Our GWP grew by 11.7% to nearly $9 billion, up from $8.1 billion last year and exceeded our guidance for GWP growth of 8–10%. The result reflects the increase in premiums needed to recover the increased costs of natural perils, including significantly higher reinsurance costs, as well as volume growth in some of our key portfolios.

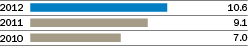

Our insurance profit increased by 26.1% to $832 million, compared with $660 million last year. This translates into an improved insurance margin of 10.6%, up from 9.1% last year, in line with our guidance of 10–12%.

Dealing with natural perils

In the first half of the year, we faced Christmas Day hailstorms in Melbourne and extreme floods in Thailand.

These events, following an unprecedented number of natural disasters in 2011, continued to test and challenge our industry and our business. Our ability to perform strongly against this backdrop makes me optimistic about the Group’s future, and even more so about the insurance industry’s place within the community.

The way we rise to meet the challenges presented by these events and support our customers makes me proud of our people and our organisation.

Accelerating profitable growth in Australia and New Zealand

It is this passion for customers that helped our businesses in Australia and New Zealand accelerate growth this year.

Australia Direct, our largest business, increased its GWP by 10.5% and achieved a strong insurance margin of 14.3%. It grew its customer base, and the number of policies it issued, by keeping its customers at the centre of everything it does – from pricing, distribution and product development, to the moment of truth at claims time.

Our Australia Intermediated business, CGU, recorded GWP growth of 12.0% and increased its insurance margin to 10.8%. CGU is moving to a new customer-focused operating model with common approaches to account management, underwriting and claims, making it easier for brokers, agents and partners to access our people’s knowledge and expertise.

In New Zealand, our business improved its financial performance after the earthquakes of the prior year, achieving an insurance margin of 10.4%, up from 0.4% last year. This year, we further enhanced our position as the country’s leading insurer by acquiring AMI, one of New Zealand’s most iconic brands, with a proud heritage and strong customer loyalty and retention rates. The transaction takes our overall market share in New Zealand to over 40% and our direct motor market share to around 60%.

Returning the UK business to profitability

We made progress towards returning the UK business to profitability this year, enabling us to consider our longer term plans for the business, and the best way to maximise shareholder value.

In light of the challenging economic and industry conditions we continue to see in the local market, we reviewed the carrying value of our UK business, and identified a $297 million writedown of all goodwill and intangible assets as at 30 June 2012. As a result, the Group’s reported net profit after tax declined to $207 million, from $250 million in the 2011 financial year.

In May 2012 we initiated a strategic review of our UK operations with potential outcomes including a continuing focus on improving the business’ performance within the current operating model; refining the business’ strategy to a more focused specialist motor offering; and a sale of all or part of the business. We will announce the outcome of the review before the end of this calendar year.

Boosting our Asian footprint

Over the past few years, we have quietly gone about our Asian strategy and are now getting real traction. This year, we acquired a 20% strategic interest in Chinese insurer, Bohai Property Insurance, and a 30% strategic interest in Vietnamese insurer, AAA Assurance. We are also expanding our Malaysian operations with our joint venture business, AmG, announcing the acquisition of Kurnia, which will make it the country’s leading general and motor insurer.

We are entering an exciting phase of our Asian ambitions as we shift from a market entry focus to driving operational performance. Our established businesses in Thailand and Malaysia produced strong underlying results this year, and our Indian joint venture business, SBI General, continued to grow rapidly.

Realising our ambition

Our performance in the past year moves us closer to reaching our ambition to be the world’s most respected group of general insurance companies. Realising this ambition means we need to deliver for the benefit of all our stakeholders and we have taken significant steps on all fronts.

For shareholders, we have improved our financial results and delivered a higher dividend. For customers, we have increased our efforts to support the building of more resilient communities. As a leading insurer, we will continue to share the information we have on managing risk and engage with governments and other stakeholders to support a move towards a more comprehensive and sustainable approach to dealing with risk.

For our people, we are creating a Group-wide talent mobility programme to identify and develop our future leaders and ensure they gain diverse experience across our organisation. We are also developing an environment where they can realise their potential and succeed, with an industry-leading parental leave programme in Australia, and refinements to our enterprise agreement which consider various life stages and employees’ changing needs.

Outlook and guidance

For the 2013 financial year, we expect to achieve GWP growth in the range of

9–11% and deliver an improved insurance margin in the range of 11–13%. This guidance assumes net losses from natural perils are within our allowance of $640 million for the year; no material movements in investment markets; and reserve releases are 1–2% of net earned premium.

I thank all those who have contributed to our results this year – the Board, our executive team, and all the people at IAG. Our organisation has enormous potential and I am proud of the way we are working together to deliver on that – for our shareholders, our customers, our people and the wider community.