OPERATING PERFORMANCE AUSTRALIA

personal

insurance

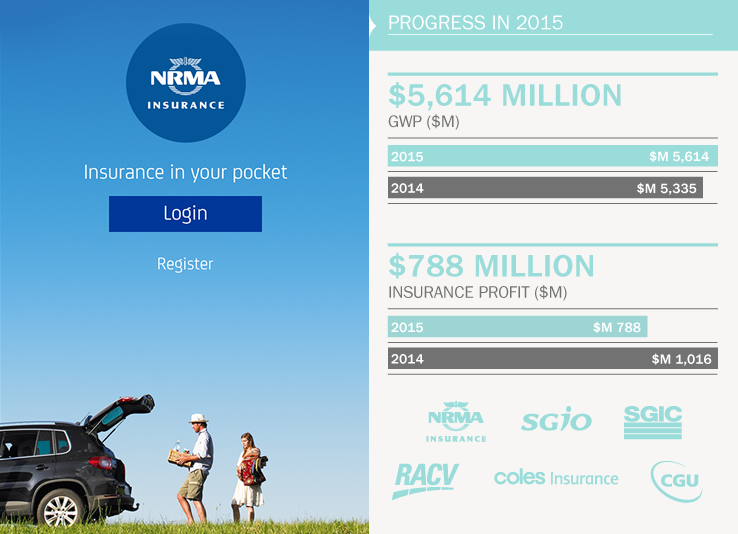

Personal Insurance continued to perform well, with reported GWP growth of 5.2% compared to last financial year, reflecting the first-time addition of personal lines volumes associated with the former Wesfarmers business, including Coles.

A pleasing feature of the result was the modest growth achieved by the pre-existing home and motor business, which held up well in an increasingly competitive environment. In particular, motor volumes maintained a modest growth profile broadly in line with the industry, with some offset from slightly lower average rates. Long tail GWP declined 2.8%, largely owing to the exit from the Queensland CTP market from 1 January 2014.

The business achieved a strong underlying margin of 13.9%. The reduction from the 15.4% achieved in the 2014 financial year reflected the inclusion of lower margin former Wesfarmers volumes, increased reinvestment in the business, and some softening of CTP profitability owing to higher claim frequency with increased legal representation.

The reported margin of 15.9% included increased reserve releases from long tail classes, offset by a significantly higher level of net natural peril claim costs.

The strong results reflect Personal Insurance’s focus on delivering an increased range of customer value propositions through its brands, to meet the changes in customer behaviours being observed. Further to providing an expanded suite of customer options, a data analytics company has been acquired to enhance the understanding of customers and risk, and a range of ventures is being explored to extend insurance coverage within the community.

Customer focus

- Personal Insurance continues to enhance its comprehensive digital sales and service offering, with an online self service centre and an integrated digital multi-channel platform, so customers can access various services across all devices. Our online sales channel registered substantial growth, with like-for-like volumes increasing by around 20%.

- We have enhanced our overall customer offering with the release of new funeral and income protection products, both underwritten by a third party.

- We set ourselves a target to settle within four months 45,000 of the 50,000 claims we received from the April east coast low, and achieved this by:

- adding 300 people to our disaster response teams by hiring temps, and reassigning people from our head office, Commercial Insurance, Enterprise Operations and New Zealand divisions;

- scaling up our builder support in the worst-affected areas;

- revising a number of our settlement processes to make them faster for customers, restorers and builders;

- having claims staff work alongside builders in their offices to help manage the volume of customer communications and speed up claim processing;

- updating our process for food spoilage claims including launching a new online claim process so customers could quickly lodge their claims and have them settled immediately;

- streamlining our cash settlement process for low value contents claimed; and

- updating communications options to include a customer call-back option when we experienced heavy call volumes, and introducing webchat.

We are working to make these and other improvements initiated during the event part of our standard ways of operating.

Future focus- Although continued modest growth is expected in personal insurance demand over the 2016 financial year, premium growth prospects are limited, as a result of aggressive customer acquisition from established players and challenger brands.