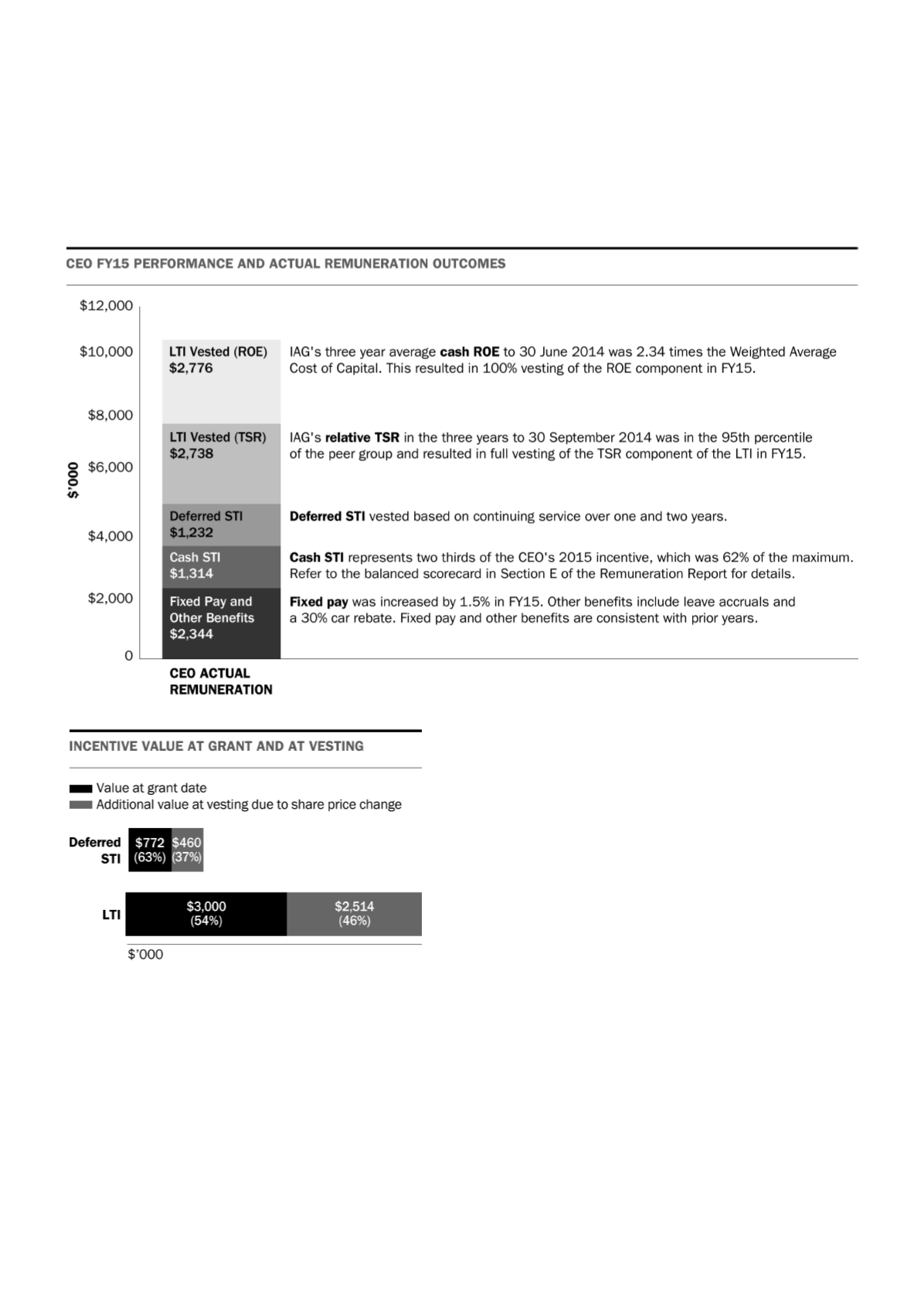

II. Actual remuneration explained

The actual remuneration outlined in table 1 shows a significant proportion of the total reward comprising at risk remuneration and in

particular the LTI. Given IAG’s strong long term performance, the value of variable reward represents a significant proportion of the

total actual reward received, highlighting the strength of the link between the incentive outcomes for IAG’s Executives and IAG’s

performance.

The actual remuneration received in a given year is based on IAG’s performance over a number of different time periods and for

achieving different, challenging objectives. The following graph illustrates the Group CEO's remuneration as an example, broken down

into the components of his remuneration plan. Beside each remuneration component is a description of the timeframe and the

objective achieved to receive this remuneration.

