Despite the cyclical industry pressures we experienced this year, like-for-like business volumes and underlying profitability held up well, supporting delivery of a cash ROE in excess of our through-the-cycle target of 15%. With a substantial portion of the benefits from the integration of the former Wesfarmers business and the move to a new operating model in Australia yet to be realised, the Group is well-placed to absorb further competitive pressure and to respond to any cyclical improvement in the medium term.

The Group continued to perform strongly at an underlying level.

The slightly reduced underlying margin1 of 13.1% reflects the addition of the lower margin former Wesfarmers business, as well as softer commercial market conditions.

Net profit after tax was 41.0% lower than the preceding year, reflecting the lower reported insurance profit, reduced shareholders’ funds income and a higher amortisation charge, partially offset by a lower effective tax rate.

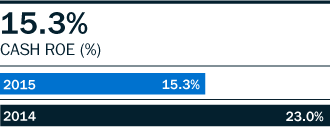

Reported return on equity (ROE) in 2015 was 11.3%, and cash ROE was 15.3%, compared to the Group’s through-the-cycle target of approximately 15% (1.5 times the weighted average cost of capital).

1 IAG defines its underlying insurance margin as the reported insurance margin adjusted for:

- Net natural peril claim costs less related allowance for the period;

- Reserve releases in excess of 1% of net earned premium; and

- Credit spread movements.