ii. Claims management and provisioning

Initial claims determination is managed by claims officers with the requisite degree of experience and competence with the assistance,

where appropriate, of a loss adjustor or other party with specialist knowledge. It is the Group's intention to respond to and settle all

genuine claims quickly whenever possible and to pay claims fairly, based on policyholders' full entitlements.

Claims provisions are established using actuarial valuation models and include a risk margin for uncertainty (refer to the claims note).

iii. Reinsurance

Refer to reinsurance risk section III below for further details.

b. CONCENTRATIONS OF INSURANCE RISK

The exposure to concentrations of insurance risk is mitigated by a portfolio diversified into many classes of business across different

regions and by the utilisation of reinsurance.

Concentration risk is particularly relevant in the case of catastrophes, usually natural disasters, which generally result in a

concentration of affected policyholders over and above the norm and which constitutes the largest individual potential financial loss.

Catastrophe losses are an inherent risk of the general insurance industry that have contributed, and will continue to contribute, to

potentially material year-to-year fluctuations in the results of operations and financial position. Catastrophes are caused by various

natural events including earthquakes, bushfires, hailstorms, tropical storms and high winds. The Group is also exposed to certain

large human-made catastrophic events such as industrial accidents and building collapses. The nature and level of catastrophes in

any period cannot be predicted accurately but can be estimated through the utilisation of predictive models. The Group actively limits

the aggregate insurance exposure to catastrophe losses in regions that are subject to high levels of natural catastrophes.

Each year, the Group sets its tolerance for concentration risk and purchases reinsurance in excess of these tolerances. Various

models are used to estimate the impact of different potential natural disasters and other catastrophes. The tolerance for

concentration risk is used to determine the Insurance Concentration Risk Charge (ICRC) which is the maximum net exposure to

insurance risk determined appropriate for any single event with a given probability. The selected ICRC is also determined based on

the cost of purchasing the reinsurance and capital efficiency.

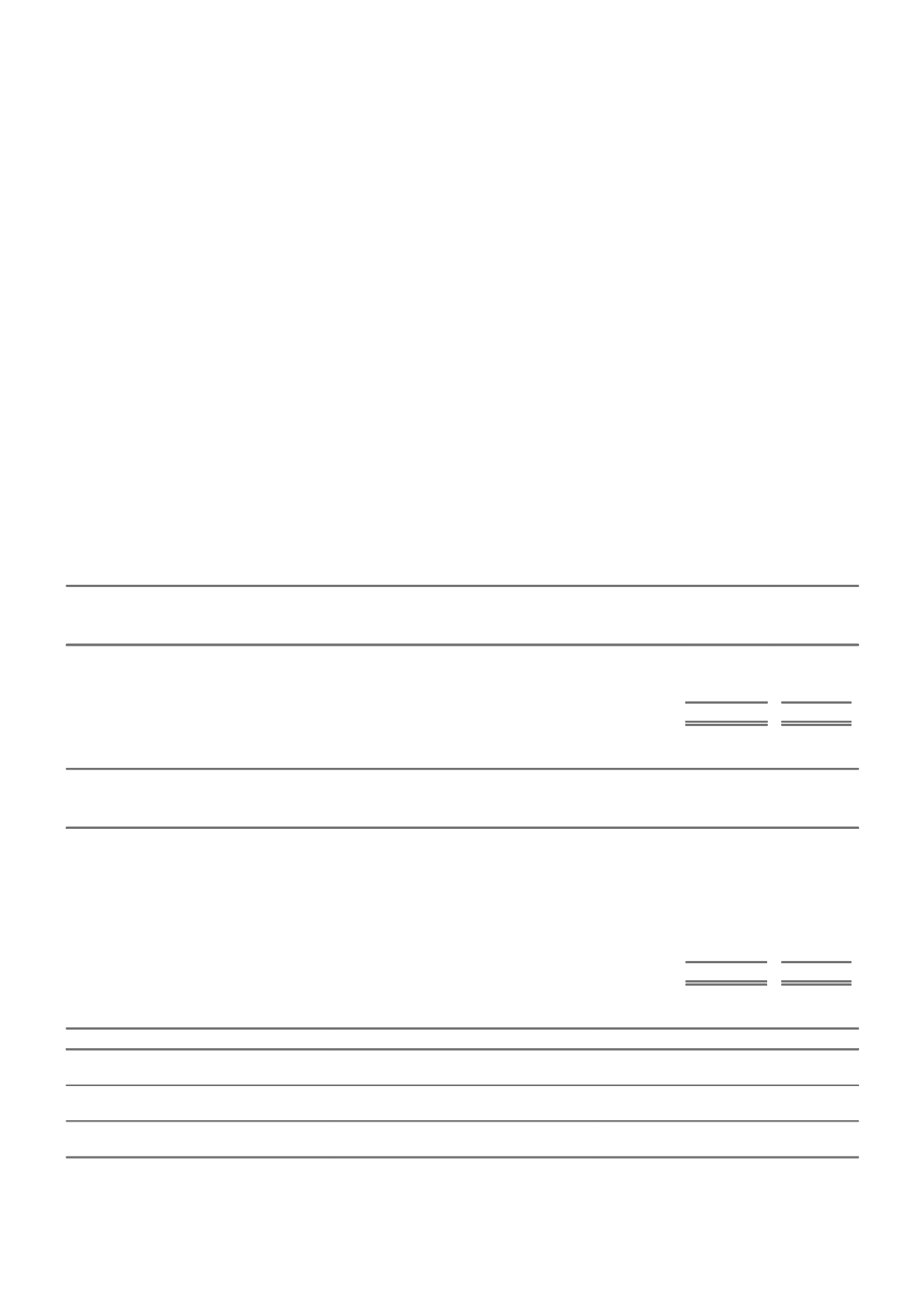

The tables below demonstrate the diversity of the Group’s operations by both region (noting that the insurance risks underwritten in

