Results

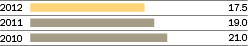

CGU achieved strong GWP growth of 12.0%, to $2,759 million in the 2012 financial year, primarily through rate increases and recent business acquisitions. Our insurance margin continued to improve, up from 6.5% last year to 10.8%. This reflected the benefits of rate increases, continuing improvement in underwriting discipline, lower net natural peril costs and enhanced control of claims and administration expenses.

THIS YEAR

We launched a new operating model to make us easier to do business with, more efficient and more effective. As part of this change, we implemented common approaches to account management, underwriting and claims, enabling brokers, agents and partners to better access the immense knowledge and expertise in our organisation. The new model will deliver annual savings of around $65 million pre-tax by the end of the 2015 financial year.

We thank our intermediaries and partners for their ongoing support during this period of transition, and acknowledge the professionalism and support of our people, without whom these changes would not have been possible.

Importantly, the quality and commitment of our people have enabled these internal changes to take place without compromising our focus on our intermediaries and customers.

We continue to operate in a difficult environment. Higher claims costs driven by natural catastrophes and claims inflation have made it necessary to reprice some portfolios so we can continue to provide cover for the long term.

Natural perils have again created challenges for our business from a claims perspective and we are proud of the way our people have supported customers during events such as the Christmas Day hailstorms in Melbourne, which generated over 5,000 claims.

Over the past year, CGU has also actively worked with governments and community stakeholders to incorporate key learnings from recent natural catastrophes. Initiatives include the introduction of flood cover for all home, contents and landlord policies, and improvements to the claims experience for our customers.

NEXT STEPS

We continue to invest in our people’s leadership and technical capabilities. Technology also remains a focus for CGU, with an emphasis on improving and simplifying systems. A key pillar of this investment is a new claims management system which will be piloted later this calendar year.

CGU remains on track to deliver a double digit underlying insurance margin in the 2013 financial year, in line with previous guidance. We remain focused on driving profitable growth in our target markets as we work to realise the benefits of our new operating model.