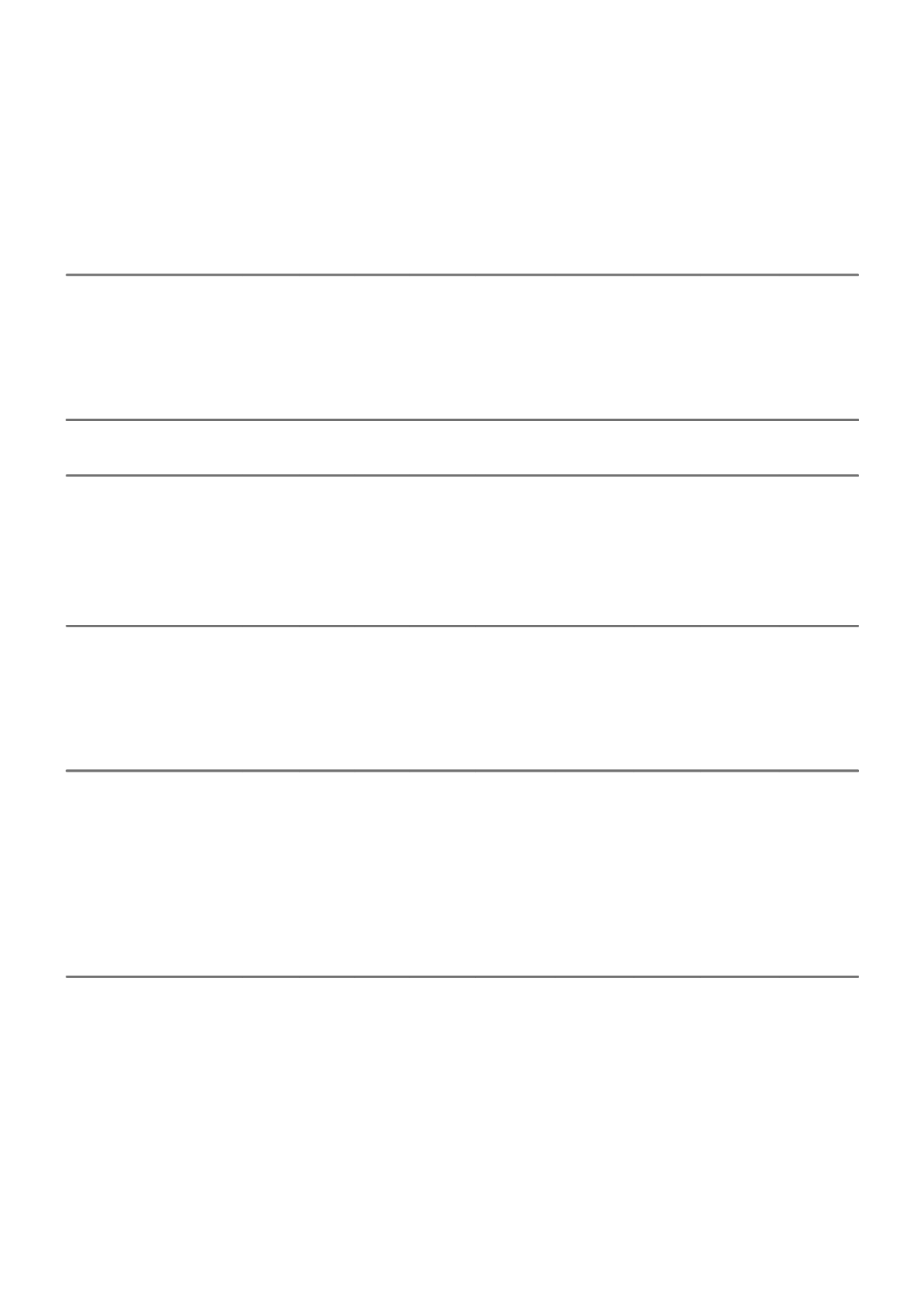

NOTE 32. DERIVATIVES

A. DERIVATIVES FOR WHICH HEDGE ACCOUNTING IS APPLIED

I. Net investment hedges

The foreign currency exposures arising on translation of net investments in foreign operations are hedged using forward exchange

contracts and the designation of certain foreign currency borrowings as hedging instruments. The fair value is determined using

observable inputs (level 2 in the fair value hierarchy).

Each of the hedging relationships has been broadly effective throughout the current financial year or since inception with the small

amount of ineffectiveness recognised in profit or loss.

II. Reporting date positions

The notional amount and fair value of derivative financial instruments, together with a maturity profile, are provided below:

CONSOLIDATED

2015

2014

Maturity profile

Notional

contract

amount

Fair value

asset

Fair value

liability

Notional

contract

amount

Fair value

asset

Fair value

liability

Within

1 year

$m

1 to 5

years

$m

Over 5

years

$m $m

$m

$m

$m

$m

$m

a. NET INVESTMENT HEDGES

Forward foreign exchange

contracts

1,643

-

-

1,643

97

(4)

1,304

9

(6)

