Results

Overview

GWP grew by 17.0%, primarily reflecting the first-time inclusion of the former Wesfarmers business.

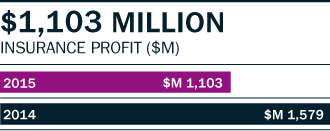

The insurance profit was influenced by the severe perils outcome, which had a net cost of $1,048 million, and was $495 million higher than the prior year.

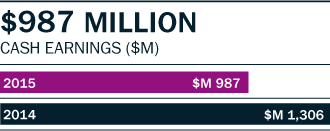

The reduction in cash earnings reflected the significantly higher level of natural perils and lower reserve releases in the 2015 financial year, compared to the prior year.

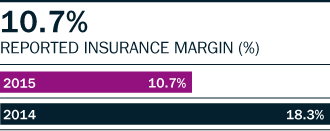

The reported insurance margin incorporates:

- net natural peril claim costs of $1,048 million, which were $348 million higher than the related allowance and after exhaustion of the $150 million reinsurance cover in excess of the 2015 financial year’s perils allowance of $700 million;

- a reduced favourable impact of $33 million from the narrowing of credit spreads, compared to $100 million last financial year; and

- prior period reserve releases of $167 million, equivalent to 1.6% of net earned premium, down from $248 million in the 2014 financial year.

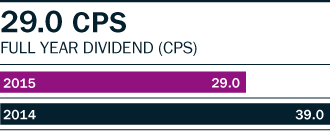

This equates to a cash payout ratio of 70.2%, at the top end of the Group’s payout policy range of

50 – 70% of full year cash earnings.

The change in community investment reflects a reduced contribution by the business to the IAG Foundation, from $1.5 million in the 2014 financial year to

$0.5 million this year, as well as an adjustment to community investment in New Zealand, where the business has exited a number of sponsorships as it moves to align its community investment to our Purpose.