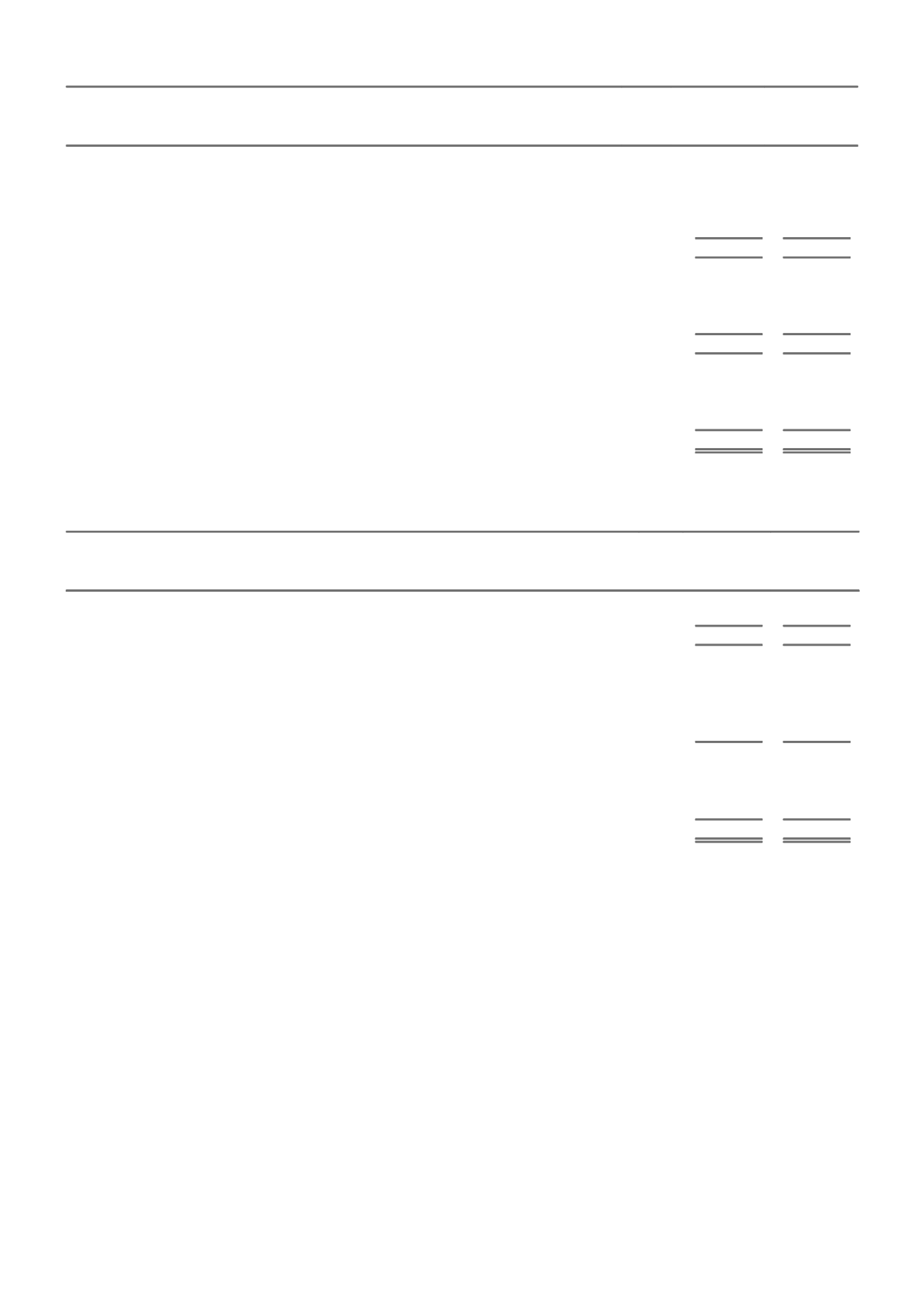

NOTE 35. REMUNERATION OF AUDITORS

CONSOLIDATED

2015

2014

$000

$000

A. KPMG

I. Assurance services

Audit of the financial statements prepared for the Parent and subsidiaries

7,927

6,883

Audit of statutory returns in accordance with regulatory requirements

1,051

1,109

Other assurance services

174

184

9,152

8,176

II. Advisory services

Taxation services

504

905

Due diligence and other services on acquisitions, divestments and capital transactions

