This year has been one of consolidation for CGU, as we maintained our double-digit insurance margin, and further strengthened our relationships with brokers and partners through enhanced service and technology platforms.

We are well positioned for the integration of the Wesfarmers insurance underwriting business in the 2015 financial year and ready to assume our position as market leader.

RESULTS

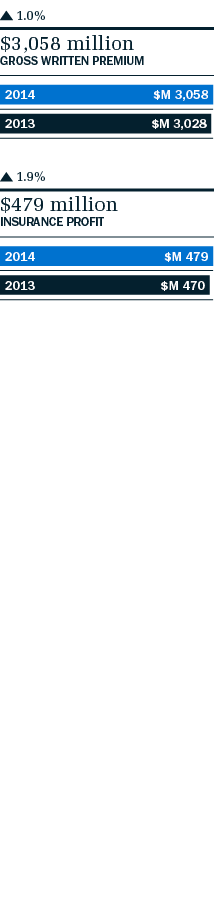

CGU grew GWP by 1.0% to $3,058 million, from $3,028 million in the last financial year, reflecting a number of factors, including:

- growth in policies across small to medium enterprises and some specialty line products;

- continued growth in workers’ compensation, with increases in new business and renewals;

- low single-digit rate increases across most products; and

- removal (from 1 July 2013) of the Victorian FSL, which represented

$54 million of GWP last financial year.

Excluding the impact of the Victorian FSL, our underlying GWP grew by 2.8% this year.

Our insurance profit of $479 million was slightly higher than for the prior year and delivered an insurance margin of 17.4%, compared to 17.8% last year. Our underlying margin increased to 11.4%.

FOCUSING ON OUR CUSTOMERS

We used the ongoing savings from the new operating model we introduced in 2012 to fund systems that will further increase our efficiency and strengthen our partnerships. We implemented a new leads and opportunities management system that provides an integrated end-to-end sales process for account managers and underwriters in the broker channel, enabling them to respond more quickly to their customers.

During the year, we launched a new brand campaign with the theme “See It Through” to reflect our commitment to being there for our customers and partners when it matters most. The campaign focuses on our small business customers who work hard, and often do not take the time to celebrate their success.

The first instalment featured our customer Max Cunningham from Marion Bay Oysters in Tasmania (who featured in last year’s annual review pages). To help Max see the success of his business, his life was carefully researched and faithfully recreated on stage through sets, props and casting. He was then invited to Tasmania’s Franklin Theatre, completely unaware that he was the star of the half-hour stage show.

COMMERCIAL INSURANCE IN IAG’S NEW AUSTRALIAN OPERATING MODEL

From 1 July 2014, IAG moved to a new operating model for its Australian operations. There are now three divisions: Personal Insurance, Enterprise Operations and Commercial Insurance, which contains:

- the commercial insurance operations which previously represented the majority of CGU;

- the Australian commercial insurance operations associated with the acquisition of the Wesfarmers insurance underwriting business; and

- the Retail Business Insurance operations which were formerly part of Australia Direct.

The affinity and financial institution partnerships which were previously part of CGU are now included in the Personal Insurance division.