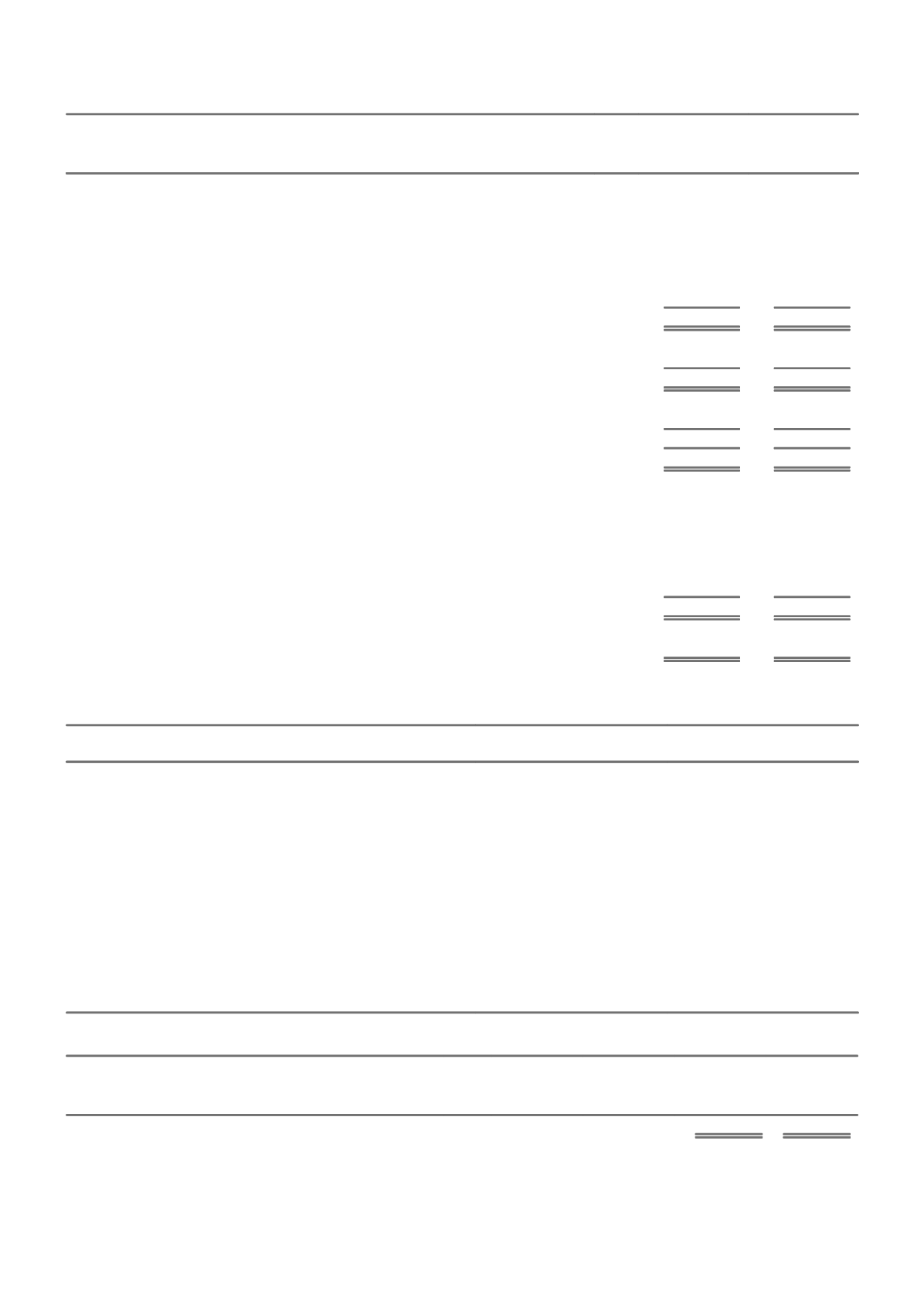

C. REGULATORY CAPITAL COMPLIANCE

The PCA calculation is based on applying the APRA Level 2 Insurance Group requirements.

CONSOLIDATED

2015

2014

$m

$m

I. Common Equity Tier 1 capital

Ordinary shares

7,275

6,775

Reserves

(38)

38

Retained earnings

(337)

(151)

Excess technical provisions (net of tax)

748

914

Minority interests

201

226

Less: Deductions

(4,637)

(4,514)

Common Equity Tier 1 capital (CET1 capital)

3,212

3,288

II. Additional Tier 1 capital

Hybrid equities

762

817

Total Tier 1 capital

3,974

4,105

III. Tier 2 capital

Subordinated term notes

811

876

Total Tier 2 capital

811

876

Total regulatory capital

4,785

4,981

IV. Prescribed Capital Amount (PCA)

Insurance risk charge

1,500

1,624

Insurance concentration risk charge

200

225

Diversified asset risk charge

1,489

1,441

Aggregation benefit

(715)

(729)

