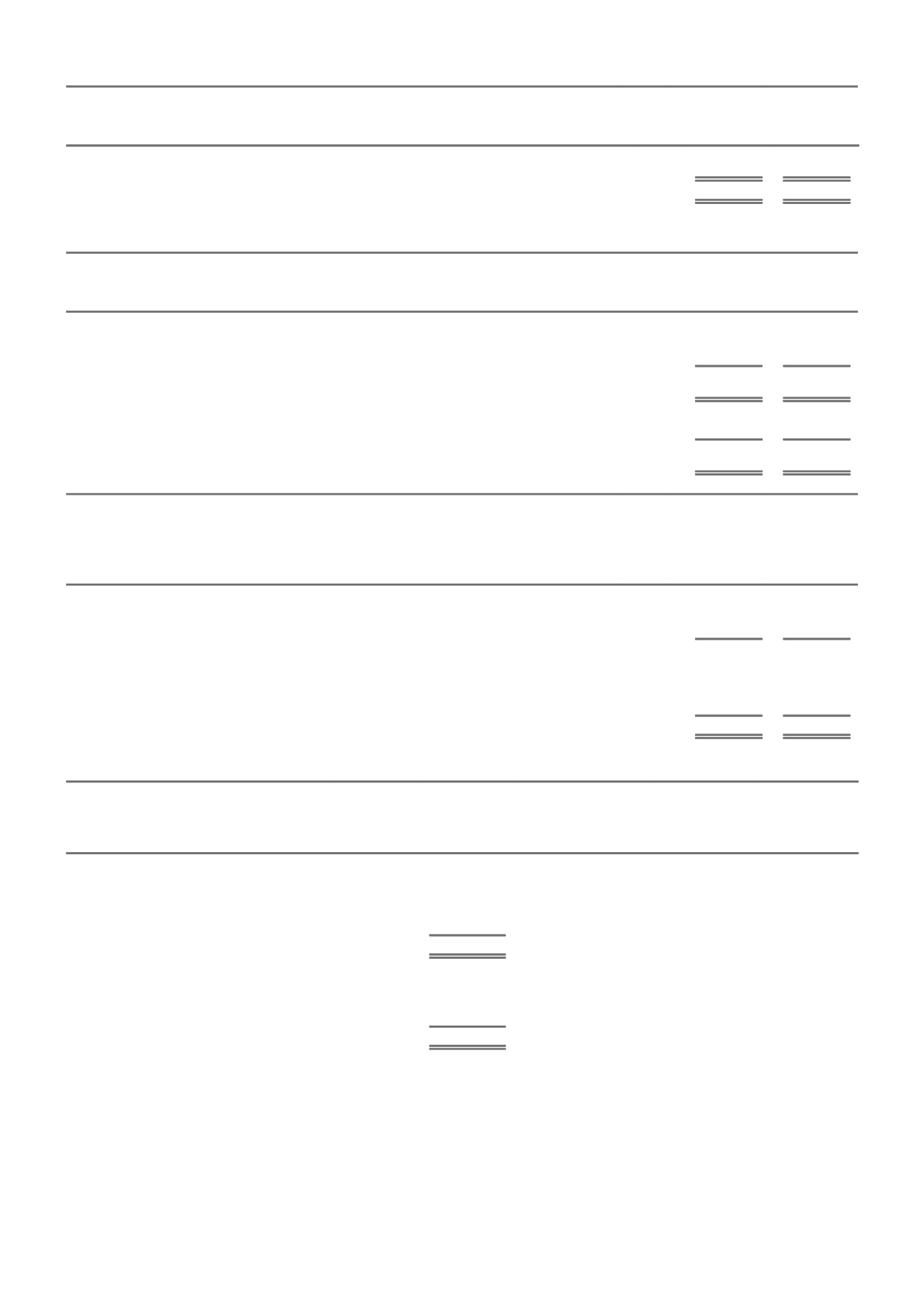

NOTE 8. EARNINGS PER SHARE

CONSOLIDATED

2015

2014

cents

cents

A. REPORTING PERIOD VALUES

Basic earnings per ordinary share

*

31.22

56.09

Diluted earnings per ordinary share

30.45

53.62

* The basic earnings per ordinary share excludes the treasury shares held in trust from the denominator of the calculation, but includes earnings attributable to those

shares in the numerator, to comply with AASB 133 Earnings Per Share.

CONSOLIDATED

2015

2014

$m

$m

B. RECONCILIATION OF EARNINGS USED IN CALCULATING EARNINGS PER SHARE

Profit/(loss) for the year

830

1,330

Profit attributable to non-controlling interests

(102)

(97)

Profit/(loss) attributable to shareholders of the Parent which is used in calculating basic and

diluted earnings per share

728

1,233

Earnings used in calculating diluted earnings per share

Finance costs of convertible securities, net of tax

26

24

Profit/(loss) attributable to shareholders of the Parent which is used in calculating diluted

earnings per share

754

1,257

CONSOLIDATED

2015

2014

Number of

shares in

millions

Number of

shares in

millions

C. RECONCILIATION OF WEIGHTED AVERAGE NUMBER OF ORDINARY SHARES USED IN CALCULATING EARNINGS PER SHARE

Weighted average number of ordinary shares on issue

2,345

2,211

Weighted average number of treasury shares held in trust

(13)

