OPERATING PERFORMANCE AUSTRALIA

Commercial

insurance

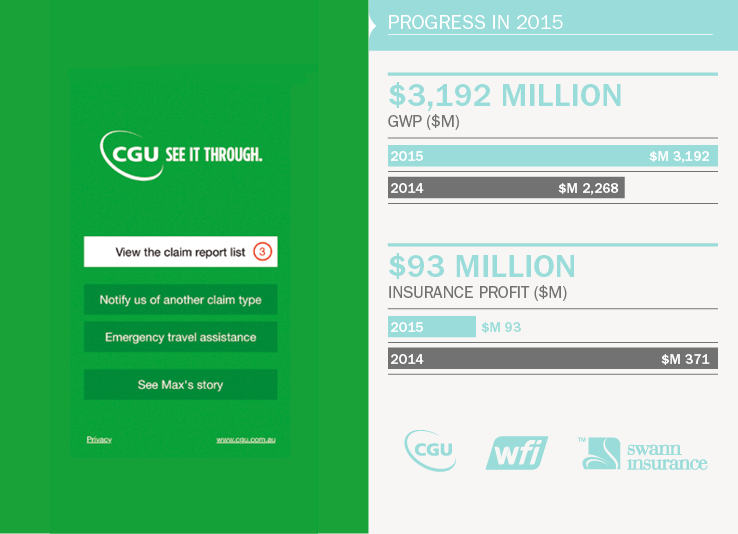

Commercial Insurance’s GWP grew by 40.7%, reflecting the addition of the former Wesfarmers business which has delivered a market-leading position in the Australian commercial insurance market.

Like-for-like GWP growth was modestly negative, reflecting slightly lower average rates and the maintenance of underwriting discipline in an increasingly competitive commercial market. The business maintained a double digit underlying margin of 10.6%, slightly reduced from 12.1% last financial year, reflecting inclusion of the lower margin former Wesfarmers business and tougher market conditions.

The reported margin of 10.5% was considerably lower, from the combination of significantly higher net natural peril claim costs, lower reserve releases, and a lower, but still favourable, credit spread movement.

The integration of the former Wesfarmers business is progressing in line with expectations, with CGU being maintained as the main brand for intermediated business, and WFI for niche and direct business.

Customer focusThe business’ strategy is to compete on the strength of its partnerships and the quality of its service. Initiatives include:

- an agency growth strategy, including complementary acquisitions such as Dynamiq, which offers risk and emergency management services;

- an increased focus on the ways customers do business with Commercial Insurance, including digital and platform capability;

- development of CGU uSurvey, an iPad application that simplifies the completion of farm risk assessment surveys. The tool allows CGU partners to submit better quality farm risk assessments, including pictures, and achieve more favourable pricing for their customers; and

- a new CGU Claims App which helps customers record essential incident details immediately after an event occurs. The app will now be developed for other products such as travel insurance, ensuring emergency travel assistance numbers are always at hand.

Improved partner relationships and service levels are reflected in growing industry recognition, with CGU:

- named Large General Insurance Company of the Year at the 2015 Australian and New Zealand Institute of Insurance and Finance Australian Insurance Industry Awards;

- voted 2015 'Insurer of the Year' by brokers in Insurance Business magazine's annual 'Brokers on Insurers Survey'; and

- winning 'Australia's Best Customer Experience Company' at the Best Customer Experience 2014 awards.

The outlook for the 2016 financial year is expected to remain challenging for Commercial Insurance, given limited growth prospects, pressure on pricing and little respite from currently record low interest rates. These headwinds are expected to be partially offset by further benefits from the integration of the former Wesfarmers business and the realisation of efficiencies from the new operating model in Australia.