Australia Direct has been protecting Australians for over 85 years, using our insights and experience to provide market-leading products and services for our 3.5 million customers.

RESULTS

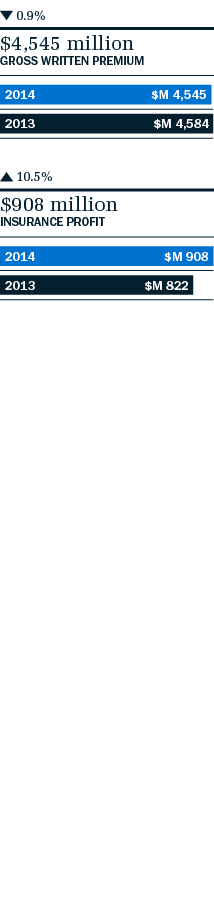

Australia Direct continued its strong underlying performance in the 2014 financial year, reflecting improved claims performance and reduced pressure on the New South Wales Compulsory Third Party (CTP) portfolio. Our GWP of $4,545 million for the year was marginally lower than last year’s $4,584 million, as a result of:

- reduced need to recover higher input costs, notably reinsurance, particularly in the home portfolio;

- removal (from 1 July 2013) of the Victorian Fire Services Levy (FSL), which represented $50 million of GWP last financial year;

- slightly lower motor GWP, from a combination of volume growth and lower average rates;

- a $33 million reduction in GWP from Queensland CTP, after we left that market from 1 January 2014;

- reduced ACT CTP market share, following the entry of competition from mid-July 2013; and

- continued remediation of the Retail Business Insurance book.

Excluding Victorian FSL and Queensland CTP, GWP growth was approximately 1.0%, supported by rate increases in the home portfolio, and growth in policies, predominantly in motor.

Our insurance profit increased by 10.5% to $908 million, compared to $822 million in the prior year, and our reported insurance margin increased from 19.7% in the 2013 financial year to 22.5%. On an underlying basis, our insurance margin improved to 16.4%.

FOCUSING ON OUR CUSTOMERS

We have a wealth of knowledge and experience that allows us to identify and meet future customer needs, lead a competitive market and help our customers make better decisions about risk and insurance.

Our goal is to lead the market for customer service with our expanding digital platforms. This year, we made significant investments in mobile functionality to provide easy, accessible experiences for our customers. We developed new mobile applications, such as Crash Note, and expanded live web chats, hosting 80,000 chats this financial year. In the same period, traffic to our mobile sites more than doubled.

Our national partner smash repair model has created a network of repairers and we unveiled a quality framework to guarantee the quality and safety of repairs completed for our customers.

Our people embody our commitment to protecting Australians, and are central to our success. This year, we promoted discussions about flood risk and insurance to educate high-risk New South Wales communities. Our New South Wales Flood Engagement programme included a commitment to host local community seminars, and visits to consumer and local, state and federal political bodies to educate them on our ability to assess and price risk for our customers. This outreach campaign was highly successful and will continue to ensure all families are able to make better decisions about risk and insurance.

We continue to focus on customer experience and cost effectiveness to maintain our strong profitability and market position. Cost savings are being reinvested to enhance our ability to achieve our customer-focused strategy, and meet customers’ needs.

PERSONAL INSURANCE IN IAG’S NEW AUSTRALIAN OPERATING MODEL

From 1 July 2014, IAG moved to a new operating model for its Australian operations. There are now three divisions: Commercial Insurance, Enterprise Operations and Personal Insurance, which contains:

- the motor, home and CTP operations which previously represented the bulk of the Australia Direct business;

- the affinity and financial institution partnerships which were previously part of CGU; and

- the 10-year distribution agreement with Coles that was part of the acquisition of the Wesfarmers insurance underwriting business.