(4)

Superannuation represents the employer’s contributions.

(5)

Long service leave accruals as determined in accordance with AASB 119.

(6)

The sum of columns (1) to (5). The sub-total includes the value of termination payments, which is not shown as no termination payments were made to Executives during

the year ended 30 June 2015 (2014-nil).

(7)

The deferred STI is granted as DAR and is valued using the Black-Scholes valuation model. An allocated portion of unvested DAR for financial years prior to 30 June 2014

is included in the total remuneration disclosure above. The deferred STI for the year ended 30 June 2015 will be granted in the next financial year, so no value was

included in the current financial year’s total remuneration.

(8)

This value represents the allocated portion of unvested EPR. To determine the EPR values the Monte Carlo simulation (for TSR performance hurdle) and Black-Scholes

valuation (for ROE performance hurdle) models have been applied. The valuation takes into account the exercise price of the EPR, life of the EPR, price of IAG ordinary

shares as at 30 June, expected volatility of the IAG share price, expected dividends, risk free interest rate, performance of shares in the peer group of companies, early

exercise and non-transferability and turnover which is assumed to be zero for an individual's remuneration calculation.

(9)

The sum of columns (6) to (8).

(10) At-risk remuneration received during the financial year as a percentage of total reward.

(11) Remuneration for Duncan Brain and Alex Harrison has increased as for the first time both executives were KMP for the full period in the year ended 30 June 2015. In the

2014 financial year, no share based payments were disclosed for Alex Harrison as those payments were not related to his role as KMP.

(12) Remuneration received by Andy Cornish is higher in the year ended 30 June 2015 than the previous financial year as he took a three-month period of unpaid leave in the

2014 financial year.

(13) Remuneration for Jacki Johnson is determined in New Zealand dollars and reported in Australian dollars. Foreign exchange movements affect the value of remuneration

disclosed. The exchange rate used to report Jacki Johnson’s remuneration in the year ended 30 June 2015 was NZD1 = AUD0.93060 (2014 - NZD1 = AUD0.90485).

