OPERATING PERFORMANCE

Asia

The Asia division experienced solid improvement in its operating performance in the 2015 financial year, as it continued to focus on operational development and capability transfer programs, including further strengthening of risk management and governance frameworks.

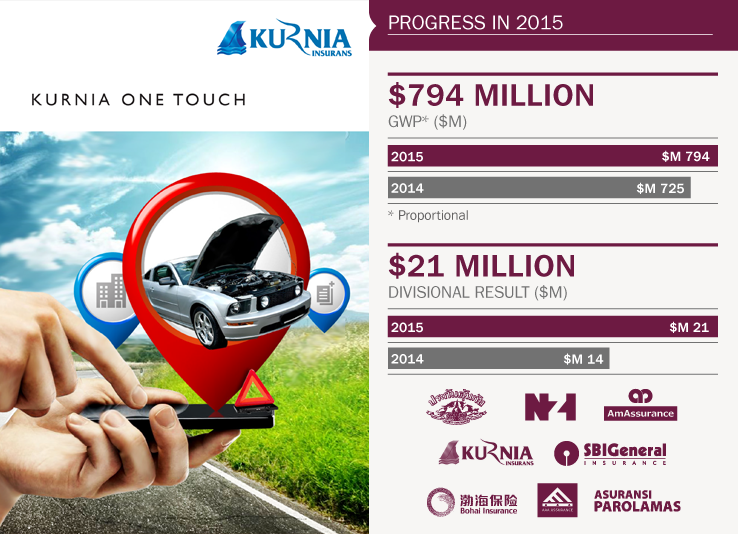

The business’ consolidated GWP rose by 11.4%, to $353 million, largely reflecting good growth in Thailand. On a proportional basis, GWP increased by 9.5% from last financial year to $794 million, aided by continued strong growth in India.

Asia’s overall earnings contribution increased from $14 million in the 2014 financial year to $21 million, as the established businesses in Thailand and Malaysia continued to perform well and the combined operating loss from developing markets (India, China, Vietnam and Indonesia) contracted significantly to $1 million.

The business achieved a key milestone in April 2015, with the acquisition of PT Asuransi Parolamas, a small general insurer in Indonesia, fulfilling IAG’s presence in its six target markets in Asia. Through its various interests, IAG now participates in a gross regional GWP pool of nearly $1.7 billion.

As at 30 June 2015, IAG’s net investment in Asia was $893 million, of which over $670 million was in the established and profitable markets of Thailand and Malaysia. The $61 million increase in the net investment since 30 June 2014 includes:

- a $57 million reduction due to dividend payments from the businesses in Thailand and Malaysia;

- a $60 million writedown in the carrying value of the investment in Bohai Insurance in China, influenced by a revision to the expected cash flows of the business, and the indicated issue price of new shares in a capital raising in which IAG does not intend to participate;

- the initial investment and capital injection in Indonesia;

- a modest capital injection in India; and

- foreign exchange movements.

Customer focus During the financial year, the Asia division expanded its protection of low income customers in its developing markets, making available several microinsurance products in India and Vietnam, primarily through the bank and agency channels. In the 2016 financial year, the division expects the range of products to be further increased, and the distribution network expanded to channels such as non-government organisations and telecommunications companies.

The Asia division also rolled out a number of initiatives including enhanced customer data collection and analysis to improve our understanding of customers’ needs, and our businesses’ delivery of improved customer experiences.

Future focus IAG has identified Asia as an important source of long term growth for the Group. The division will continue to seek profitable growth through improved customer focus, innovation and partnerships, while maintaining its focus on excellence in operating fundamentals and risk management.

In particular, the Group has expressed an interest in gaining a national exposure to the Chinese market.

In India, IAG and the State Bank of India have commenced the process towards increasing IAG’s shareholding in SBI General to 49%, following amendment of the insurance law in March 2015 to increase the foreign direct investment limit. It is anticipated that this will be completed in the 2016 financial year.