CONSOLIDATED

2015

2014

$m

$m

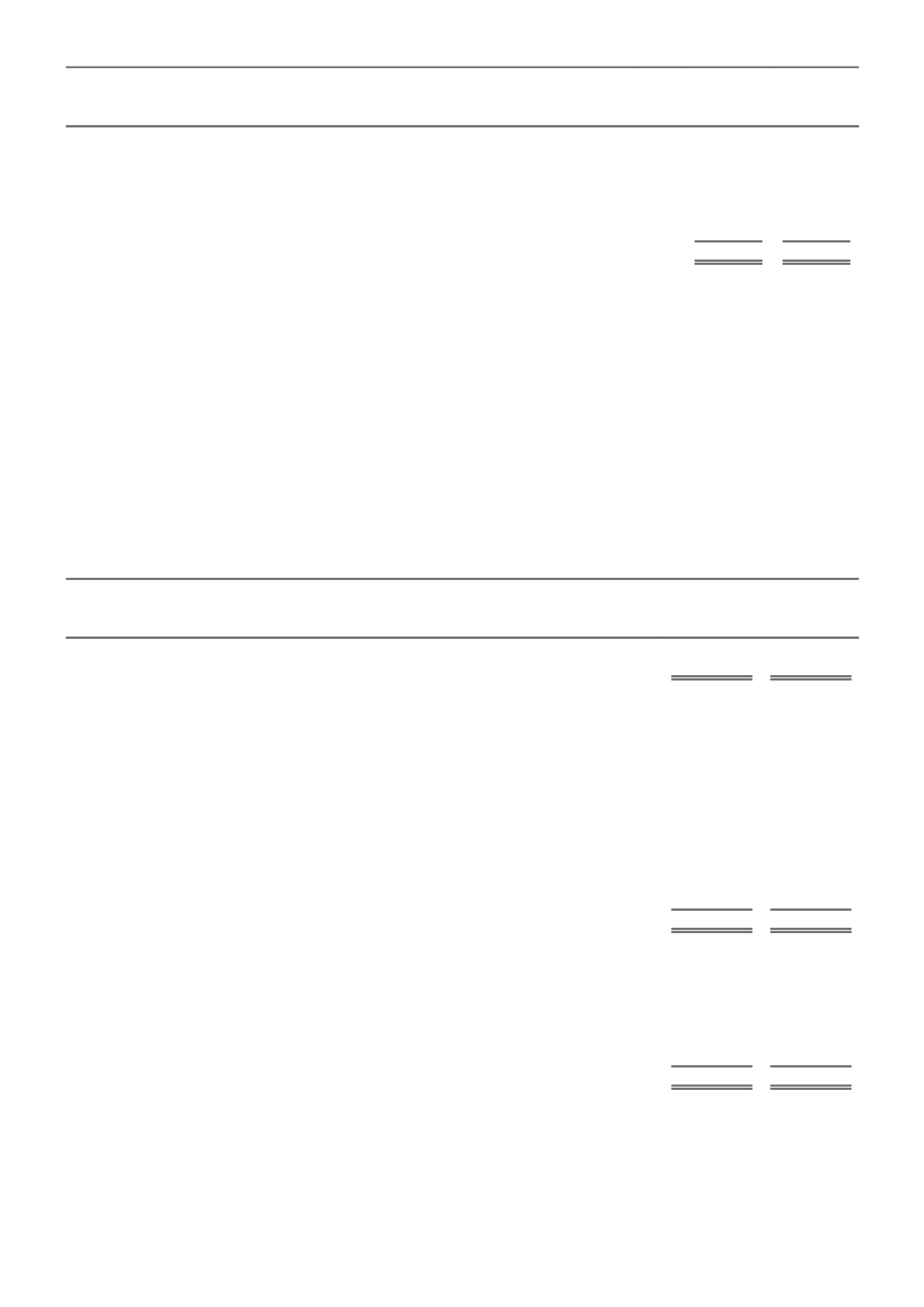

INCREASE/(DECREASE) IN OPERATING LIABILITIES

Trade and other payables

1,057

42

Provisions

(17)

(33)

Current tax liabilities

(94)

(32)

Outstanding claims liability

672

207

Unearned premium liability

(107)

124

Net cash flows from operating activities

698

1,077

D. SIGNIFICANT NON-CASH TRANSACTIONS RELATING TO FINANCING AND INVESTING TRANSACTIONS

There were no financing or investing transactions during the year which have had a material effect on the assets and liabilities that did

not involve cash flows.

NOTE 23. ACQUISITIONS AND DISPOSALS OF BUSINESSES

A. ACQUISITION OF SUBSIDIARIES

I. For the financial year ended 30 June 2015

During the current financial year, the Group acquired the Dynamiq Group, PT Asuransi Parolamas and the Ambiata Group for a total

consideration of $28 million.

II. For the financial year ended 30 June 2014

a. WESFARMERS ACQUISITION

During the financial year ended June 2015, the acquisition accounting was finalised in respect of the acquisition of the former

Wesfarmers business. The provisional fair values on consolidation disclosed at 30 June 2014 have been revised to reflect new

information about conditions that existed at the date of acquisition. The consolidated balance sheet and associated notes as at 30

June 2014 have been restated to reflect these adjustments, with no overall impact to the Group's net assets.

