We are now in five of our six targeted markets in Asia and we continue to build on our growth platform by further developing our operations and enhancing risk management and governance.

As at 30 June 2014, IAG’s investment in Asia was approximately $832 million; around $626 million of this was in the established and profitable markets of Thailand and Malaysia.

RESULTS

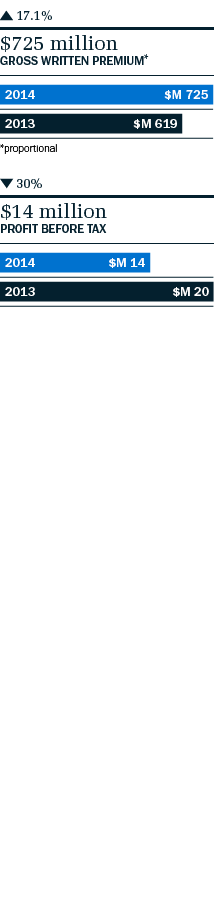

The Asia division reported a total profit of $14 million for the 2014 financial year, down from $20 million in 2013. Factors underpinning the result include:

- strong underlying performances by our established businesses in Thailand and Malaysia;

- a similar combined operating loss from the emerging businesses in India and China which was broadly in line with expectations;

- a higher operating loss from Vietnam, owing to its first time consolidation following an increase in ownership;

- an approximately $12 million adverse year-on-year movement in mark-to-market valuations of investments, including those within associates’ shareholders’ funds; and

- increased regional support and development costs to $31 million, from $25 million in the prior year, due to increases in regional support resources.

Proportional GWP of $725 million for the year was 17% higher than 2013. Factors influencing GWP were:

- a full year’s contribution from Kurnia in Malaysia, compared to nine months in the prior year;

- a marginal contraction in Thailand, in line with weaker vehicle sales;

- strong growth in the developing markets of India and China; and

- our increased ownership of AAA Assurance in Vietnam.

ESTABLISHED MARKETS

Our business in Thailand reported a modest decline of 2.4% in GWP this financial year, or 7.5% in local currency terms. This followed the significant contraction in new vehicle sales since May 2013, when the government ended its first-car-buyer tax incentive scheme, and a normalisation of commercial insurance rates following the spike experienced in the aftermath of the catastrophic flood event in the 2012 financial year. The business’ insurance profit improved to $28 million, compared to $26 million in the 2013 financial year.

In Malaysia, the AmGeneral business continued to perform strongly, with the overall result boosted by a full-year contribution from Kurnia which saw GWP grow by over 22% to $564 million, with IAG’s share being approximately $276 million. AmGeneral’s operating performance remained strong, and it reported an improved insurance margin of 14.1% for the year, up from 13.3% in the prior year.

EMERGING MARKETS

In India, SBI General continued to grow strongly, generating GWP equivalent to $218 million in the 2014 financial year, an increase of 33% on the prior year. Growth was primarily derived from motor, home and personal accident insurance business written through the bancassurance channel, while a health insurance product launched through the bank channel is steadily gaining traction.

In China, Bohai Insurance reported strong growth in GWP to $376 million in the 2014 financial year, an increase of 55% compared to the prior year. This reflects the business’ sharpened strategic focus, driving branch performance in selective geographical areas and pursuing growth in targeted motor and non-motor segments.

In Vietnam, AAA Assurance recorded GWP equivalent to $29 million for the year, representing growth of approximately 20% on the prior year following ongoing remediation activity, which has seen concentration on higher quality risks offset by stronger growth from selected segments. Our increased ownership of 63.17% from July 2013 allowed us to accelerate many business case programmes.