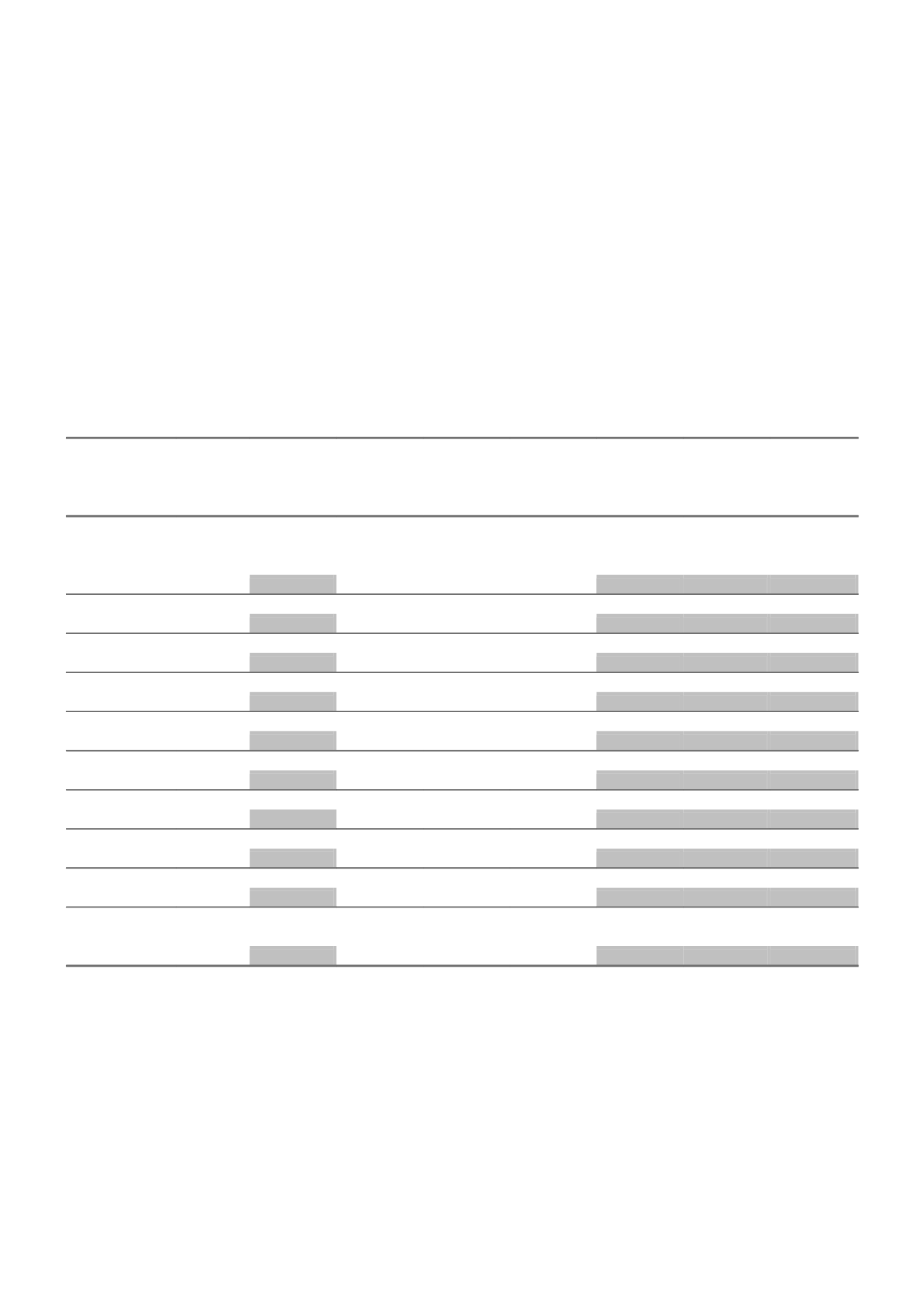

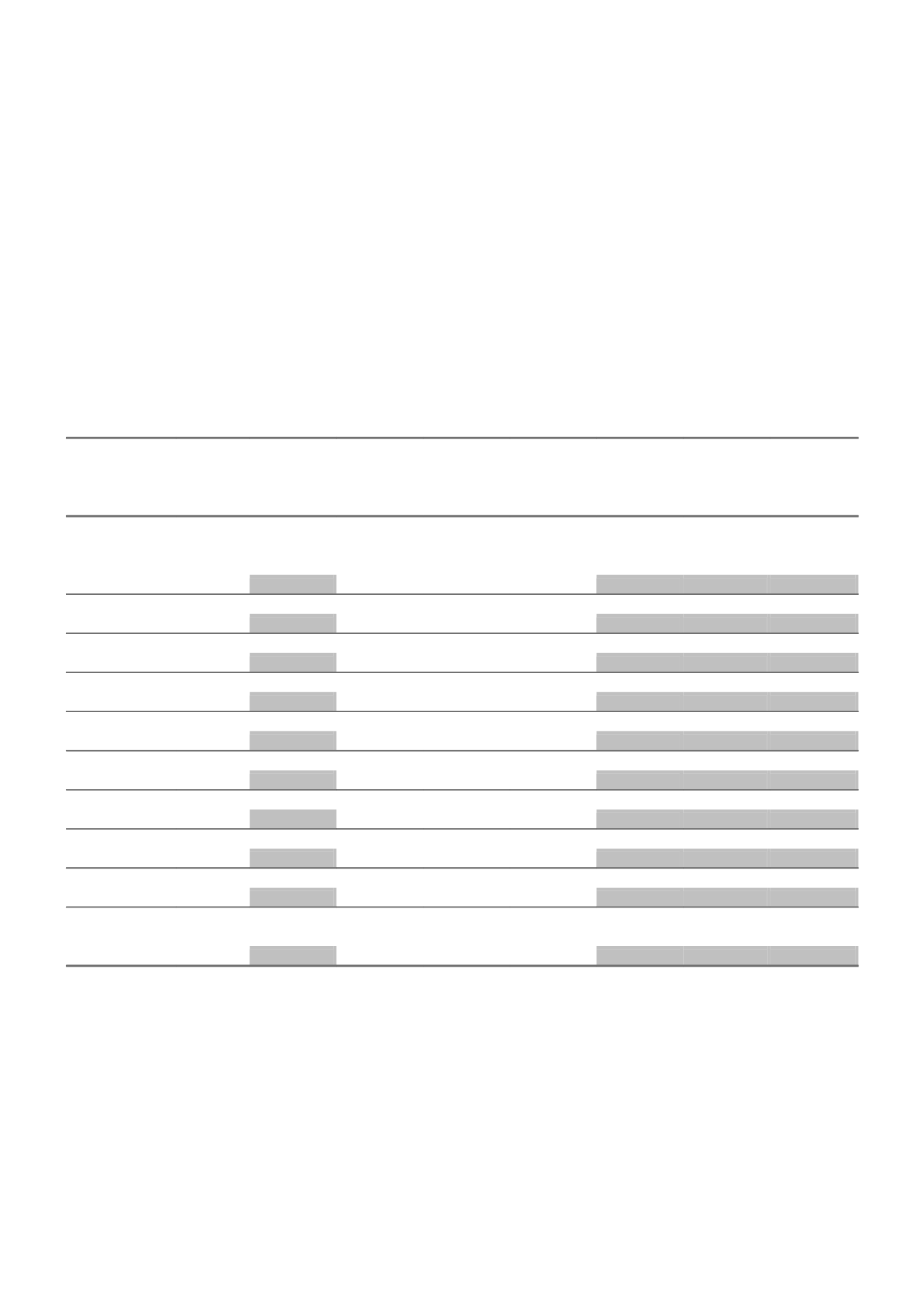

II. Movement in equity plans within the financial year

Changes in each Executive’s holding of DAR during the financial year are set out below. The DAR granted during the year reflect the

deferred portion of the STI outcome for the year ended 30 June 2015. Refer to the share based remuneration note of the Financial

Statements for further DAR Plan details.

TABLE 10 - MOVEMENT IN POTENTIAL VALUE OF DAR FOR THE YEAR ENDED 30 JUNE 2015

DAR

ON ISSUE

1 JULY

DAR

GRANTED

DURING

THE YEAR

(a)

DAR

EXERCISED

DURING

THE YEAR

(b)

DAR

LAPSED

DURING

THE YEAR

DAR

ON ISSUE

30 JUNE

DAR

VESTED

DURING

THE YEAR

DAR

VESTED

AND EX-

ERCISABLE

30 JUNE

2015

EXECUTIVES

Michael Wilkins Number

266,850 153,800 (189,700)

-

230,950 189,700

-

$000

927

1,154

-

Duncan Brain Number

44,600

35,500 (32,400)

-

47,700

32,400

-

$000

214

197

-

Andy Cornish Number

101,250

41,700 (72,200)

-

70,750

72,200

-

$000

251

439

-

Peter Harmer

Number

96,800

60,300 (66,500)

-

90,600

66,500

-

$000

363

405

-

Alex Harrison

(c)

Number

41,800

25,300 (29,500)

-

37,600

29,500

-

$000

153

179

-

Nicholas Hawkins Number

101,750