(13)

Weighted average number of ordinary shares used in the calculation of basic earnings per share

2,332

2,198

Weighted average number of dilutive potential ordinary shares relating to:

Convertible securities

131

133

Unvested share based remuneration rights supported by treasury shares held in trust

13

13

Weighted average number of ordinary shares used in the calculation of diluted earnings per share

2,476

2,344

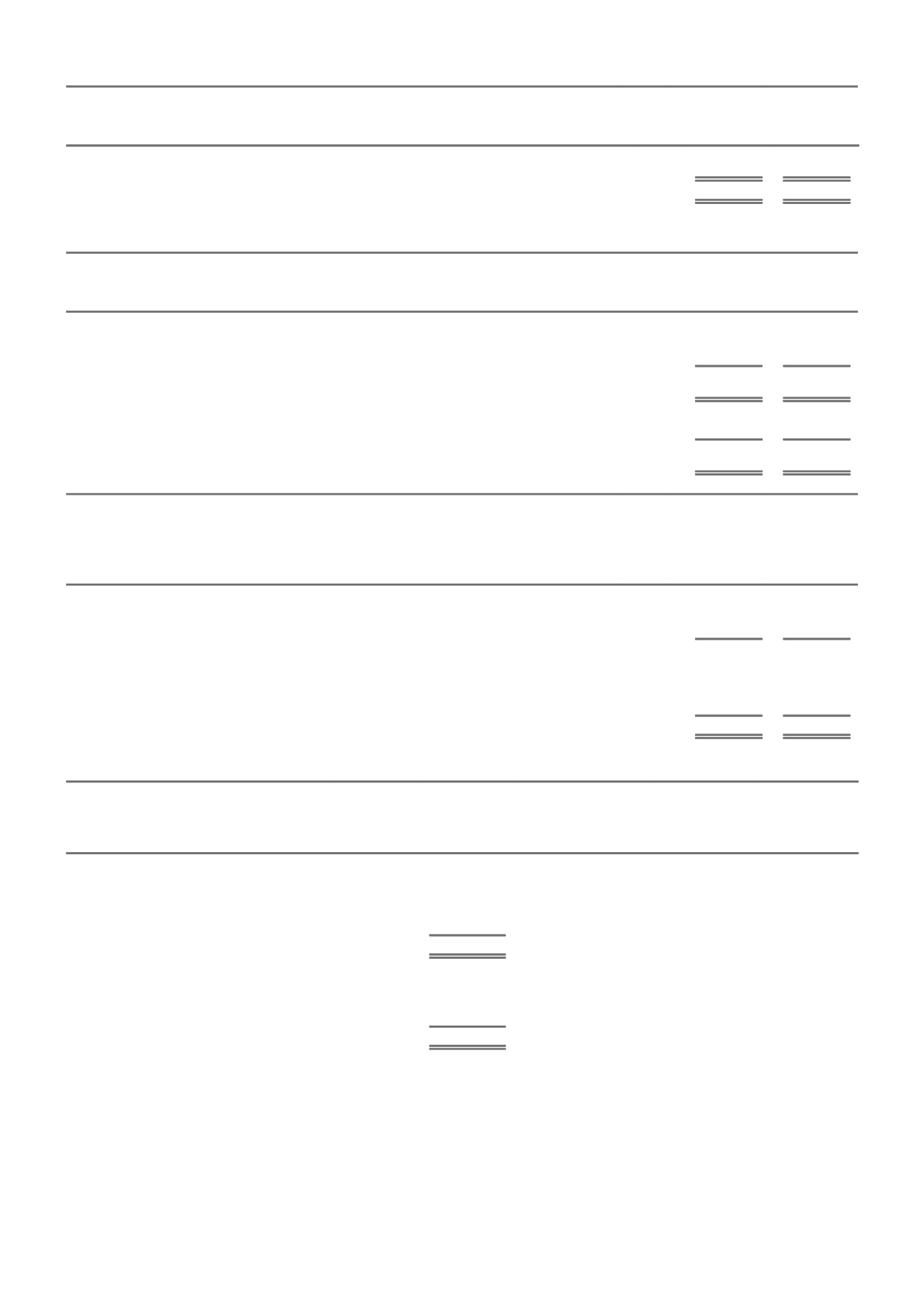

NOTE 9. DIVIDENDS

CENTS PER

SHARE

TOTAL

AMOUNT

PAYMENT DATE

TAX RATE FOR

FRANKING

CREDIT

PERCENTAGE

FRANKED

$m

A. ORDINARY SHARES

2015

2015 interim dividend

13.0

304

1 April 2015

30%

100%

2014 final dividend

26.0

609 8 October 2014

30%

100%

913

2014

2014 interim dividend

13.0

304

2 April 2014

30%

100%

2013 final dividend

25.0

519

9 October 2013

30%

100%

823

It is standard practice that the Board determines to pay the dividend for a period after the relevant reporting date. In accordance with

the relevant accounting policy (refer to section AD of the summary of significant accounting policies note) a dividend is not accrued for

until it is determined to pay and so the dividends for a six-monthly period are generally recognised and measured in the financial

reporting period following the period to which the dividend relates.

The dividends recognised in the current reporting year include $4 million (2014-$3 million) paid in relation to treasury shares held in

trusts controlled by the Consolidated entity.

67