Results

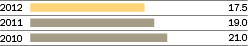

In the 2012 financial year, our GWP increased by 10.5% from the prior year to $4,299 million, driven by a combination of rate increases, to recover higher losses from natural perils and increased reinsurance costs, and volume growth, notably in comprehensive motor. Our insurance profit was $544 million, compared to $702 million last year, and our insurance margin was lower at 14.3%. These results were affected by significantly higher reinsurance costs, up nearly 42% or $77 million, an unfavourable net natural peril claims experience and lower reserve releases.

THIS YEAR

Australia Direct performed strongly, despite headwinds from the significant rise in reinsurance costs following the recent spate of natural disasters and continued weather events.

By improving the delivery and coverage of our products, we grew our customer base, as well as the number of policies we issued, showing the success of our strategy of putting the customer at the centre of everything we do.

We have an industry-leading approach to customer insights and we use these to deliver products and services that meet and exceed customers’ needs.

After the challenges that followed the natural disasters of early 2011, we redesigned our home and caravan products to include flood cover across all of our state-based brands.

Our recent advertising campaign, ‘we automatically insure the extras others do not’, highlighted the difference in the products we have developed to meet customers’ needs.

We have significantly improved our website so customers can deal with us when they choose. At the same time, we remain committed to improving our branch network because we believe this complements our digital channels.

We continue to improve our understanding of risk and have enhanced our rating factors so we can better tailor the products we offer to customers.

We rolled out a new repairer relationship model in NSW/ACT which we believe will improve the cost, quality and timeliness of repairs.

Above all, everything we do is underpinned by our people and we recognise the commitment they make to us, and the support they provide to our customers. We have continued to develop our people and nurture their growth through training and learning opportunities, including a wide range of leadership development pathways.

NEXT STEPS

While there is intense competition in the market, we are confident we will continue to perform strongly by providing customers with brands they can trust, and products and services that differentiate us from the competition.

In the year ahead, we remain focused on four sources of profitable growth:

■ maximising the relationship with our existing customers;

■ attracting new customers through effective marketing, multiple distribution channels and sophisticated pricing;

■ product and service innovation; and

■ reducing expenses through mutually beneficial partnerships in our repair and supply chain networks.