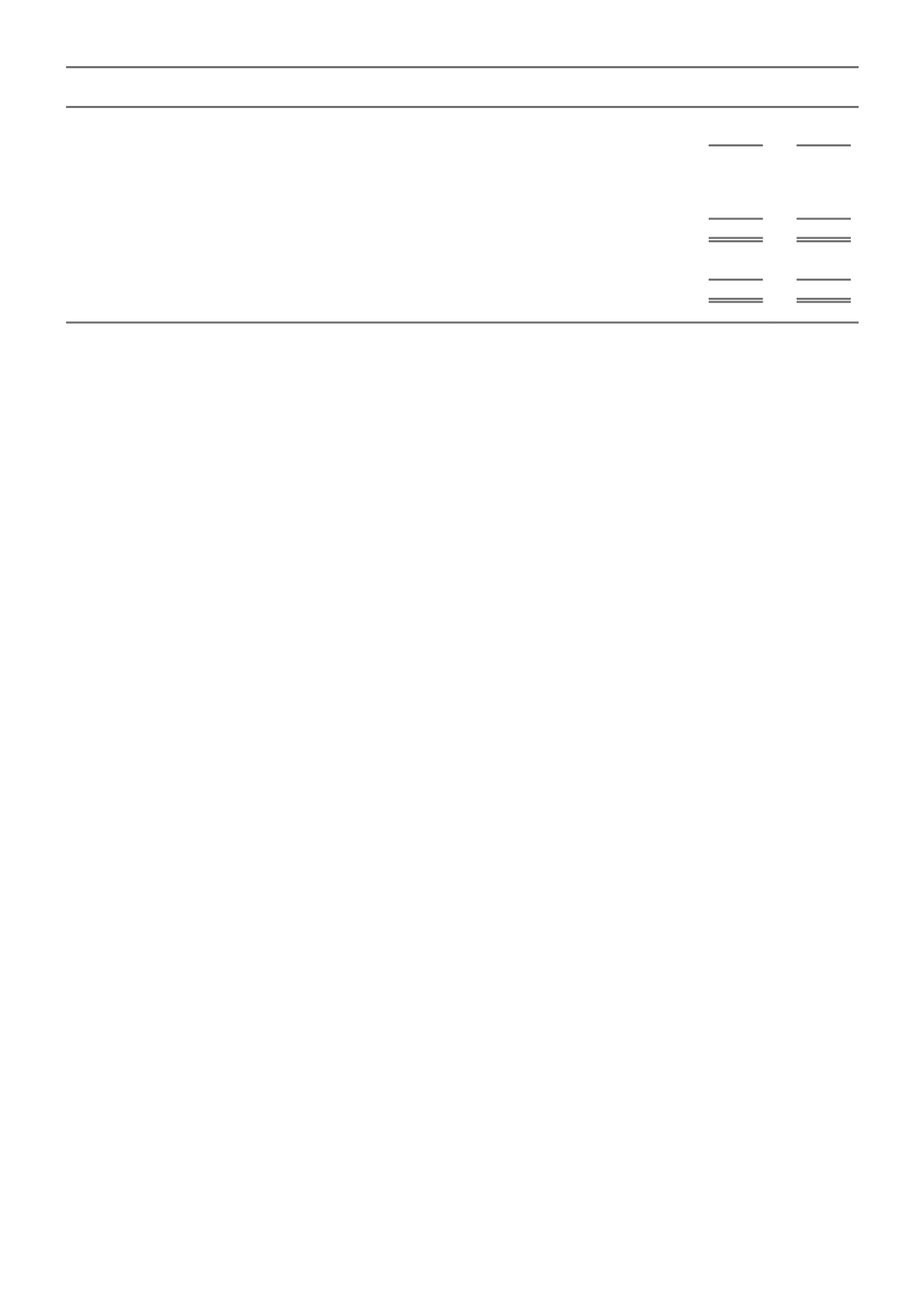

2015

2014

CASH EARNINGS

$m

$m

Net profit after tax

728

1,233

Intangible amortisation and impairment

150

21

878

1,254

Unusual items:

