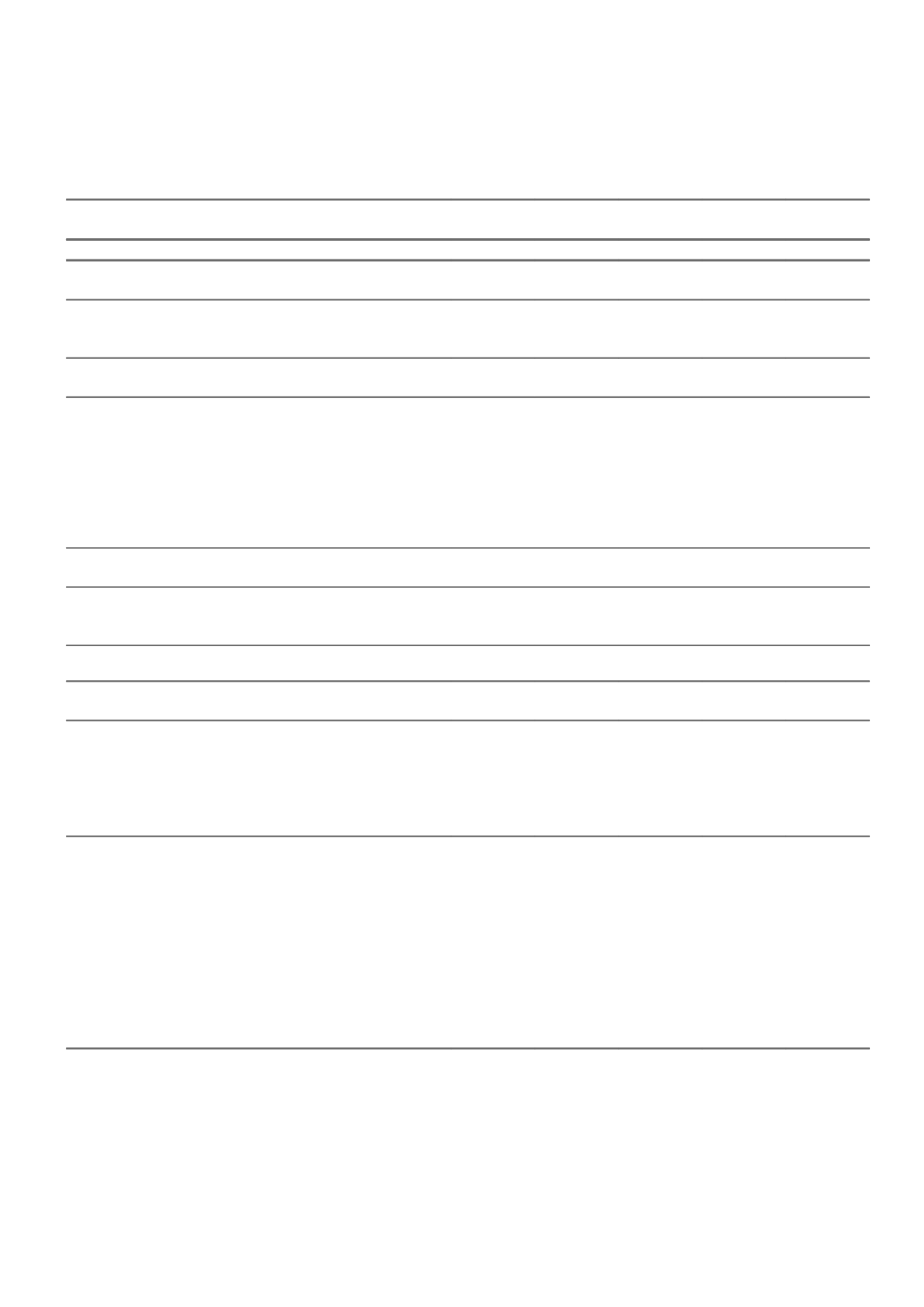

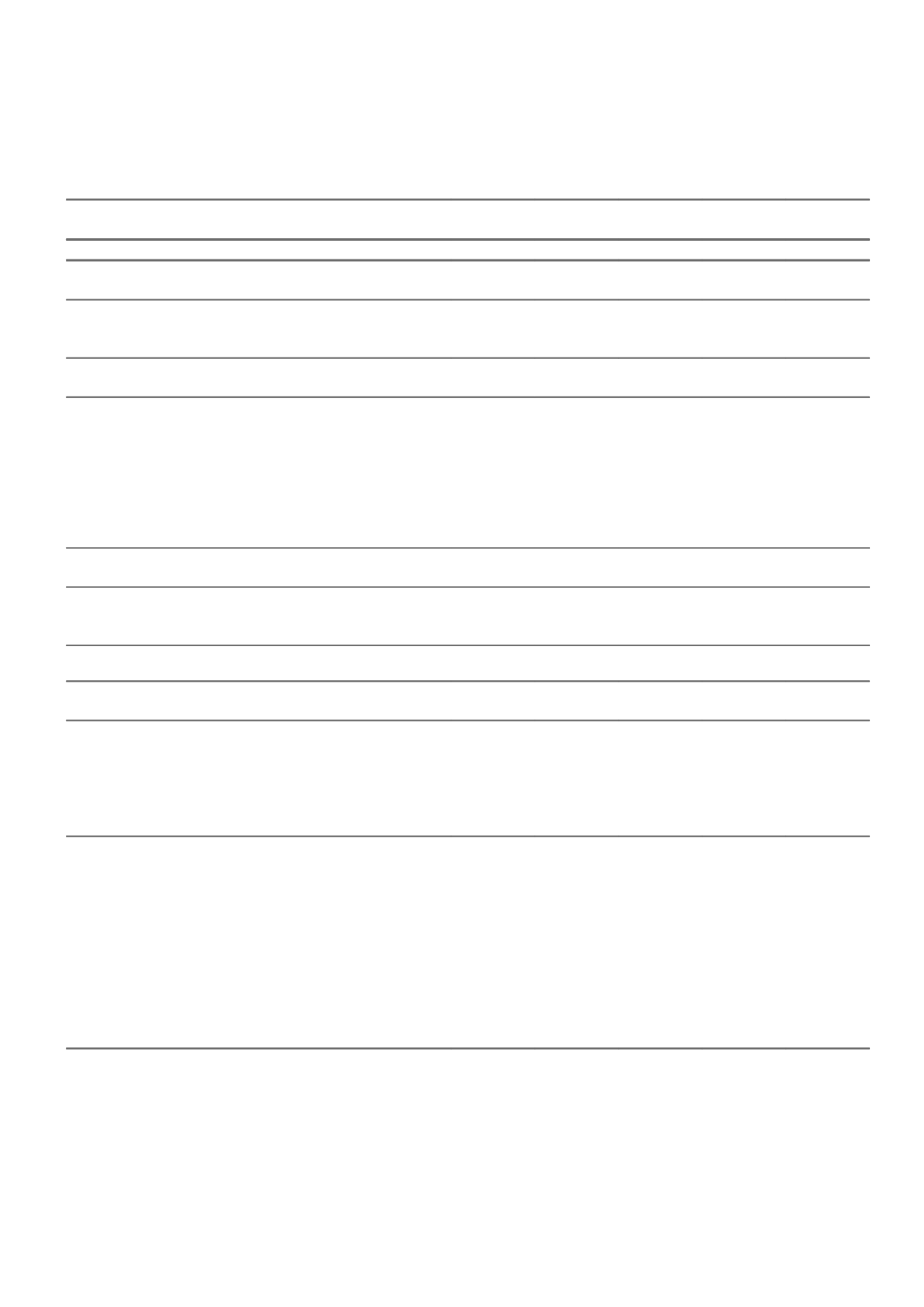

FIVE YEAR FINANCIAL

SUMMARY

2015

2014

2013

2012

(a)

2011

(a)

$m

$m

$m

$m

$m

Gross written premium

11,440

9,779

9,498

8,495

8,050

Premium revenue

11,525

9,721

9,135

8,046

7,858

Outwards reinsurance premium expense

(1,196)

(1,077)

(817)

(700)

(620)

