Culture and

employee

development

10%

Exceeded target: IAG focused on aligning the culture of the Group and the Group

people strategies in light of the recent acquisition and change in operating

model. The Group culture results were positive and continue to outperform

those of the financial services sector. IAG proudly embraces an inclusive and

diverse workplace. Women hold 31.5% of senior management roles across the

Group, and 33.3% in the Australian and New Zealand businesses. Although this

is short of the goal set in 2010 of 33% of senior management roles being held

by women across the Group, IAG has improved significantly from 27% reported in

2010. IAG continues to improve this, including by introducing training to reduce

unconscious bias in recruitment.

II. STI outcomes for the year ended 30 June 2015

Cash and deferred STI payments made to the Group CEO and the Executive team for the year ended 30 June 2015 are set out below,

and were based on achievement against the balanced scorecard measures described in table 5.

Each individual Executive’s STI outcome is linked to the financial performance of the Group as well as to the execution of his or her

division’s strategic goals during the year. In line with the overall performance, the STI awarded to the Group CEO and the Executive

team are, on average, less than those for last year.

TABLE 6 - ACTUAL STI OUTCOMES FOR THE YEAR ENDED 30 JUNE 2015

MAXIMUM STI

OPPORTUNITY

ACTUAL STI OUTCOME

CASH STI

OUTCOME

(2/3 OF OUTCOME)

DEFERRED STI

OUTCOME

(1/3 OF OUTCOME)

(% of fixed pay)

(a)

(% of maximum)

(a)

(% of fixed pay)

(% of fixed pay)

(% of fixed pay)

Michael Wilkins

150

%

62

%

93

%

62

%

31

%

Ben Bessell

120

%

51

%

61

%

41

%

20

%

Duncan Brain

120

%

64

%

76

%

51

%

25

%

Andy Cornish

120

%

71

%

86

%

57

%

29

%

Peter Harmer

120

%

58

%

70

%

47

%

23

%

Alex Harrison

(b)

120

%

60

%

72

%

72

%

-

%

Nicholas Hawkins

120

%

74

%

89

%

59

%

30

%

Jacki Johnson

120

%

48

%

57

%

38

%

19

%

Leona Murphy

120

%

69

%

83

%

55

%

28

%

Clayton Whipp

120

%

55

%

66

%

44

%

22

%

(a)

The proportion of STI forfeited is derived by subtracting the actual % of maximum received from the maximum STI opportunity and was 39% on average for the year

ended 30 June 2015 (compared to 21% in 2014).

(b)

Alex Harrison's STI will be settled entirely in cash due to his departure from IAG on 31 August 2015.