Corporate expenses

155

68

Tax effect on corporate expenses

(46)

(16)

Cash earnings

*

987

1,306

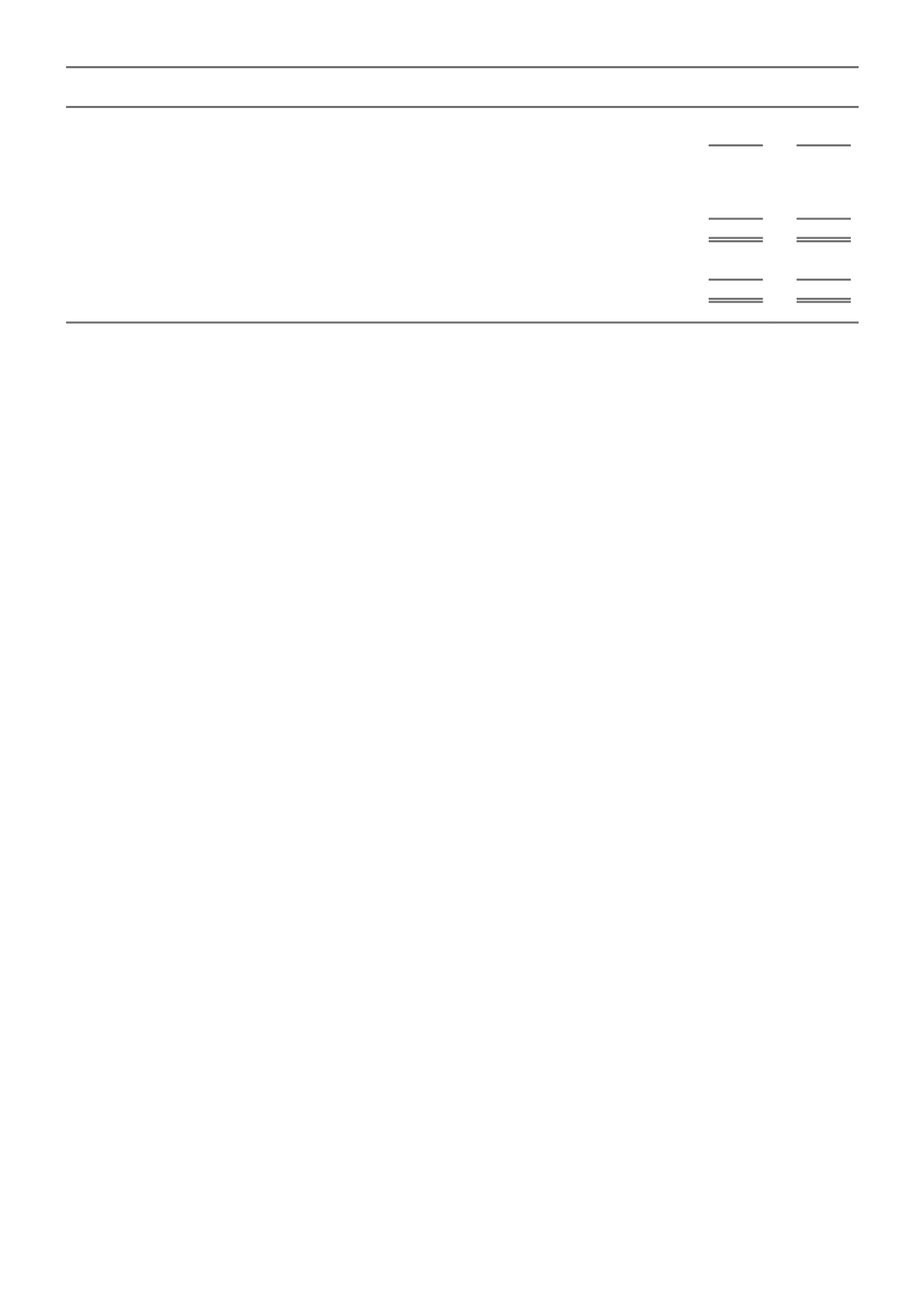

Interim dividend

304

304

Final dividend

389

609

Dividend payable

693

913

Cash payout ratio

*

70.2%

69.9%

*

Cash earnings and cash payout ratio represent non-IFRS financial information.