The provisional and final fair values are disclosed below:

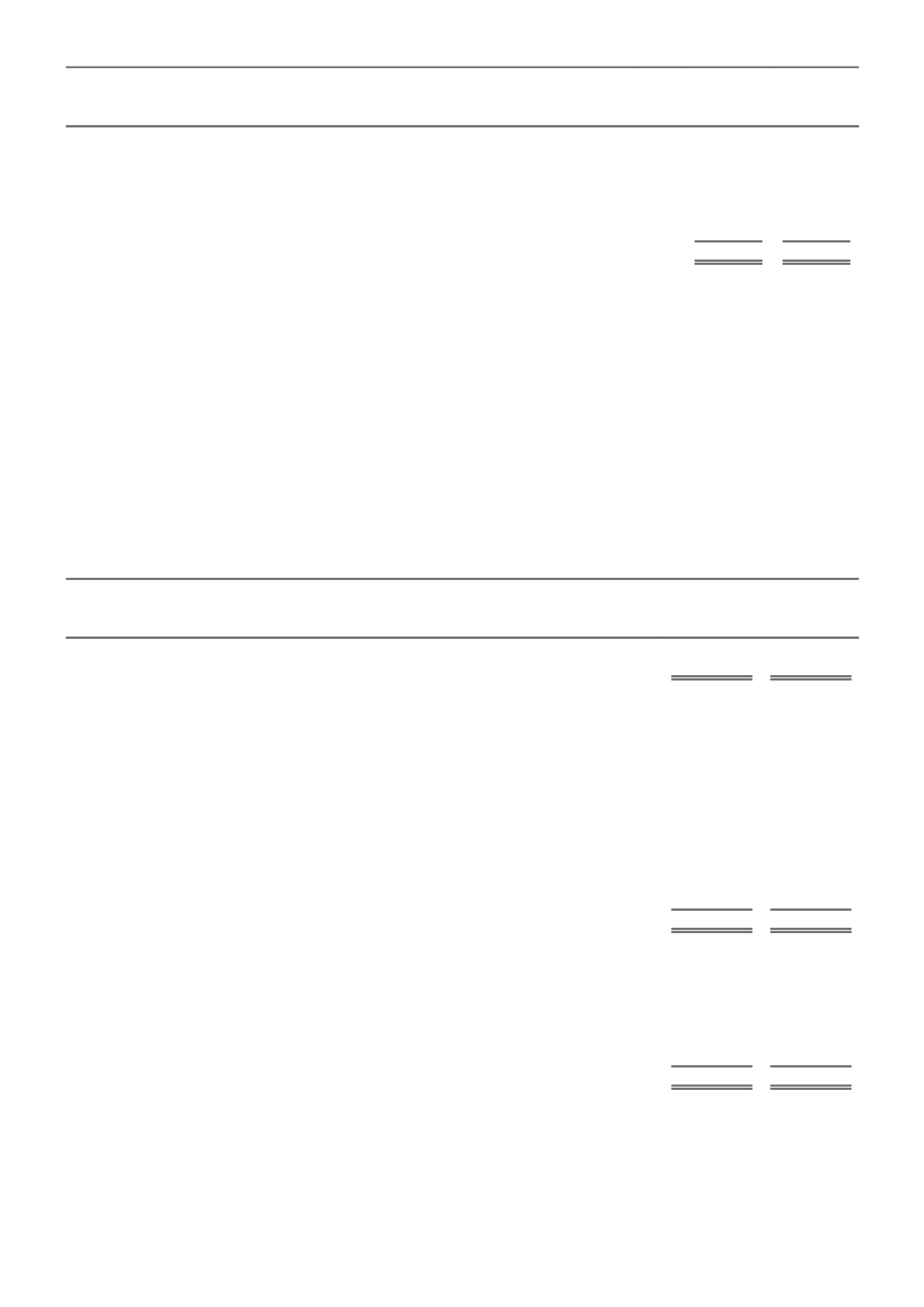

WESFARMERS ACQUISITION

FINAL

PROVISONAL

$m

$m

Purchase price

Total purchase consideration

1,986

1,980

Fair value of identifiable assets and liabilities acquired and goodwill recognised by acquiree

Cash and cash equivalents

1,558

1,558

Investments

218

218

Trade and other receivables

536

536

Reinsurance and other recoveries on outstanding claims

308

291

Deferred tax assets

60

40

Trade and other payables

(144)

(134)

Deferred tax liabilities

(108)

(108)

Unearned premium liability

(976)

(976)

Outstanding claims liability

(1,320)

(1,251)

Other assets and liabilities

283

294

Net identifiable assets acquired during the financial year

415

468

Intangible assets recognised upon acquisition

Brands

77

77

Customer relationships

104

104

Distribution channels

140

140

Software development expenditure

57

57

Goodwill

1,193

1,134

1,571

1,512

B. OTHER ACQUISITIONS

I. For the financial year ended 30 June 2015

There were no other material acquisitions by the Consolidated entity.

C. DISPOSAL OF SUBSIDIARIES

I. For the financial year ended 30 June 2015

There were no material disposals of subsidiaries by the Consolidated entity.

83