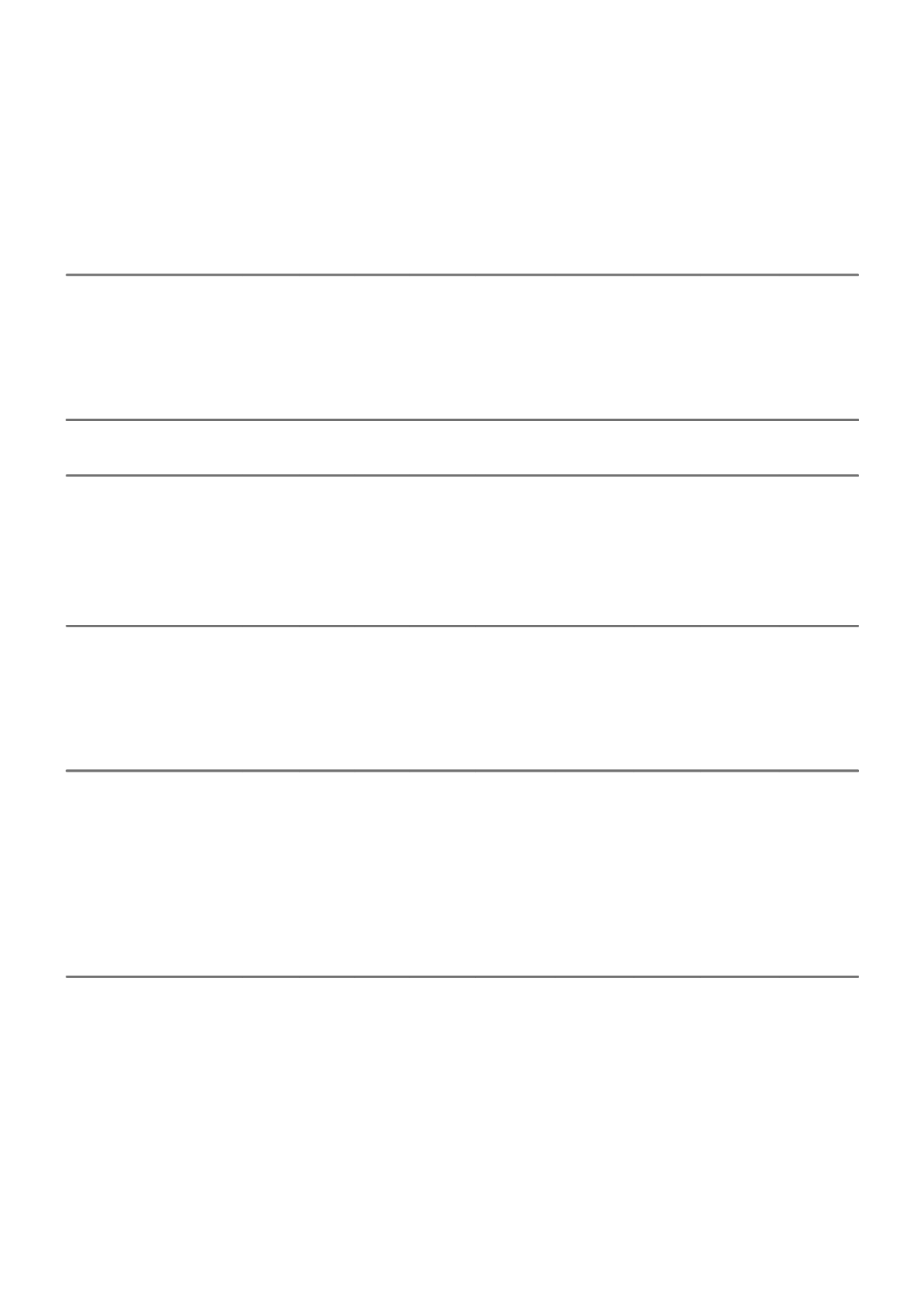

B. DERIVATIVES FOR WHICH HEDGE ACCOUNTING IS NOT APPLIED (DERIVATIVES HELD FOR ECONOMIC HEDGING PURPOSES

ONLY)

The fair value of the options, bond futures and share price index futures are measured using a quoted price in an active market (level

1 in the fair value hierarchy), whilst the fair value of the interest rate swaps and forward foreign exchange contracts are determined

using observable inputs (level 2 in the fair value hierarchy).

I. Reporting date positions

The notional amount and fair value of derivative financial instruments, together with a maturity profile, are provided below:

CONSOLIDATED

2015

2014

Maturity profile

Notional

contract

amount

Fair value

asset

Fair value

liability

Notional

contract

amount

Fair value

asset

Fair value

liability

Within

1 year

$m

1 to 5

years

$m

Over 5

years

$m $m

$m

$m

$m

$m

$m

a. PRESENTED IN INVESTMENTS/TRADE AND OTHER PAYABLES (INVESTMENT RELATED DERIVATIVES)

Interest rate swaps

-

-

-

-

-

-

310

8

-

Options

-

-

-

-

-

-

(2)

-

-

Bond futures

4,548

-

-

4,548

-

-

3,415

-

(1)

Share price index futures

271

-

-

271

-

-

271

-

-

Forward foreign exchange

contracts

711

-

-

711

-

(10)

445

6

-

b. PRESENTED IN TRADE AND OTHER RECEIVABLES/PAYABLES (TREASURY RELATED DERIVATIVES)

Forward foreign exchange

contracts

1,356

-

-

1,356

11

(101)

302

7

-

Interest rate swaps

200

-

-

200

-

-

50

-

-

In addition to the derivatives described above, certain contracts entered into include embedded derivative features. Such embedded

derivatives are assessed at inception of the contract and, depending on their characteristics, are accounted for as separate derivative

financial instruments. The fair value of the embedded derivatives was nil as at 30 June 2015 (2014-nil).

94 IAG ANNUAL REPORT 2015