IAG’s policy is to pay dividends equivalent to approximately 50–70% of reported cash earnings in any given financial year.

The Board has determined to pay a fully franked final dividend of 16.0 cents per ordinary share (2014-26.0 cps). The final dividend is

payable on 7 October 2015 to shareholders registered as at 5pm on 9 September 2015.

The Company's Dividend Reinvestment Plan (DRP) will operate for the final dividend by acquiring shares on-market with no discount

applied. The DRP Issue Price will be based on a volume weighted average share price as defined in the DRP terms. The last date for

the receipt of an election notice for participation in the Company's DRP is 10 September 2015. Information about IAG’s DRP is

available at

.

SIGNIFICANT CHANGES IN STATE OF AFFAIRS

During the financial year the following changes became effective:

Effective 1 July 2014 the Group implemented a new operating model for its Australian operations, creating a more customer

focused and efficient organisation. This change is reflected in the segment reporting note within the Financial Statements.

On 16 June 2015, IAG announced it had formed a strategic relationship with Berkshire Hathaway, comprising:

an exclusive operating relationship in Australia and New Zealand;

a ten-year, 20% whole-of-account quota share arrangement, commencing 1 July 2015;

a $500 million equity placement to Berkshire Hathaway (through National Indemnity Company), representing approximately

3.7% of IAG's expanded issued capital (with anti-dilution arrangements); and

a put option exercisable by IAG to place further new shares to National Indemnity Company within 24 months after 16 June

2015. Refer to the notes to the statement of changes in equity note for further details.

The Group regards this strategic relationship, which builds on its long-standing relationship with Berkshire Hathaway, as endorsing

IAG’s strategy and the strength of its franchises in the Asia Pacific region. Expected benefits include the harnessing of complementary

operating capabilities, reduced earnings volatility via the quota share and significant capital flexibility.

EVENTS SUBSEQUENT TO REPORTING DATE

Detail of matters subsequent to the end of the financial year is set out below and in the events subsequent to reporting date note

within the Financial Statements. These include:

On 21 August 2015, the Board determined to pay a final dividend of 16 cents per share, 100% franked. The dividend will be paid

on 7 October 2015. The dividend reinvestment plan will operate by acquiring shares on-market for participants with no discount

applied; and

The announcement on 11 August 2015 that Mr Jonathan Nicholson will be appointed to the IAG Board, as an Independent Non-

Executive Director, effective 1 September 2015.

NON-AUDIT SERVICES

During the financial year, KPMG has performed certain other services for the Group in addition to its statutory duties.

The Directors have considered the non-audit services provided during the financial year by KPMG and, in accordance with written

advice provided by resolution of the AC, are satisfied that the provision of those non-audit services by the Group’s auditor is compatible

with, and did not compromise, the auditor independence requirements of the Corporations Act 2001 for the following reasons:

all non-audit assignments were approved in accordance with the process set out in the IAG framework for engaging auditors for

non-audit services; and

the non-audit services provided do not undermine the general principles relating to auditor independence as set out in APES 110

Code of Ethics for Professional Accountants of the Chartered Accountants Australia and New Zealand and CPA Australia, as they

did not involve reviewing or auditing the auditor’s own work, acting in a management or decision making capacity for the

Company, acting as an advocate for the Company or jointly sharing risks and rewards.

The level of fees for total non-audit services amounted to approximately $1.2 million (refer to the remuneration of auditors note for

further details of costs incurred on individual non-audit assignments).

14 IAG ANNUAL REPORT 2015