This has been a significant year as we completed the integration of AMI, continued to make solid progress on the Canterbury rebuild and maintained our strong operating performance as we prepared to bring Lumley Insurance into our operations.

RESULTS

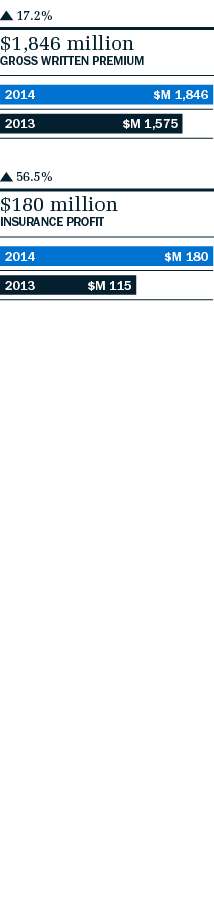

Our New Zealand business reported GWP growth of 17.2%, to $1,846 million for the 2014 financial year, including a significantly favourable exchange rate effect compared to the 2013 financial year. In local currency, GWP grew by a solid 3.7%. Growth in all our distribution channels was driven by:

- rate increases in the domestic homeowners’ portfolios to continue to recover higher reinsurance costs and price appropriately for risk; and

- a continued focus on customer and sales initiatives.

Our reported insurance margin increased to 11.5%, from 8.9% in the prior year, reflecting the net effect of an improved underlying business performance; lower net reserve strengthening; higher net natural peril costs; and benefits associated with the business’ continued focus on operational initiatives, including synergies from the AMI integration.

The strength of our performance was evident in our improved underlying margin of 14.8%, up from 11.1% in the prior year.

FOCUSING ON OUR CUSTOMERS

We continued to support our customers by ensuring the availability of insurance capacity while balancing customer affordability with changes to the home insurance product.

The majority of New Zealand households have moved from open-ended home insurance policies to those requiring specified sum insured limits, over the course of this financial year. We have led the industry through this fundamental change with a nationwide public education programme, the "Need2know" campaign. With over 1.6 million website visits since its May 2013 launch, the website has helped New Zealanders understand their risks more clearly and take a more active role in deciding on their insurance cover.

We are constantly working to find ways to help our customers. This year we launched two mobile applications in our Direct Insurance division that encourage our customers to stay safer on the roads by offering numerous discounts including safety, maintenance and pre-purchase checks, discounts on tyres and fuel purchases, and coffee breaks to accompany these.

During the year, further development of the online channel for our direct personal lines businesses led to an increase in website traffic of around 30%. The website now accounts for over 25% of private motor new business sales.

Our NZI intermediated business maintained its strong market standing, winning both the “Intermediated Insurer of the Year” (Australia and New Zealand Institute of Insurance and Finance) and the “Most Valued Insurer” (Insurance Brokers Association of New Zealand Annual Survey) awards for the 2013 calendar year.

In Canterbury, the majority of home customers have now selected their preferred option of claim settlement, either by cash or entering the managed rebuild or repair programme. However, there continues to be a steady flow of newly reported claims as the Earthquake Commission identifies an increasing number of claims exceeding its statutory NZ$100,000 limit.

At the end of June 2014, we had paid over NZ$3.3 billion of earthquake related claims and fully settled 58% of claims by number. While we are working through a number of strategies to complete all rebuilds to our target of December 2015, our expectation is that this challenging target will now extend to mid-2016.