62,700 (71,300)

-

93,150

71,300

-

$000

378

434

-

Jacki Johnson Number

147,300

48,400 (122,400)

-

73,300

61,250

-

$000

292

745

-

Leona Murphy Number

89,700

48,800 (63,250)

-

75,250

63,250

-

$000

294

385

-

Clayton Whipp

(c)

Number

43,200

23,900 (32,450)

-

34,650

32,450

-

$000

144

197

-

EXECUTIVES WHO CEASED AS KEY MANAGEMENT PERSONNEL

Justin Breheny Number

95,300

49,600 (68,750)

-

76,150

68,750

-

$000

299

418

-

(a)

DAR that were granted on 3 November 2014, have a first exercisable date of 1 September 2015 and an expiry date of 3 November 2021. The value of DAR granted

during the year is the fair value of the DAR at grant date calculated using the Black-Scholes valuation model, which was $6.03. The value of DAR granted is included in

the table above. This amount is allocated to remuneration over the vesting period (i.e. in years ending 30 June 2015 to 30 June 2017).

(b)

DAR that vested on 1 September 2014 or before and were exercised in the financial year. The value of DAR exercised is based on the weighted average share price

which was $6.08 for the year ended 30 June 2015.

(c)

Opening number of DAR on issue represents the balance as at the date of appointment of 1 July 2014.

29