OPERATING PERFORMANCE

New Zealand

Division

IAG is the largest general insurer in New Zealand, trading under the State, NZI, AMI and Lumley Insurance brands.

RESULTS

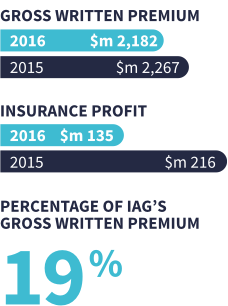

The business’ gross written premium decreased by 3.7% to $2,182 million, compared to the previous financial year. This result included a slightly negative foreign exchange translation effect compared to 2015, as well as the combination of:

- softer premium rates and volume loss in commercial lines, in the face of increased industry capacity; and

- partially offsetting premium growth in the private motor vehicle portfolio from a combination of increases in policy numbers and rates.

The business’ operating performance remained strong, with an underlying margin of 16.9%. Its reported insurance margin was 8.6% after the recognition of an additional NZ$150 million of risk margin for the February 2011 Canterbury earthquake event.

CLOSER TO CUSTOMERS

The business’ Consumer division represented 57% of its total premiums this year, up from 55% last year. It remains focused on meeting customers’ needs and expectations by providing greater choice on insurance offerings, ensuring affordability issues are addressed and providing positive customer experiences. It achieved growth with a number of targeted customer initiatives, including:

- AMI’s Young Drivers campaign, which has had particular success in helping to drive private motor premium growth;

- AMI’s New New Zealander campaign, which is meeting the needs of an increasing migrant population;

- a range of digital services, such as ‘quote and buy’; State and AMI ‘Online Accounts’; and the establishment of a social media presence through Facebook; and more recently,

- the launch of AMI’s Renters Insurance campaign.

The State online channel has continued to register strong growth as it focuses on balancing customer affordability and increased competition by appropriately managing rate increases.

The Business division represented 43% of gross written premium in the 2016 financial year, down from 45% the previous year, as harsher competitive conditions continued to place pressure on commercial product lines, especially commercial property where IAG lost business and experienced rate reductions.

The Business division remains focused on providing certainty for its customers and being able to respond quickly and flexibly to meet their changing needs in an extremely dynamic market. One example of this approach is NZI’s recent launch of a Liability Cyber Insurance product, to help customers navigate the risks of an increasingly digital environment.

CANTERBURY REBUILD

At 30 June 2016, the business had completed over NZ$5.7 billion of claim settlements for the Canterbury earthquakes, and fully settled approximately 93% of all claims by number.

As at this date, over 96% of commercial claims and over 92% of residential claims were settled, with the majority of outstanding residential properties either in construction or negotiation for cash settlement.

OUTLOOK

The business’ strategy remains focused on maintaining its market-leading position by delivering affordable, customer-centric offerings while delivering strong underlying profitability by focusing on pricing and underwriting disciplines.

The market is expected to remain competitive across both the Business and Consumer divisions, with low rate increases across key personal products offset by continued pressure on commercial products contributing to relatively flat gross written premium growth prospects in the 2017 financial year.

Underlying profitability of the business is expected to remain strong.