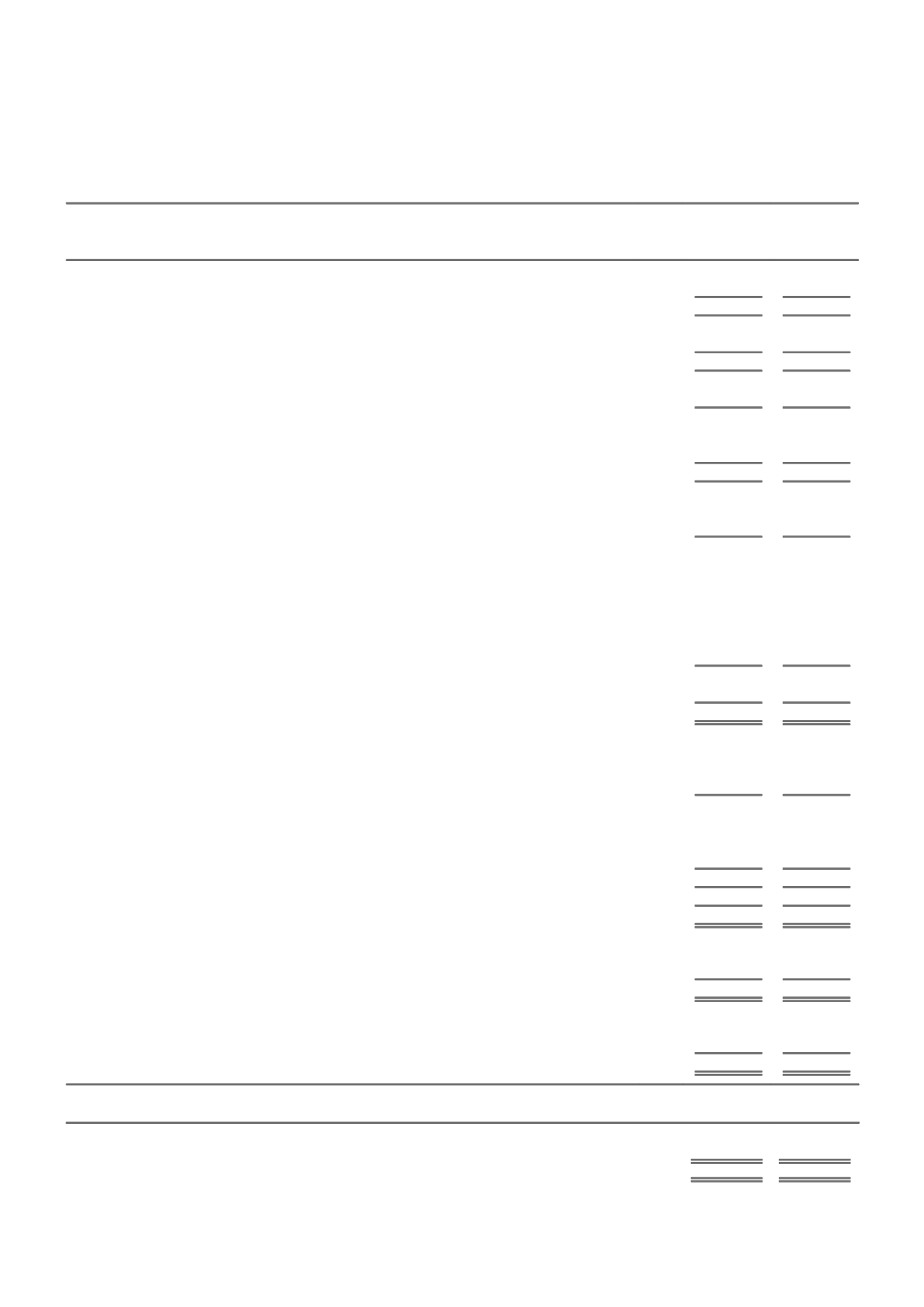

STATEMENT OF

COMPREHENSIVE INCOME

FOR THE YEAR ENDED 30 JUNE 2015

NOTE

CONSOLIDATED

2015

2014

$m

$m

Premium revenue

4

11,525

9,721

Outwards reinsurance premium expense

5

(1,196)

(1,077)

Net premium revenue (i)

10,329

8,644

Claims expense

5

(9,363)

(7,058)

Reinsurance and other recoveries revenue

4

2,422

1,857

Net claims expense (ii)

10

(6,941)

(5,201)

Acquisition costs

5

(1,750)

(1,386)

Reinsurance commission revenue

4

52

51

Net acquisition costs

(1,698)

(1,335)

Other underwriting expenses

5

(924)

(752)

Fire services levies

5

(225)

(216)

Underwriting expenses (iii)

(2,847)

(2,303)

Underwriting profit/(loss) (i) + (ii) + (iii)

541

1,140

Investment income on assets backing insurance liabilities

4

585

459

Investment expenses on assets backing insurance liabilities

5

(23)

(20)

Insurance profit/(loss)

1,103

1,579

Investment income on shareholders' funds

4

231

400

Fee and other income

4

187

199

Share of net profit/(loss) of associates

4

6

(8)

Finance costs

5

(107)

(98)

Fee based, corporate and other expenses

5

(465)

(256)

Net income/(loss) attributable to non-controlling interests in unitholders' funds

5

(6)

(14)

Profit/(loss) before income tax

949

1,802

Income tax (expense)/credit

6

(119)