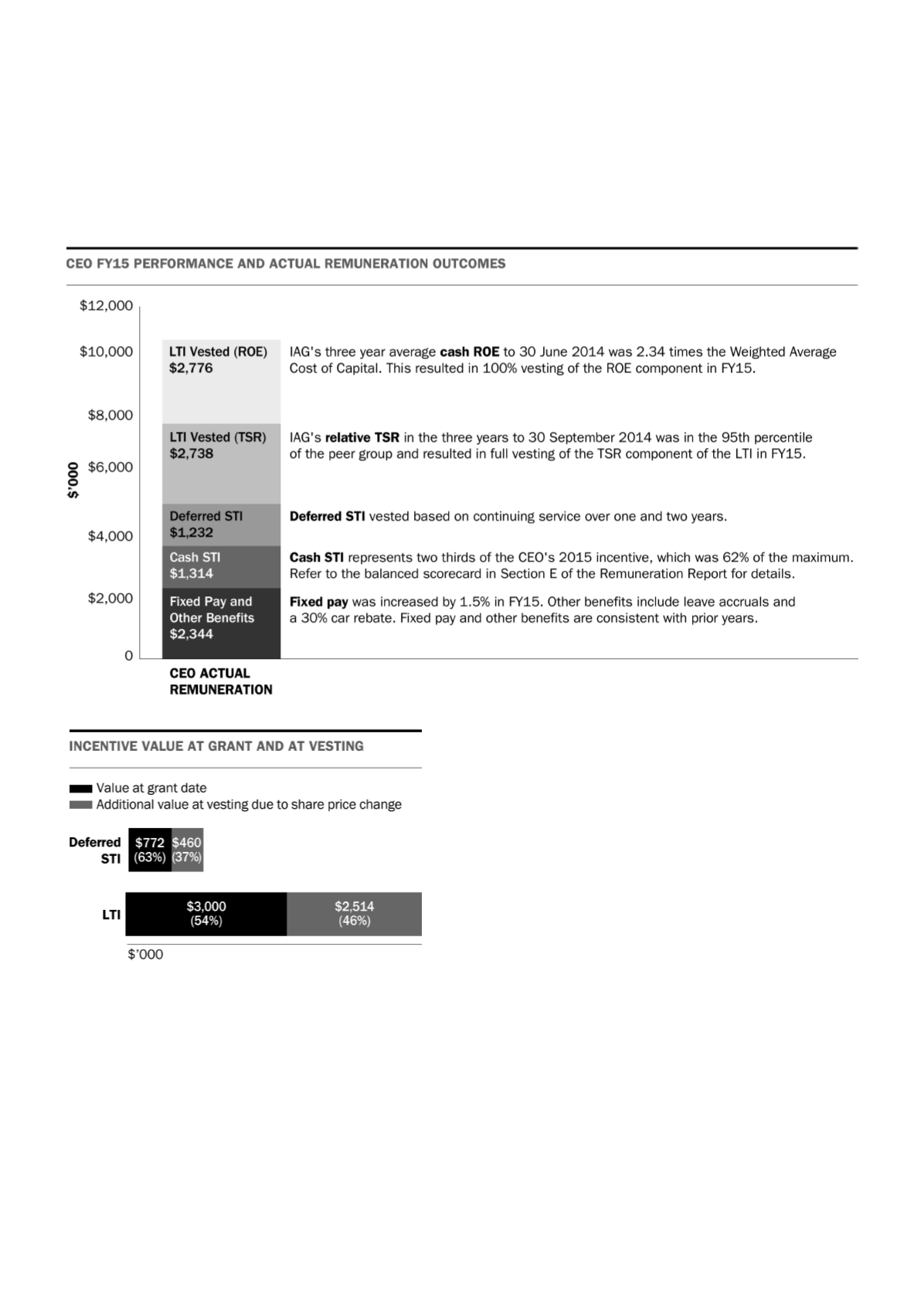

Significant elements of the total actual reward received by the

Group CEO are those of the deferred STI and LTI plans. The

disclosed value of both plans is impacted by a significant increase

in the value of IAG's share price since they were allocated, which

also benefited IAG’s shareholders. The adjacent graph outlines

the dollar value and proportion of deferred STI and LTI when they

were awarded as well as the additional value achieved through

share price growth.

IAG’s ROE has been positively reflected in the dividends shareholders receive as well as the LTI for executives, further demonstrating

the alignment of reward to our shareholder interests. IAG’s performance has resulted in sound dividend payments provided to

shareholders over a number of years. The dividend paid/payable to shareholders for the year ended 30 June 2015 is 29 cents per

ordinary share. IAG continues to adhere to its dividend policy of paying approximately 50–70% of reported cash earnings to

shareholders in any given financial year.

20 IAG ANNUAL REPORT 2015