b. LIQUIDITY RISK EXPOSURE

i. Outstanding claims liability and investments

The breakdown of the fixed term investments are provided by expected maturity. Actual maturities may differ from expected maturities

because certain counterparties have the right to call or prepay certain obligations with or without call or prepayment penalties.

A maturity analysis of the estimated net discounted outstanding claims liability based on the remaining term to payment at the

reporting date and the investments that have a fixed term is provided in the table below.

This maturity profile is a tool used in the investment of assets backing insurance liabilities in accordance with the policy of broadly

matching the overall interest rate sensitivity of the assets with the overall interest rate sensitivity created by the maturity profile of the

estimated pattern of claims payments.

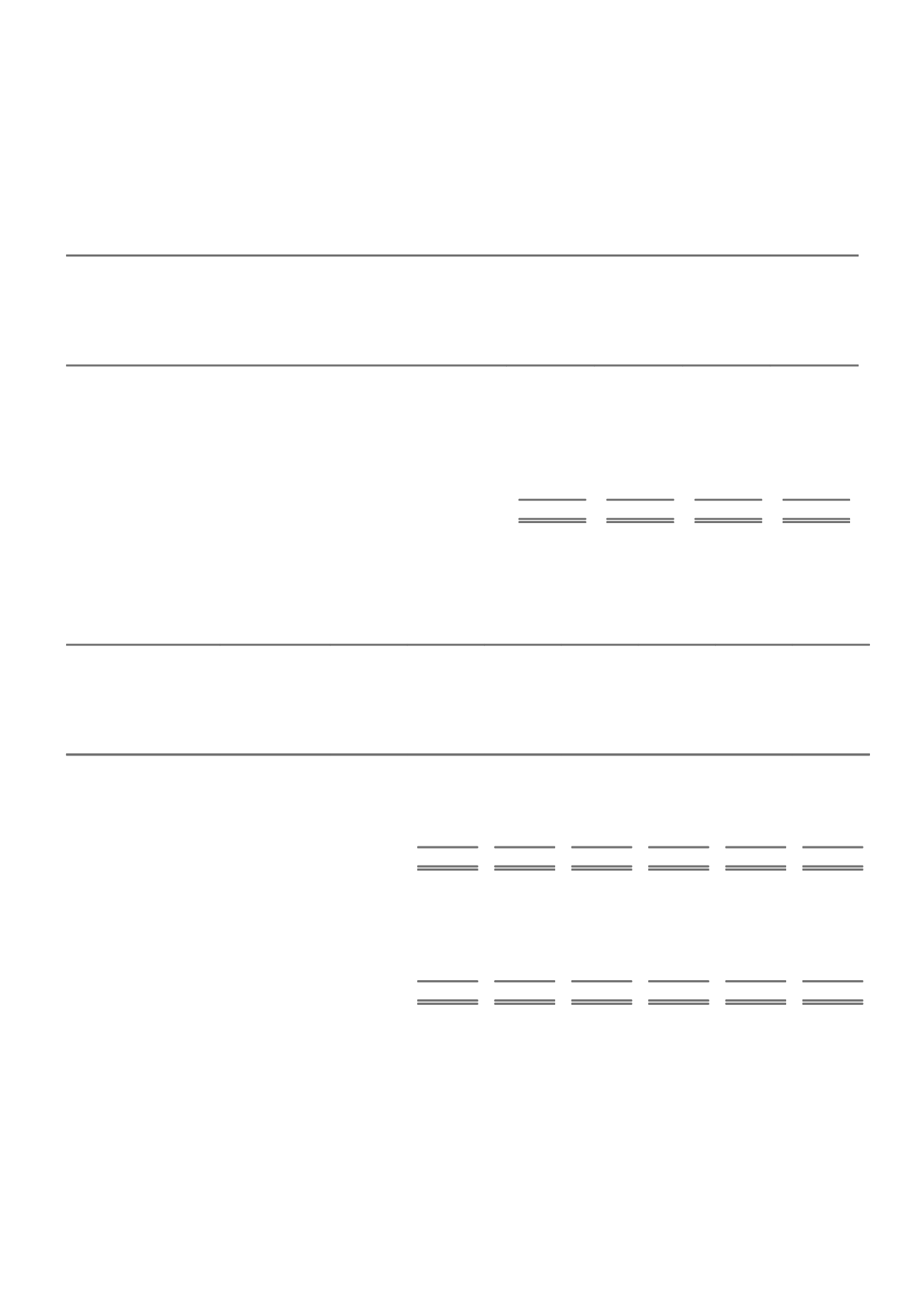

CONSOLIDATED

MATURITY ANALYSIS

NET DISCOUNTED

OUTSTANDING CLAIMS

LIABILITY

INVESTMENTS

2015

2014

2015

2014

$m

$m

$m

$m

Floating interest rate (at call)

-

-

1,002

948

Within 1 year or less

3,836

3,400

3,058

4,042

Within 1 to 2 years

1,549

1,611

1,192

581

Within 2 to 3 years

946

1,039

2,804

1,340

Within 3 to 4 years

641

678

1,542

3,509

Within 4 to 5 years

433

441

1,674

1,424

Over 5 years

1,569

1,589

2,853

1,940

Total

8,974

8,758

14,125

13,784

Timing of future claim payments is inherently uncertain. The table above presents estimated timing.

ii. Interest bearing liabilities

The following table provides information about the residual maturity periods of the interest bearing liabilities of a capital nature based

on the contractual maturity dates of undiscounted cash flows. All of the liabilities have call, reset or conversion dates which occur prior

to any contractual maturity.

