OPERATING PERFORMANCE

Asia Division

Asia represents an important source of long term growth for IAG, with a presence in five markets: Thailand, Malaysia, India, Vietnam and Indonesia. Earlier in the 2016 financial year, IAG determined not to pursue further investment in China, and the interest held in Bohai Property Insurance Company Ltd was transferred to shareholders’ funds investment portfolio.

RESULTS

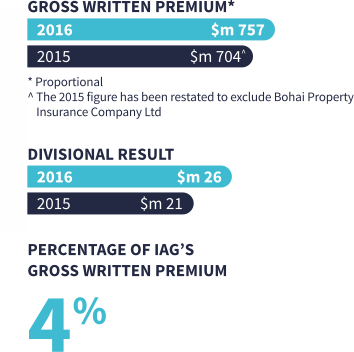

IAG’s operations in Asia continued to make sound progress. The division contributed a total profit of $26 million this year, including income earned from its shares in associates. This compares to a $21 million profit in the 2015 financial year, and includes:

- sound underlying performances by the established businesses in Thailand and Malaysia, where combined profitability increased by over 16% compared to the previous year; and

- higher, but still relatively modest, losses from the developing businesses in India, Vietnam and Indonesia.

In 2016, Asia represented 6.4% of IAG’s gross written premium, on a proportional basis, compared to 6.0% in 2015. Its proportional gross written premium increased by 7.5% to

$757 million, reflecting:

- sound growth in Thailand, from a continued focus on the used car segment, enhanced by a favourable foreign exchange translation effect;

- flat local currency premium in Malaysia, including an encouraging resumption of growth in the second half of the year, reduced to a 4.2% contraction on translation;

- continuing strong growth in India;

- steady like-for-like growth in Vietnam, on improving economic conditions; and

- a first full year inclusion of premium from the small business acquired in Indonesia towards the end of the 2015 financial year.

CLOSER TO CUSTOMERS

Businesses in the Asia Division introduced a number of products and services to improve their customer connections, including:

- SBI General simplifying its claims process for customers affected by the Chennai floods in India

- Safety Insurance in Thailand introducing open house visits where key commercial customers are given tours of the company’s offices and educational seminars for customers;

- AmGeneral in Malaysia launching the AutoGen Club and Opal Auto Mart Partnership to provide faster claims services for customers, and additional benefits to Club members;

- AmGeneral launching Agent Portal Services, the first-ever white label online insurance platform where customers can purchase online from their trusted agent via the AmGeneral platform;

- Kurnia and AmAssurance’s OneTouch App for customers to request immediate accident and roadside assistance, submit claims information, and connect with their preferred agent;

- AmGeneral offering an improved windscreen claims process where specialist windscreen repairers are able to fix or replace customers’ windscreens in a matter of hours, with no upfront payment, and the work is covered by a two-year guarantee; and

- AAA Assurance in Vietnam using feedback from customers to improve its claim processes to provide a faster, solutions-focused service that is better meeting customer needs.

OUTLOOK

A stronger underlying performance from the Asia Division is anticipated in the 2017 financial year.

The business will deepen its focus on the profitable established markets of Thailand and Malaysia, with Thailand expected to produce modestly higher premium and Malaysia maintaining its focus on restoring premium growth.

Growth from SBI General in India is expected to remain strong; work is underway in Vietnam to more clearly define AAA’s strategic position; and the emphasis in Indonesia will be on the further development of a new digital business model and the pursuit of potential partnership and distribution opportunities.