(472)

Profit/(loss) for the year

830

1,330

OTHER COMPREHENSIVE INCOME AND (EXPENSE), NET OF TAX

Items that will not be reclassified to profit or loss:

Remeasurements of defined benefit plans

22

26

Income tax on items that will not be reclassified to profit or loss

(7)

(8)

15

18

Items that may be reclassified subsequently to profit or loss:

Net movement in foreign currency translation reserve

(80)

(31)

Income tax on items that may be reclassified to profit or loss

2

13

(78)

(18)

Other comprehensive income and (expense), net of tax

(63)

-

Total comprehensive income and (expense) for the year, net of tax

767

1,330

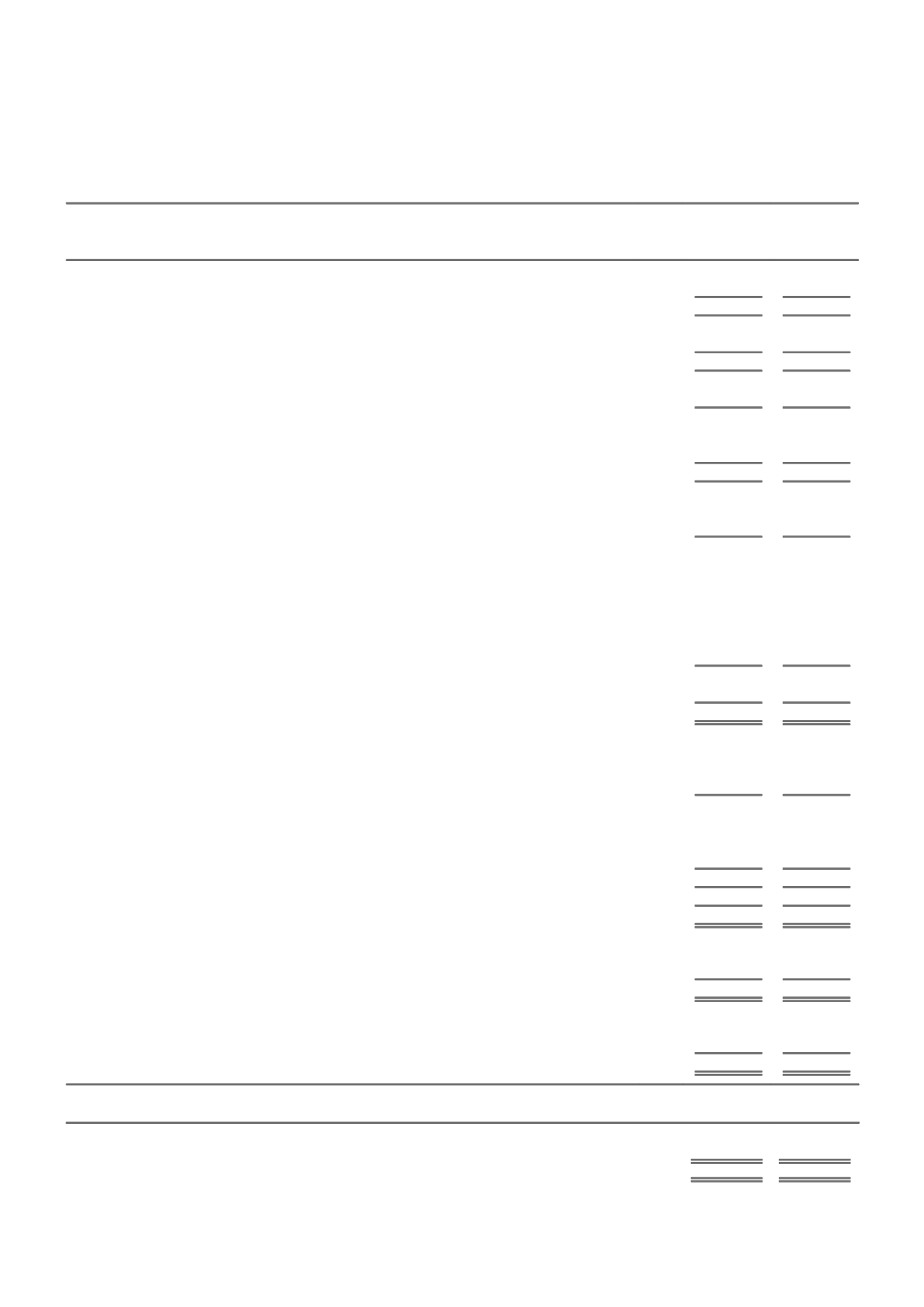

PROFIT/(LOSS) FOR THE YEAR ATTRIBUTABLE TO

Shareholders of the Parent

728

1,233

Non-controlling interests

102

97

Profit/(loss) for the year

830

1,330

TOTAL COMPREHENSIVE INCOME AND (EXPENSE) FOR THE YEAR ATTRIBUTABLE TO

Shareholders of the Parent

665

1,233

Non-controlling interests

102

97

Total comprehensive income and (expense) for the year, net of tax

767

1,330

NOTE

2015

2014

cents

cents

EARNINGS PER SHARE

Basic earnings per ordinary share

8

31.22

56.09

Diluted earnings per ordinary share

8

30.45

53.62

The above statement of comprehensive income should be read in conjunction with the notes to the financial statements.

38 IAG ANNUAL REPORT 2015