OPERATING PERFORMANCE

New Zealand

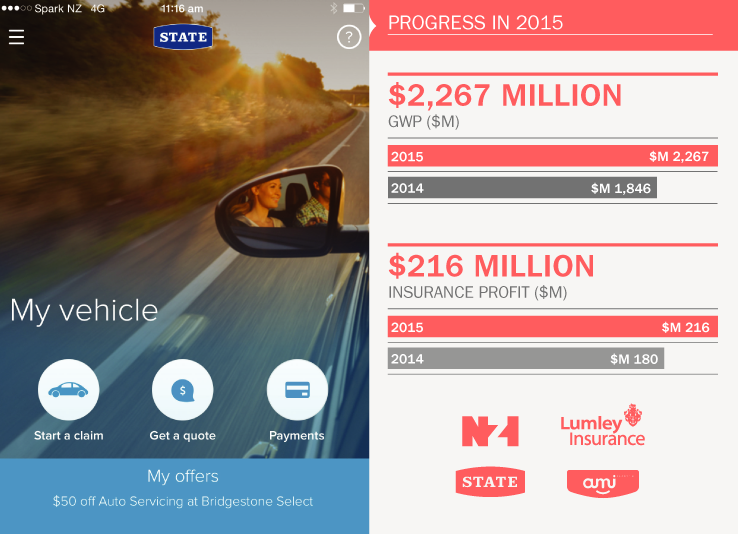

New Zealand maintained its market-leading position, with GWP growth of 22.8% derived from the inclusion of the local Wesfarmers business and a favourable foreign exchange translation effect. In local currency, GWP grew by 19.4%.

On a like-for-like basis, GWP fell slightly, with growth in personal lines offset by tougher commercial market conditions. The business’ continued strong performance was evident in a slightly higher underlying margin of 15.9%. This reflects a continued focus on pricing and underwriting discipline, while balancing affordability for customers with availability of insurance capacity, as well as ongoing operational improvements across the business.

The lower reported margin of 10.8% included a reserve strengthening for the 2011 financial year earthquakes, which saw the Group exceed its reinsurance cover for the February 2011 event.

Customer focus

- NZI maintained its strong market standing, winning the ‘Intermediated Insurer of the Year’ from the Australia and New Zealand Institute of Insurance and Finance for the third consecutive year.

- The direct business launched State and AMI-branded home and contents ‘quote and buy’ online tools in May and June 2015 and mobile apps for both brands in June 2015 as part of its digital transformation program.

- NZI launched a risk solutions program with a suite of fact sheets and guides covering business risk management issues, and partnered with accounting software innovator Xero on CoverKit which enables Xero customers to compile a financial profile that they can use to work with their broker to get an insurance solution.

- The business launched a regular segment on a nationwide radio show targeting house-proud do-it-your-selfers to provide information about insurance-related themes such as contract works cover, understanding gradual damage and setting an appropriate sum insured amount for your home.

Future focus

The business’ underlying profitability is expected to remain strong, sustained by its focus on pricing and underwriting discipline to protect underwriting margins, and assisted by the full realisation of synergies from the former Wesfarmers business.

Canterbury rebuild

At 30 June 2015, the business had completed approximately NZ$4.5 billion in claim settlements related to the Canterbury earthquakes, with over 91% of commercial and 75% of residential claims settled by number.

During the financial year, there was a significant increase in the expected final claim cost from the Canterbury earthquakes. This was due to continued notification of new household claims that have exceeded the Earthquake Commission’s NZ$100,000 residential dwelling limit, an increase in forecast repair and rebuild costs and a series of adverse court judgements which have affected the insurance industry.

While the Group believes it has adopted an appropriate reserving position, given the complexity of the Canterbury earthquake events there remains a degree of uncertainty as to the ultimate cost.