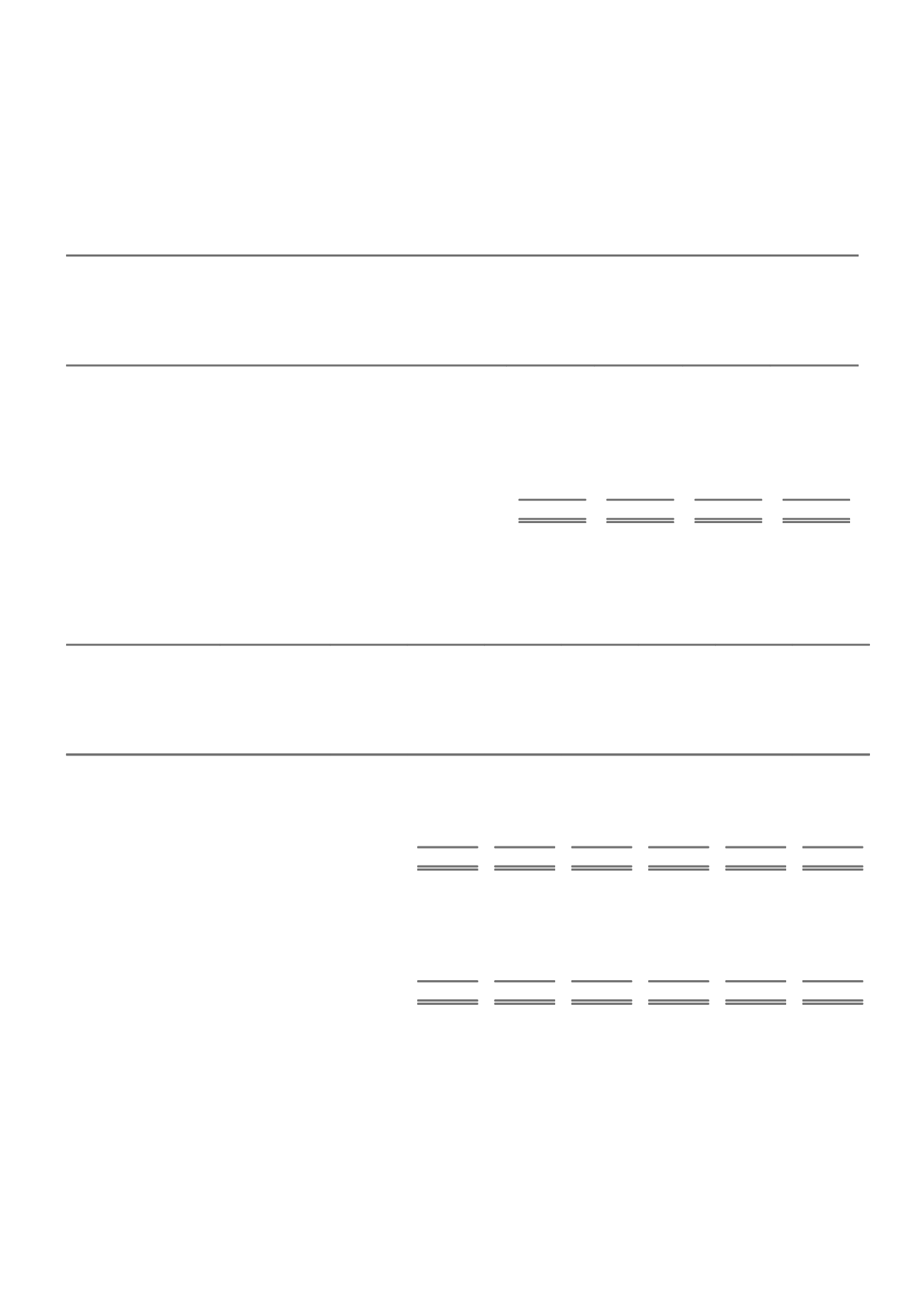

CONSOLIDATED

CARRYING

VALUE

MATURITY DATES OF CONTRACTUAL UNDISCOUNTED CASH

FLOWS

Within 1

year 1 - 2 years 2 - 5 years

Over 5

years Perpetual

Total

$m

$m

$m

$m

$m

$m

$m

2015

Tier 1 regulatory capital

(a)

927

-

-

-

-

927

927

Tier 2 regulatory capital

(a)

841

-

-

-

841

-

841

Contractual undiscounted interest

payments

(b)

90

86

227

-

-

403

Total contractual undiscounted payments

90

86

227

841

927 2,171

2014

Tier 1 regulatory capital

(a)

927

-

-

-

-

927

927

Tier 2 regulatory capital

(a)

834

-

-

-

834

-

834

Contractual undiscounted interest

payments

(b)

96

96

287

-

-

479

Total contractual undiscounted payments

96

96

287

834

927 2,240

(a)

These liabilities have call, reset or conversion dates upon which certain terms, including the interest or distribution rate, can be changed or the security may be

redeemed or converted. The detailed descriptions of the instruments are provided in the interest bearing liabilities note. The classification of Tier 1 and Tier 2 is subject

to Life and General Insurance Capital transitional arrangements.

(b)

Contractual undiscounted interest payments are calculated based on underlying fixed interest rates or prevailing market floating rates as applicable at the reporting

date. Interest payments have not been included beyond five years. Reporting date exchange rates have been used for interest projections for liabilities in foreign

currencies.

61