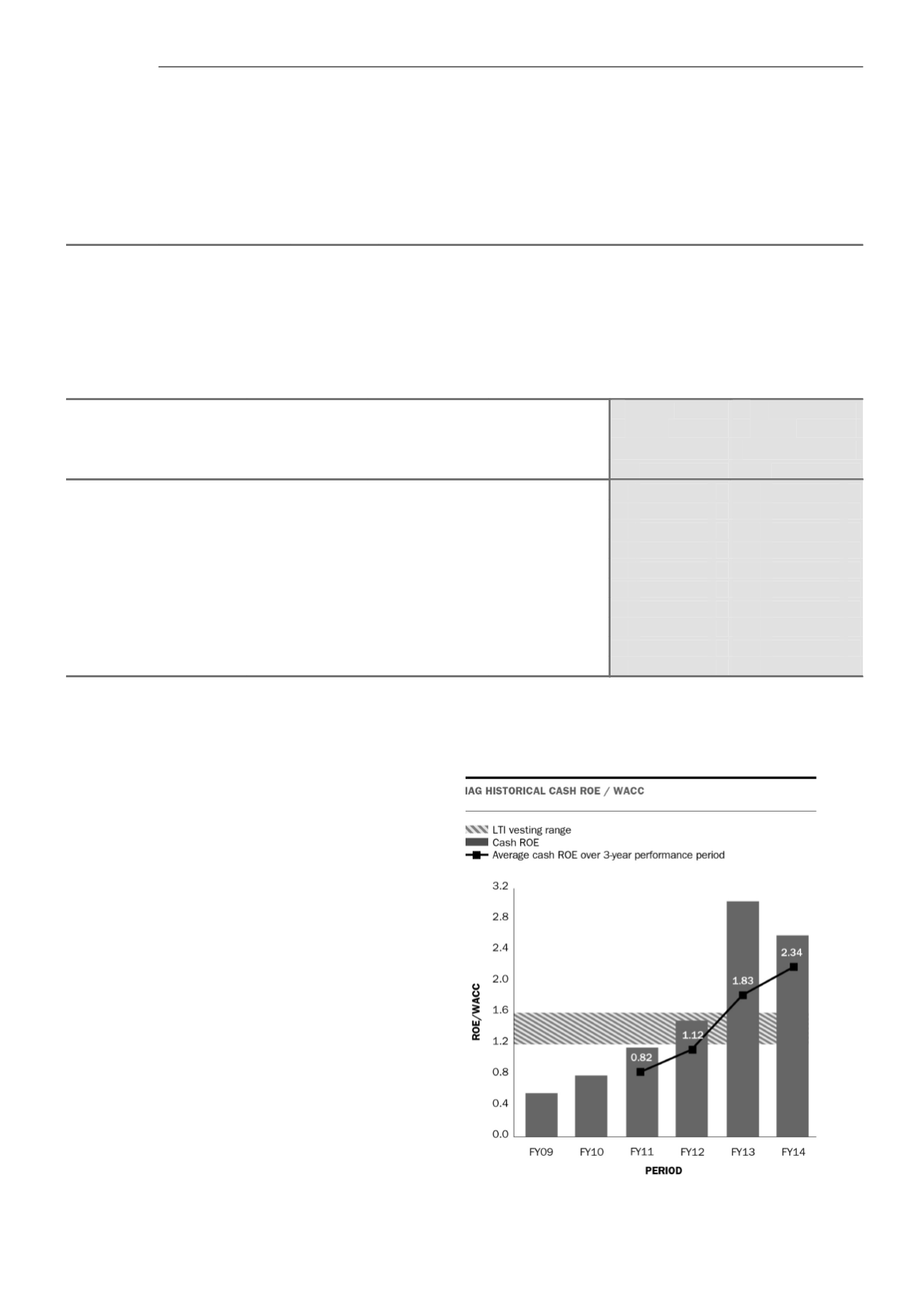

III. Linking IAG's long term performance and long term reward

IAG’s LTI performance measures are challenging over the long

term and require strong performance over both an internal capital

efficiency measure (ROE) and an external market measure

(relative TSR). Executives are only rewarded under the LTI plan

when the Group exceeds its challenging long term performance

targets and delivers superior financial performance over at least a

three-year period.

The LTI vested in the year ended 30 June 2015 was based

against IAG’s performance against the ROE hurdle at 30 June

2014, and relative TSR measured at 30 September 2014.

IAG measures the ROE component of the LTI over three years

using cash ROE, which is the basis on which dividends are

calculated for shareholders. The average cash ROE for the three

years to 30 June 2014 was 2.34 times IAG’s WACC. This was a

strong result compared to historical returns and resulted in full

vesting of the ROE portion of the 2011/2012 Series 4 EPR. This

is only the second time the ROE portion of the LTI has vested and

this strong cash ROE performance has similarly been reflected in

the solid dividend provided to shareholders. The adjacent graph

shows IAG’s cash ROE against WACC for each of the last five

financial years with reference to the LTI vesting range, to put the

recent performance in a longer term context. The graph also

shows the three year average cash ROE over the performance

period, as measured by the LTI plan.

IAG’s TSR was in the top quartile of its peer group, ranking at the 95th percentile over the three years up to 30 September 2014.

26 IAG ANNUAL REPORT 2015