Group revenue for the year, measured as gross written premium (GWP), increased 11.7% to almost $9 billion and our insurance margin improved to 10.6% compared with 9.1% in the prior year.

The Group’s reported net profit after tax declined to $207 million, as a result of the decision to write off all goodwill and intangibles associated with the UK business as at 30 June 2012.

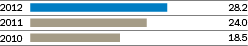

A true indication of how our business has performed year on year is cash earnings, and for the 2012 financial year, our cash earnings increased 17.5% to $583 million.

The performance of our individual businesses is described in more detail in the Chief Executive Officer’s Review and in the business pages.

Focus on strategy

For the Group as a whole, the year was characterised by an absolute focus on our strategy – by the Board, by management, and people working at all levels of IAG.

We continued to enhance our position in Australia and New Zealand, by delivering a world-class service from trusted local brands.

We also see a significant opportunity for growth close to home, in Asia.

The Asian Development Bank has estimated that by 2030, Asia’s annual consumption will reach $32 trillion – almost half of all global consumption. As a result, Asia’s middle class population will double, as will their asset ownership and the need to protect those assets through insurance in a region where insurance penetration is low.

Our presence in five of our six targeted markets in Asia means we are well placed to take advantage of this potential. Already, our businesses in Thailand and Malaysia are delivering strong returns.

In the UK, we have made good progress against our remediation programme, and management has initiated a strategic review to determine how best to maximise shareholder value. The outcome of the review is expected to be announced before the end of this calendar year.

We continued to focus on our people, with leadership programmes and succession planning to ensure we have the leaders we need to help us deliver our strategy.

Taking a leadership role

During the year, the Group contributed more broadly to public debate shaping the regulatory landscape in Australia, New Zealand and some of the Asian markets in which we operate. Issues on which we engaged include the role of insurance and mitigation in dealing with natural peril events in Australia; management of the aftermath of earthquakes in New Zealand; and new capital requirements in both these countries.

The Board

During the year, the Board worked closely with management to oversee the implementation of the Group's strategy, and also considered the issue of board renewal, assessing the optimum mix of directors and skills required to continue to support the strategy.

I thank all my fellow Directors for the counsel and insight they provided throughout the year. Additional information about our Directors and the work carried out by the Board this year is set out in the Directors' Report within the 2012 annual report.

Dividends

In line with our Group policy to pay dividends equivalent to approximately 50–70% of reported cash earnings, the Board has determined to pay a fully franked final dividend of 12 cents per share (cps) on 3 October 2012, resulting in an increased full year payout of 17 cps. The Dividend Reinvestment Plan will operate for the final dividend.

Capital strength

Our capital position remained above our long term benchmark of 1.45 to 1.5 times the amount of capital required by our regulator, the Australian Prudential Regulation Authority (APRA). At 30 June 2012, we held capital equivalent to 1.74 times the minimum requirement.

We have maintained this sound position despite over $400 million of acquisitions completed during the financial year.

Outlook

This year’s result demonstrates the effectiveness of our current management team, guided by our Managing Director and Chief Executive Officer, Mike Wilkins, in rebuilding a solid foundation from which we can pursue profitable growth.

We are well positioned to take the next steps to achieve our strategy, and we believe our success will be reflected in continued improvement in our performance in the 2013 financial year.