D. EXECUTIVE REMUNERATION STRUCTURE

I. Summary of remuneration components

The remuneration components for the Executives are explained below:

TABLE 2 - SUMMARY OF REMUNERATION COMPONENTS

REMUNERATION COMPONENT

STRATEGIC PURPOSE

Fixed remuneration Cash

Base salary and superannuation.

Attract and retain high quality

people.

At-risk remuneration Cash STI

2/3 of the STI outcome paid as cash following the

end of year assessment and approval by the

Board.

Motivate and reward

performance within a financial

year.

Deferred STI

1/3 of the STI outcome is deferred over a period

of two years, subject to ongoing employment

conditions.

Provided as a grant of rights in the form of DAR.

Number of DAR issued based on face value of an

IAG ordinary share.

The actual value of shares will depend on the

future share price.

The Board has discretion to adjust remuneration

to protect the financial soundness of the Group or

to ensure an appropriate reward outcome.

Align reward to shareholder

interests.

Strike a balance between short

and long term results and reward

for exceptional performance.

Retain high quality people.

Protect the financial soundness

of the Group.

LTI

Provided as a grant of rights in the form of EPR.

Number of EPR issued based on face value of an

IAG ordinary share.

3-4 year performance period.

Subject to performance hurdles of relative TSR

and ROE being achieved.

The Board has discretion to adjust remuneration

to protect the financial soundness of the Group or

to ensure an appropriate reward outcome.

Align reward to shareholder

interests.

Align remuneration with longer

term financial performance.

Retain high quality people.

Protect the financial soundness

of the Group.