132

978

Other

439

277

1,075

2,160

B. OTHER AUDITORS

Assurance services

Audit of the financial statements prepared for subsidiaries

39

873

Assurance related to regulatory requirements

-

164

Total remuneration of auditors

10,266

11,373

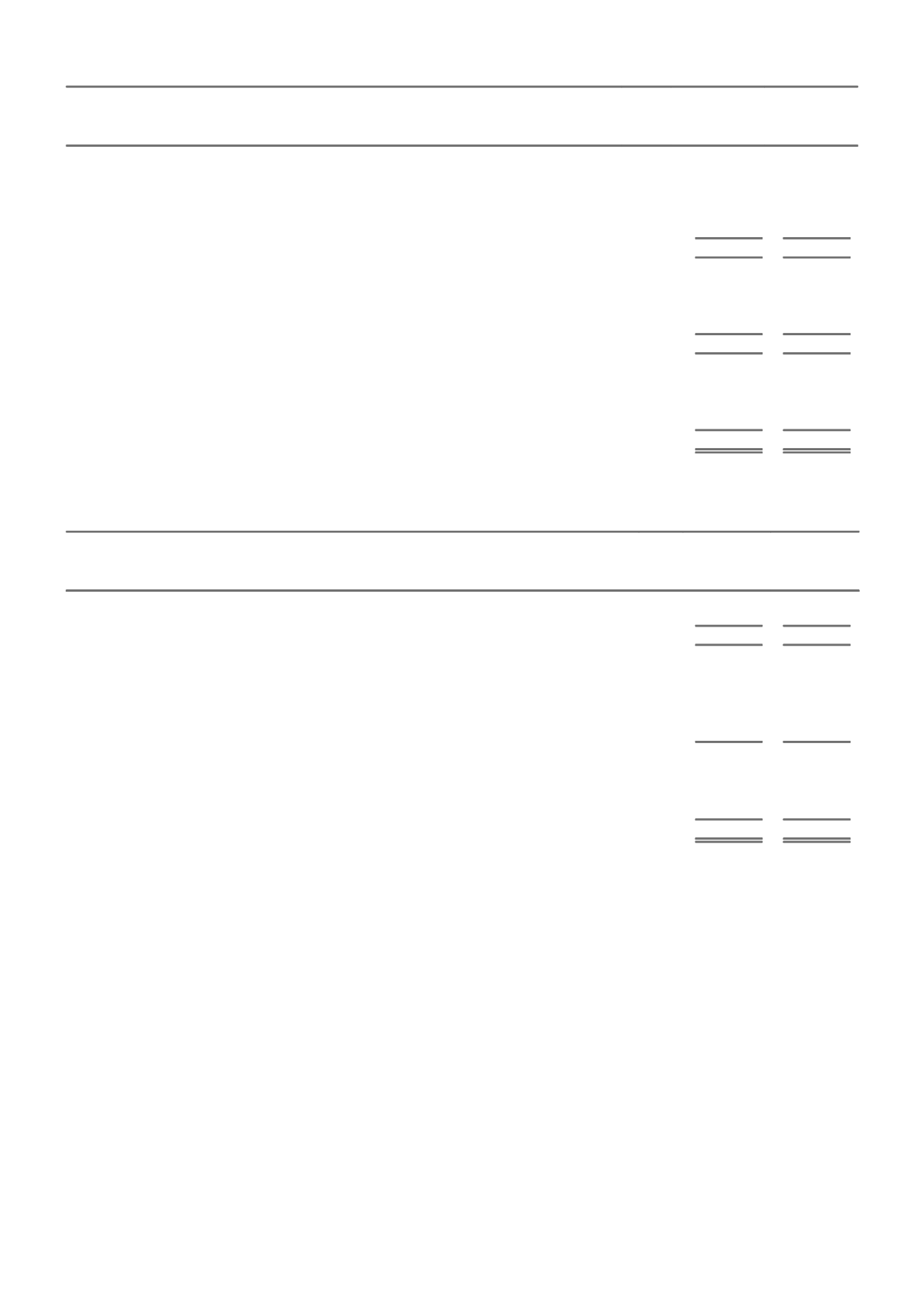

NOTE 36. PARENT ENTITY DISCLOSURES

The ultimate Parent entity in the Consolidated entity is Insurance Australia Group Limited, which is incorporated in Australia. The

following information of the Parent entity is disclosed as required by the current regulatory requirements in Australia.

PARENT

2015

2014

$m

$m

A. FINANCIAL RESULTS

Profit/(loss) for the year

463

769

Total comprehensive income and (expense) for the year, net of tax

463

769

B. FINANCIAL POSITION

Current assets

259

344

Total assets

13,917

13,401

Current liabilities

216

370

Total liabilities

4,362

3,882

C. SHAREHOLDERS' EQUITY

Share capital

7,275

6,775

Reserves

(29)

(12)

Retained earnings

2,309

2,756

Total shareholders' equity

9,555

9,519

D. CONTINGENT LIABILITIES

Contingent liabilities are not recognised on the balance sheet but are disclosed where the possibility of settlement is less than

probable but more than remote. Provisions are not required with respect to these matters as it is not probable that a future sacrifice

of economic benefits will be required or the amount is not reliably measurable. If settlement becomes probable, a provision is

recognised. The best estimate of the settlement amount is used in measuring a contingent liability for disclosure. The measurement

involves judgement. There are no known material exposures to the Parent or events that would require it to satisfy the guarantees or

take action under a support agreement.

E. COMMITMENTS

The Parent has no material commitments.

F. OTHER

IAG has an option to raise further share capital as part of the strategic relationship with Berkshire Hathaway, which provides IAG

access to additional liquidity. Refer to the statement of changes in equity note for further details.

NOTE 37. EVENTS SUBSEQUENT TO REPORTING DATE

As the following transactions occurred after reporting date and did not relate to conditions existing at reporting date, no account has

been taken of them in the financial statements for the current reporting year ended 30 June 2015. These include:

On 21 August 2015, the Board determined to pay on 7 October 2015 a final dividend of 16 cents per share, 100% franked. The

dividend reinvestment plan will operate by acquiring shares on-market for participants with no discount applied; and

The announcement on 11 August 2015 that Mr Jonathan Nicholson will be appointed to the IAG Board, as an Independent Non-

Executive Director, effective 1 September 2015.

97