Results

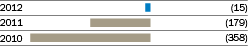

The full year insurance loss of $13 million for the UK business is a significant improvement on the insurance loss of $181 million last year, and reflects the benefits of the extensive programme of remedial actions begun in 2010. However, the performance of the business continued to be affected by:

■ the ongoing issue of bodily injury claim inflation, driven by aggressive claim farming activities and exacerbated by prolonged recessionary economic conditions;

■ the time taken to re-establish a number of key broker relationships on a financially mutual basis; and

■ the highly competitive nature of the UK motor insurance market.

Despite these factors, the business achieved a close to breakeven result in the 2012 financial year, and a modest full year profit is expected in the 2013 financial year.

THIS YEAR

The operating environment for the UK business was extremely challenging with a return to recession, and recovery hampered by the ongoing financial crisis in Europe.

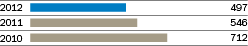

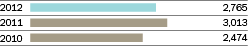

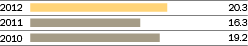

The business experienced a decline in reported GWP for the 2012 financial year, reflecting:

■ the impact of the ongoing remediation programme in exiting unprofitable segments and broker relationships; and

■ the re-emergence of price-based competition in certain segments, which affected renewal retention and new business volumes.

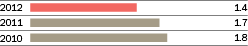

In this environment, the UK business focused on accelerated recovery initiatives which included improvements to the underwriting portfolio, application of targeted rate increases, and improved claims management and handling, as well as continued development of core capabilities.

Equity Red Star also enhanced its customer offer, introducing some new and enhanced fleet, home and classic car products to the market.

The adverse development covers we acquired in the 2010 and 2011 financial years, in respect of the underwriting years up to and including 31 December 2010, continued to provide considerable reinsurance protection against further deterioration in bodily injury claims.

NEXT STEPS

In the 2013 financial year, we will continue to focus on improving our underwriting, pricing and claims handling processes, and seeking efficiency gains across the business.

Strategic review

In May 2012, the Group initiated a strategic review of the UK business, to establish the best way to maximise shareholder value.

We are considering options including a continuing focus on improving the business’ performance within the current operating model; refining the business’ strategy to a more focused specialist motor offering; and a potential sale of all or part of the business.

We expect to announce the outcome of this review before the end of this calendar year.