Operating risk charge

343

335

Total PCA

2,817

2,896

PCA multiple

1.70

1.72

CET1 multiple

1.14

1.14

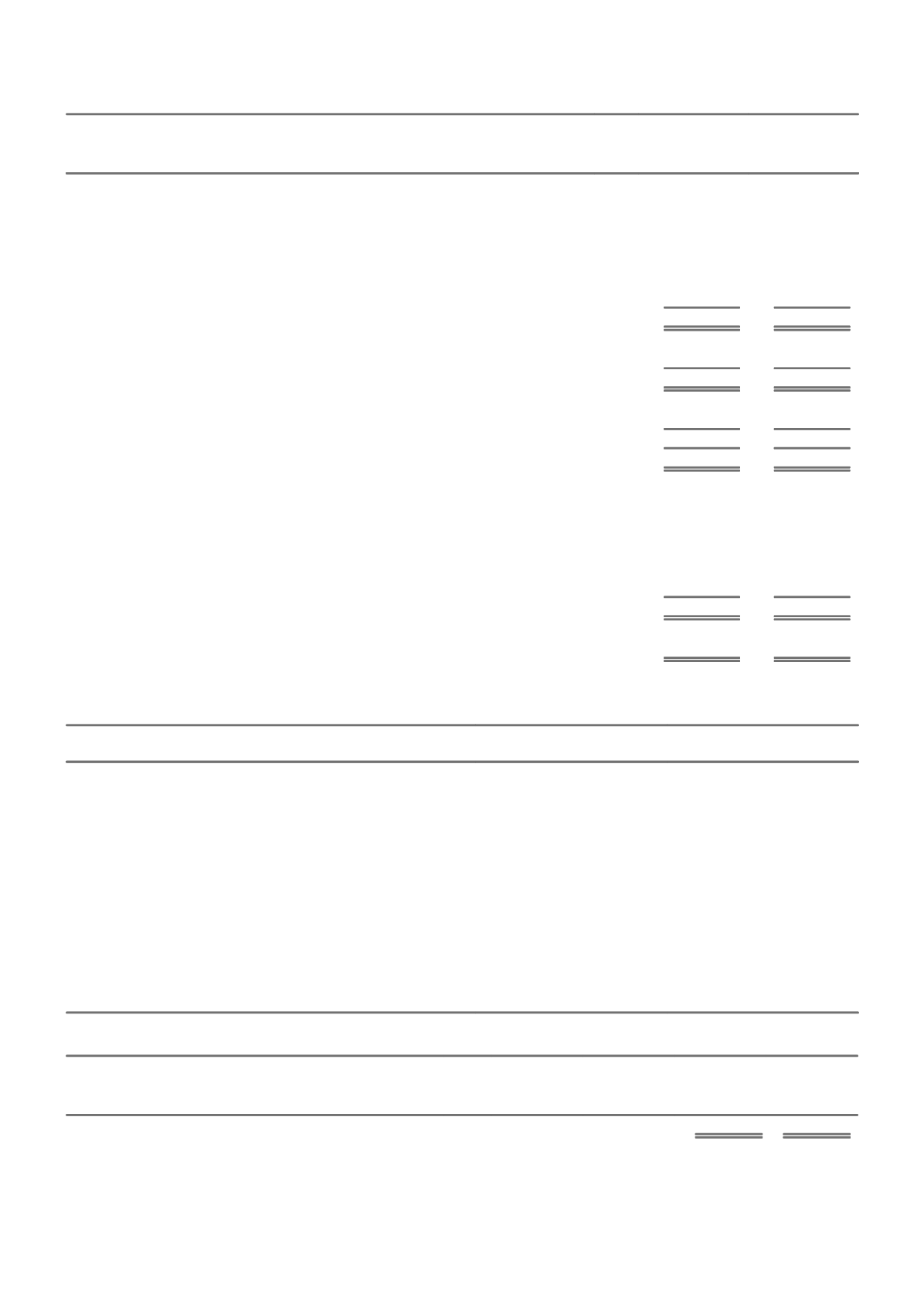

D. CREDIT RATING

Ratings published by Standard & Poor's (S&P) for key wholly owned insurers within the Group as at the current reporting date.

ENTITY

ISSUER CREDIT RATING

FINANCIAL STRENGTH

RATING

I. Parent

Insurance Australia Group Limited

A/Stable

n/a

II. Licensed insurers

Insurance Australia Limited

AA-/Stable

AA-/Stable

IAG New Zealand Limited

AA-/Stable

AA-/Stable

CGU Insurance Limited

AA-/Stable

AA-/Stable

Swann Insurance (Aust) Pty Ltd

AA-/Stable

AA-/Stable

IAG Re Labuan (L) Berhad

n/a

AA-/Stable

IAG Re Australia Limited

AA-/Stable

AA-/Stable

IAG Re Singapore Pte Ltd

AA-/Stable

AA-/Stable

Lumley General Insurance (NZ) Limited

A+/Stable

A+/Stable

WFI Insurance Limited

A+/Stable

A+/Stable

AMI Insurance Ltd

n/a

AA-/Stable

NOTE 34. NET TANGIBLE ASSETS

CONSOLIDATED

2015

2014

$

$

Net tangible assets per ordinary share

1.34

1.27

Net tangible assets per ordinary share has been determined using the net assets on the balance sheet adjusted for non-controlling

interests, intangible assets and goodwill.

96 IAG ANNUAL REPORT 2015