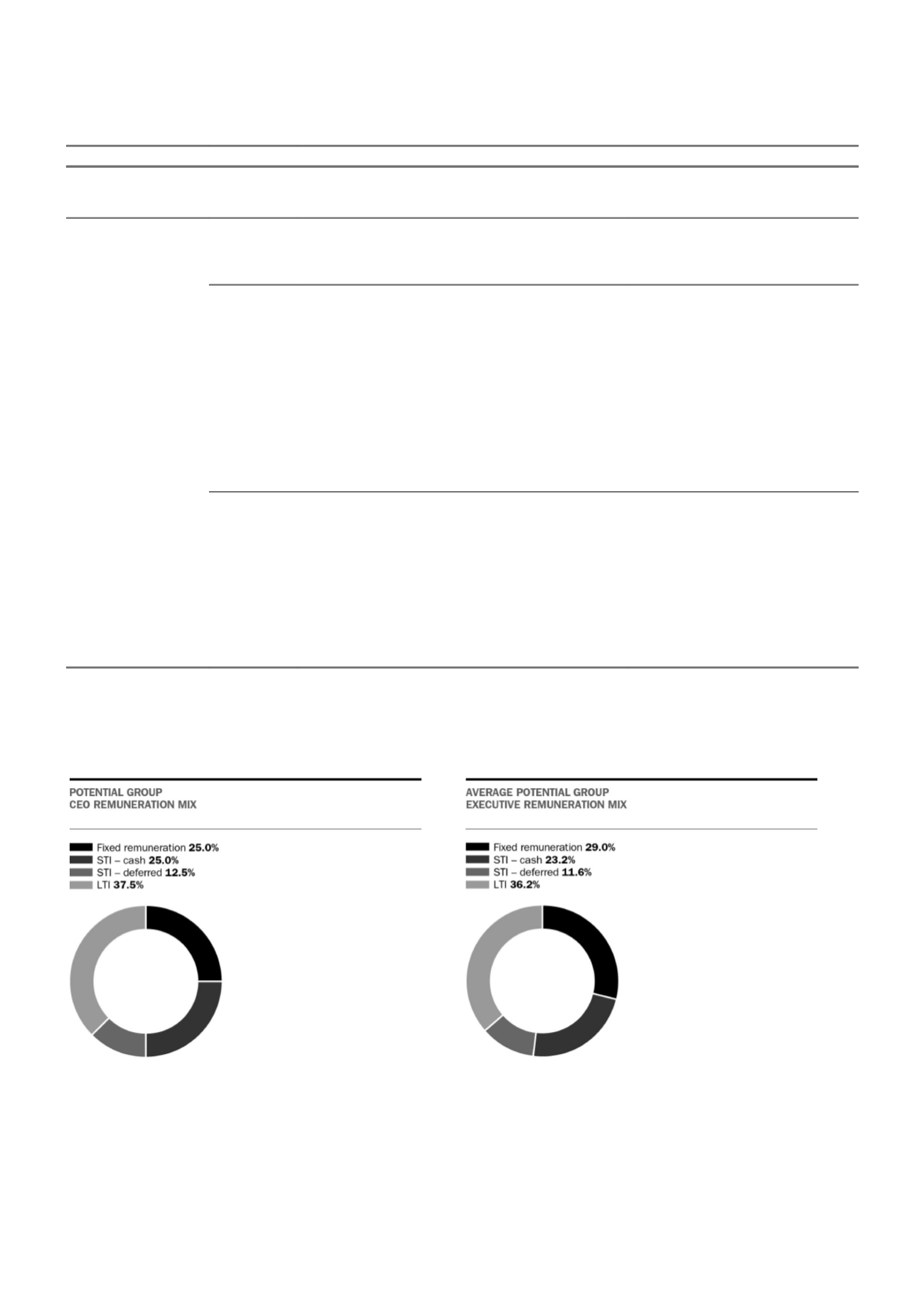

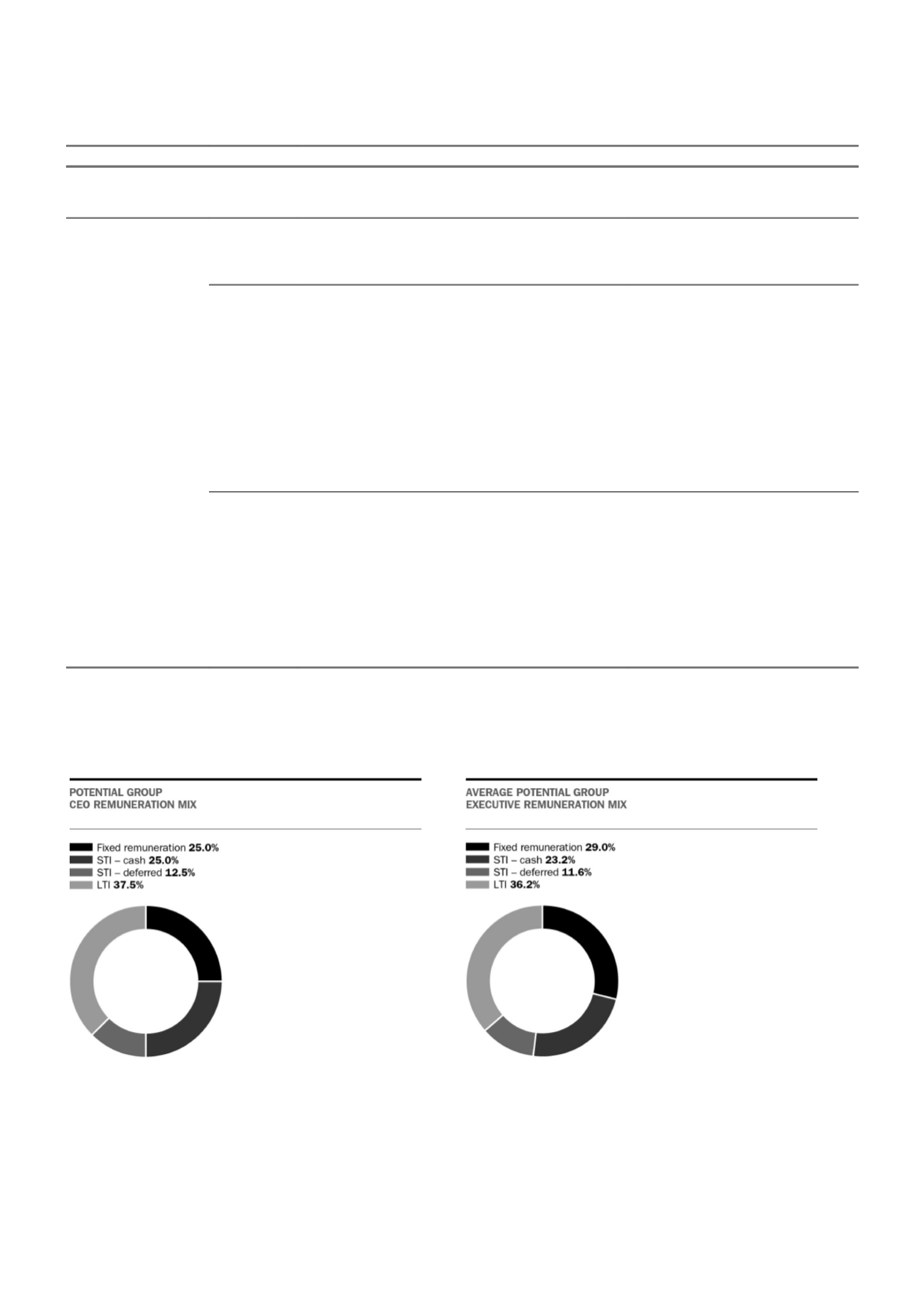

II. Potential remuneration mix

Total remuneration for the Group CEO and the Executive team comprises a mix of fixed remuneration and maximum potential at-risk

remuneration (STI and LTI). The mix, shown in the graph below, is designed to pay Executives competitively based on their

performance, while providing strong governance to protect the financial soundness of the business and shareholders’ interests.

Notes:

Potential remuneration is based on current remuneration at 30 June 2015. STI and LTI are based on maximum opportunities.

22 IAG ANNUAL REPORT 2015