How we performed

FINANCIAL PERFORMANCE – SELECTED HIGHLIGHTS

| Six months ended 31 Dec 2013 $m |

Six months ended 31 Dec 2014 $m |

|

|---|---|---|

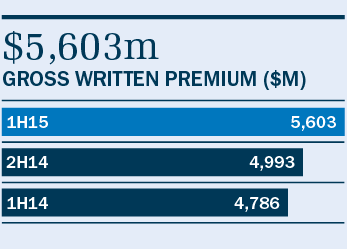

| Gross written premium | 4,786 | 5,603 |

| Net earned premium | 4,320 | 5,154 |

| Net claims expense | (2,508) | (3,481) |

| Underwriting profit | 671 | 266 |

| Investment income on technical reserves | 87 | 427 |

| Insurance profit | 758 | 693 |

| Investment income on shareholders’ funds | 233 | 137 |

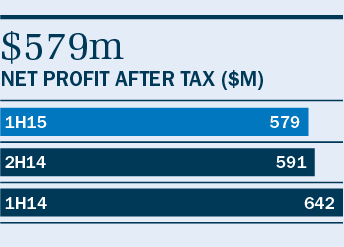

| Net profit attributable to holders of ordinary shares |

642 | 579 |

FINANCIAL POSITION

| As at 30 June 2014 $m |

As at 31 Dec 2014 $m |

|

|---|---|---|

| Cash and investments | 16,396 | 16,090 |

| Other assets | 9,721 | 10,525 |

| Goodwill and intangibles | 3,540 | 3,595 |

| Total assets | 29,657 | 30,210 |

| Claims provisions and unearned premium | 18,193 | 18,936 |

| Borrowings and other liabilities | 4,670 | 4,467 |

| Total liabilities | 22,863 | 23,403 |

| Net assets | 6,794 | 6,807 |

| Equity attributable to IAG shareholders | 6,568 | 6,583 |

| Non-controlling interests | 226 | 224 |

| Total equity | 6,794 | 6,807 |

Key Figures

Increased by 17.1% to $5.6 billion, largely reflecting the first-time inclusion of the former Wesfarmers business.

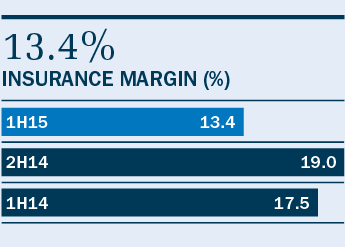

The Group’s reported insurance margin of 13.4% was affected by net natural peril claim costs of $421 million, $71 million higher than our allowance and including $165 million for the Brisbane storm in November 2014; and lower prior period reserve releases of $92 million, equivalent to 1.8% of net earned premium (NEP), down from 4.3% in the first half of the 2014 financial year.

Compared to the first half of last financial year, net profit after tax decreased by nearly 10% to $579 million.

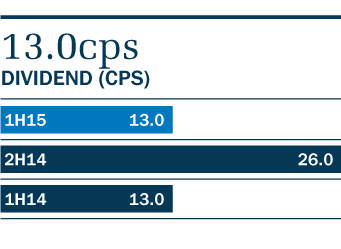

Consistent with the last interim dividend of 13.0 cents per share (cps) and equal to a payout ratio of 46.6% of cash earnings. The Group’s policy is to pay out 50-70% of cash earnings in any given year. The fully franked dividend will be paid on 1 April 2015, to shareholders registered at 4 March 2015. The Dividend Reinvestment Plan will operate for the interim dividend.