Australia are written in all states and territories) and product, demonstrating the limited exposure to additional risks associated with

long-tail classes of business. The table below provides an analysis of gross written premium by region:

CONSOLIDATED

2015

2014

%

%

Australia

77

78

New Zealand

20

19

Asia

3

3

100

100

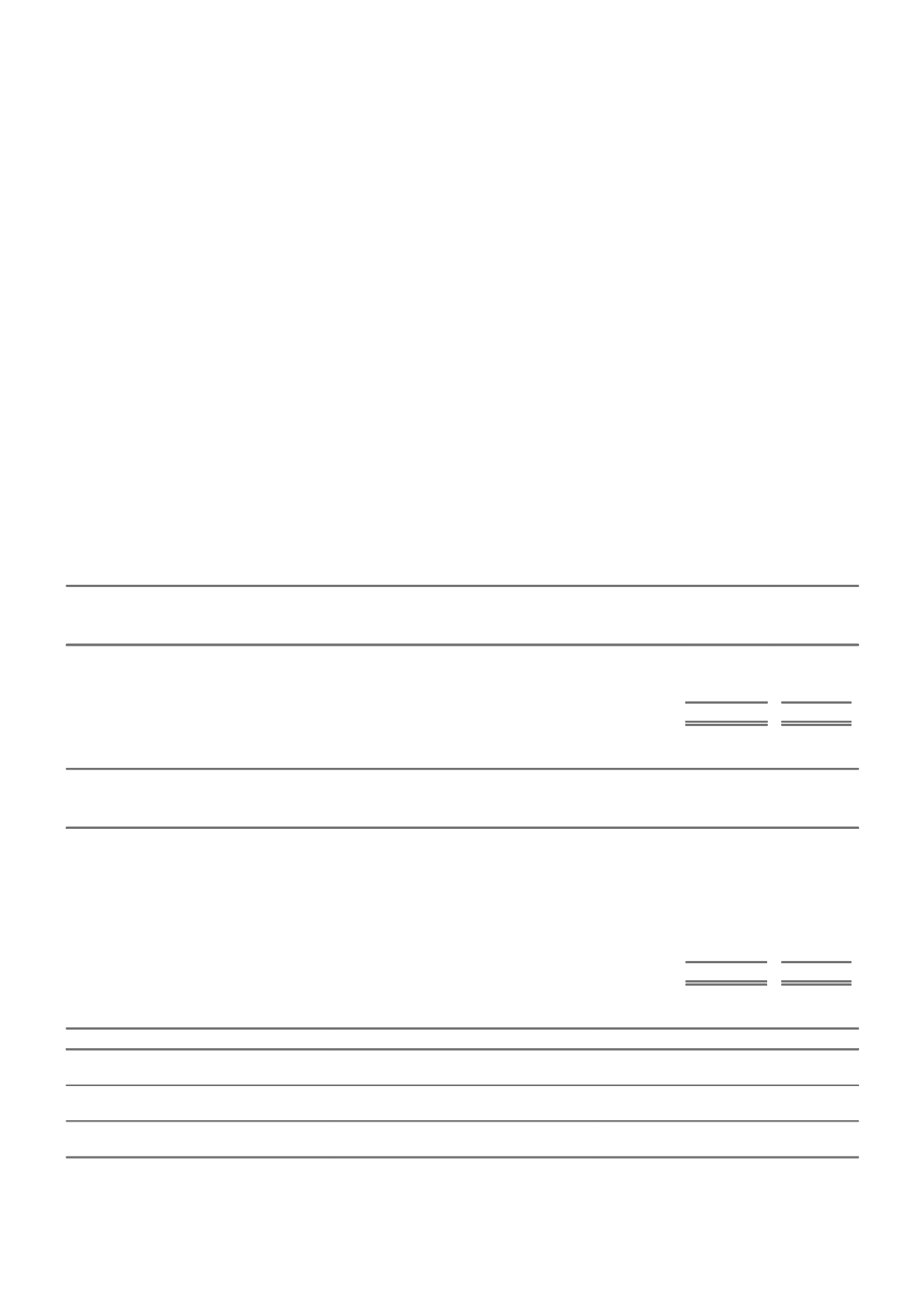

The following table provides a percentage analysis of gross written premium by product:

CONSOLIDATED

2015

2014

%

%

Motor

30

32

Home

26

27

Short-tail commercial

24

19

CTP (motor liability)

8

9

Liability

6

5

Other short-tail

3

4

Workers' compensation

3

4

100

100

Specific processes for monitoring identified key concentrations are set out below.

RISK

SOURCE OF CONCENTRATION

RISK MANAGEMENT MEASURES

An accumulation of risks arising from a

natural peril

Insured property concentrations

Accumulation risk modelling, reinsurance

protection

A large property loss

Fire or collapse affecting one building or a

group of adjacent buildings

Maximum acceptance limits, property risk

grading, reinsurance protection

Multiple liability retentions being

involved in the same event

Response by a multitude of policies to the

one event

Purchase of reinsurance clash protection

55