Net premium revenue

10,329

8,644

8,318

7,346

7,238

Net claims expense

(6,941)

(5,201)

(4,982)

(5,421)

(5,089)

Underwriting expenses

(2,847)

(2,303)

(2,178)

(1,994)

(1,978)

Underwriting profit/(loss)

541

1,140

1,158

(69)

171

Net investment income on assets backing insurance liabilities

562

439

270

914

489

Insurance profit/(loss)

1,103

1,579

1,428

845

660

Net investment income from shareholders' funds

223

396

347

89

213

Other income

187

199

175

164

264

Share of net profit/(loss) of associates

(b)

6

(8)

(29)

(13)

(8)

Finance costs

(107)

(98)

(95)

(97)

(86)

Corporate and administration expenses

(c)

(383)

(255)

(208)

(205)

(259)

Amortisation expense and impairment charges of acquired

intangible assets and goodwill

(d)

(80)

(11)

(25)

(20)

(170)

Profit/(loss) before income tax

949

1,802

1,593

763

614

Income tax expense

(119)

(472)

(424)

(177)

(276)

Profit/(loss) after tax from continuing operations

830

1,330

1,169

586

338

Profit/(loss) after tax from discontinued operation

-

-

(287)

(321)

-

Net profit attributable to non-controlling interests

(102)

(97)

(106)

(58)

(88)

Net profit/(loss) attributable to shareholders of Insurance

Australia Group Limited

728

1,233

776

207

250

Ordinary shareholders' equity ($ million)

6,817

6,568

4,786

4,343

4,417

Total assets ($ million)

(e)

31,402

29,748 24,859 25,132 23,029

KEY RATIOS

Gross written premium growth

% 17.0

%3.0

% 11.8

n/a

%3.4

Loss ratio

(f)

% 67.2

% 60.2

% 59.9

% 73.8

% 70.3

Expense ratio

(g)

% 27.6

% 26.7

% 26.2

% 27.1

% 27.3

Combined ratio

(h)

% 94.8

% 86.9

% 86.1

% 100.9

% 97.6

Insurance margin

(i)

% 10.7

% 18.3

% 17.2

% 11.5

%9.1

SHARE INFORMATION

Dividends per ordinary share - fully franked (cents)

29.00

39.00

36.00

17.00

16.00

Basic earnings per ordinary share (cents)

31.22

56.09

37.57

10.01

12.08

Diluted earnings per ordinary share (cents)

30.45

53.62

36.44

9.96

12.01

Ordinary share price at 30 June ($) (ASX: IAG)

5.58

5.84

5.44

3.48

3.40

Convertible preference share price at 30 June ($) (ASX: IAGPC)

101.60

106.44 101.88

98.10

-

Reset exchangeable securities price at 30 June ($) (ASX: IANG)

103.10

107.00 102.80

99.30 103.00

Issued ordinary shares (million)

2,431

2,341

2,079

2,079

2,079

Issued convertible preference shares (million)

4

4

4

4

-

Market capitalisation (ordinary shares) at 30 June ($ million)

13,565

13,671 11,310

7,235

7,069

Net tangible asset backing per ordinary share ($)

(e)

1.34

1.27

1.38

1.20

1.23

(a)

The financial information for 2012 has been re-presented to reflect the treatment of the United Kingdom business as a discontinued operation. Financial information for

2011 is not re-presented.

(b)

Share of net profit/(loss) of associates includes regional support and development costs. Refer to note 26 within the Financial Statements for further details.

(c)

Includes a $60 million impairment of the investment in Bohai Insurance for 2015.

(d)

This included impairment charges for acquired identifiable intangible assets and goodwill of $150 million for 2011.

(e)

The financial information for 2014 has been restated to reflect the fair value adjustments to the net assets acquired in respect of the former Wesfarmers business in

2014.

(f)

The loss ratio refers to the net claims expense as a percentage of net premium revenue.

(g)

The expense ratio refers to underwriting expenses as a percentage of net premium revenue.

(h)

The combined ratio refers to the sum of the loss ratio and expense ratio.

(i)

Insurance margin is a ratio of insurance profit over net premium revenue.

1